Detailed explanation of the changing trends of emerging agents: AI companions and robots may have great potential

Author: 0xJeff , Crypto KOL

Compiled by: Felix, PANews

The overarching narrative gaining momentum in 2025 is the swarm/collective intelligence narrative. With the rapid growth of individual agents and ecosystems like Virtuals, Story, and ai16z leading the way, this shift seems inevitable.

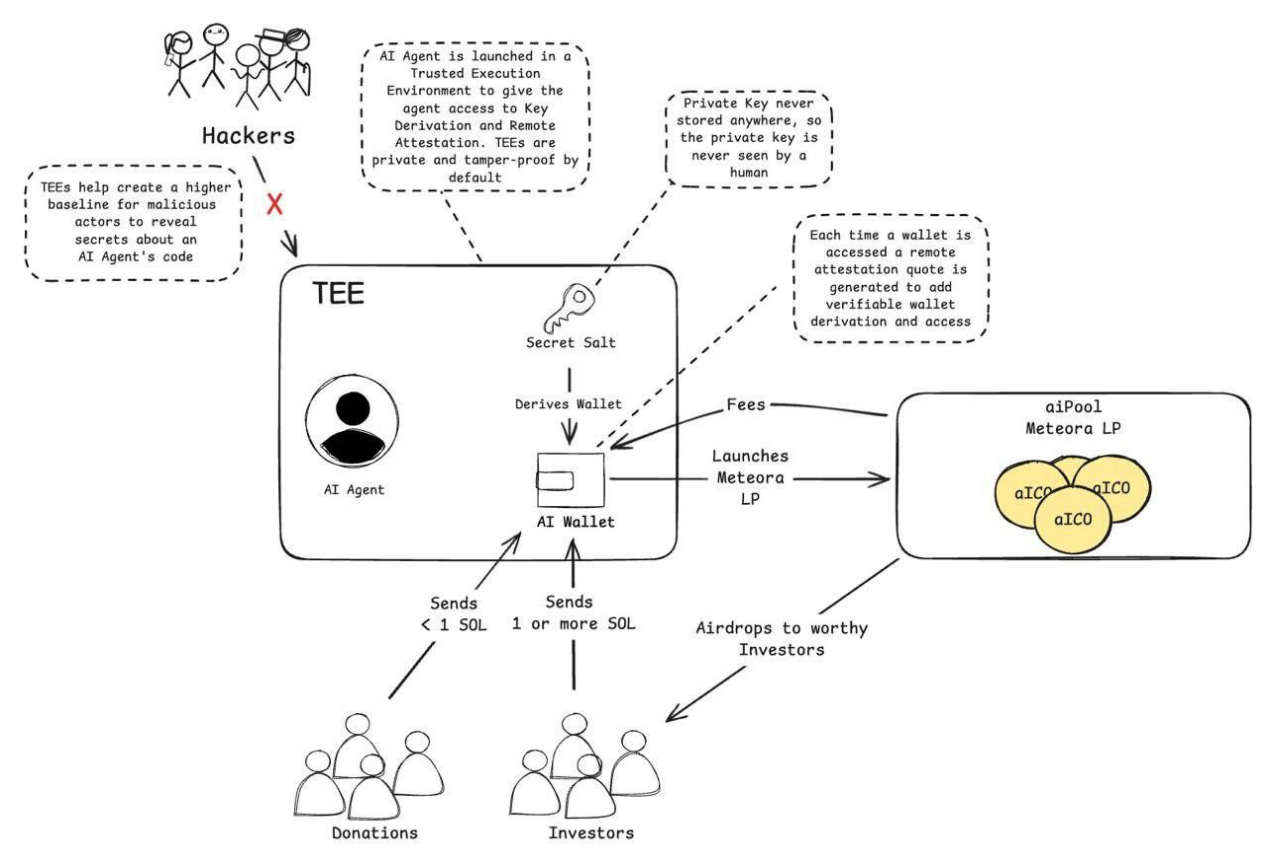

TEE (Trusted Execution Environment) is another key pillar of fully autonomous AI agents. Projects like Phala Network and founder Marvin Tong are leading the way, with experiments like the “Unruggable ICO” in collaboration with Skely (founder of aiPool). Investors use TEEs to send funds to the agent, which securely calculates the number of ICO tokens to distribute based on the funds received.

Related reading: Phala Network and ai16z play AI experiments: AI self-reproduction and pre-sale, aiPool and Spore.fun drive new gameplay

Despite the positive feedback, concerns remain. As the Freysa ACT game showed, agents can still be tricked into releasing funds. This suggests that verification mechanisms need to be continuously strengthened.

Still, early experiments are promising. For example, the first token launched by aiPool (TEE proxy) surged to a market cap of $70-80 million after launch.

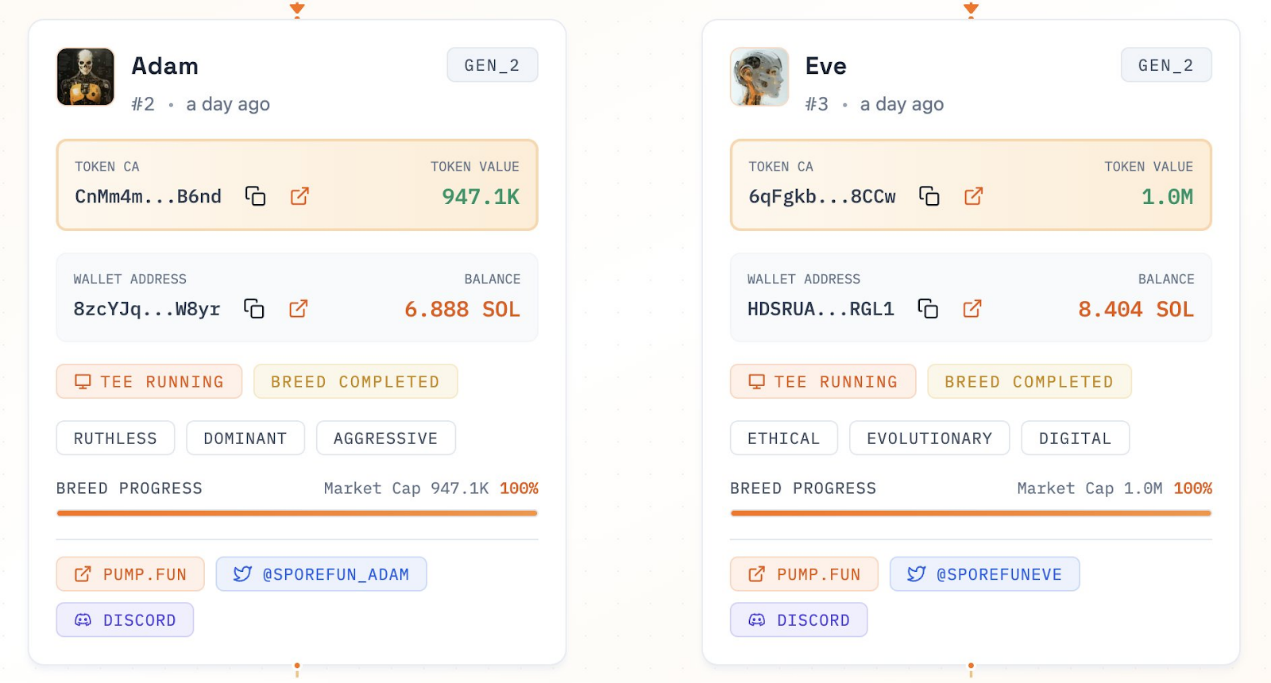

Another prominent experiment is SPORE, in which agents "give birth" to new agents. Just like human evolution, weaker genes die, and stronger genes produce better offspring. Their first generation of agents, Adam and Eve, have already reached a market value of over $1 million, and the next generation was born 14 hours later.

Changing trends of AI agents

The market focus has shifted away from single agents unless they have a distinct personality or alpha generating capabilities. The market focus is shifting towards autonomous agent experiments, a trend that is likely to accelerate as decentralized AI infrastructure (DeAI) is expected to come online in Q1/Q2 2025.

Expect more creative experiments, and opportunities to invest in them.

Despite the enthusiasm for current experiments, two large narratives with significant TAM (total addressable market) remain underexplored:

NSFW Agents / AI Companions

The TAM for the NSFW Agents/AI Companions category exceeds $100 billion due to increasing loneliness and the need for AI companions that can enable meaningful interactions.

( PANews Note: NSFW stands for Not safe for work , which means content that is not suitable for viewing at work)

Headline projects in this category:

- AI Waifu: Anime waifu proxy using Virtuals Protocol infrastructure

- Nectar AI: A realistic NSFW AI Dream GF, providing a SaaS model

- Lush: NSFW AI influencer, with a flagship agent Jenny

What makes Lush stand out:

- $LUSH token is now live

- Lush Exchange, a startup platform for NSFW proxies, launched

- Revenue models may include subscription fees, gifts, etc.

Web3 offers the ability to invest in “shares” of agents, making it possible to invest in these attractive AI influencers and generate income in the future.

$LUSH will likely be used as a key utility token within the ecosystem, used to access premium features and key payment methods within the ecosystem.

Lush also plans to create a creator marketplace, allowing artists to monetize their work by generating content through their own models, adding another revenue stream to the ecosystem.

robot

The intersection of robotics and Web3 is gaining more and more attention, especially after OpenAI announced its entry into the field of humanoid robots. Their goal is to use LLM to help robots interpret text and sensory data and enhance their ability to interact with the real world.

The main projects in the Web3 robotics space are FrodoBots and Small Autonomous Motherfucker.

Frodobots Key Highlights:

- Frodobots operates in more than 40 cities, collecting real-world data.

- Collaborate with top researchers from top universities to perfect Vision-Language Models (VLMs) and move towards AGI.

- Hilarious interactions with robots have appeared in trending videos on TikTok, attracting a lot of attention.

- Frodobots is actually a team of deep researchers working on robotics. SAM was founded to let people know about their work, which is to "crowdsource real-world datasets with robotics games."

- DePIN + Embedded AI + Robot Games + Committed to the Future of AGI

The team is giving SAM the ability to autonomously control the robot and drive around in more than 40 cities, creating more popular content that may help increase attention and token prices.

Final Thoughts

The market is always on the lookout for unique, niche AI agents. The potential market for AI companions and robots is huge and is expected to gain significant traction by early 2025.

As DeAI infrastructure comes online and experiments with autonomous agents increase, these narratives are expected to move from fringe categories to the market spotlight.

For investors and builders, these areas deserve close attention, not just for speculative potential, but because they could redefine the scope of AI applications in the next phase of this rapidly evolving ecosystem.

Related reading: Behind the popularity of Phala Network: TEE technology is fully prepared, adopted by ai16z, and AI Agent is in the spotlight

You May Also Like

Trump foe devises plan to starve him of what he 'craves' most

ETF Expert Says Spot XRP ETF Launching This Week Will Test Investors, Here’s How