Crypto outflows cool as investors rotate from Bitcoin to altcoins

Digital asset investment products showed early signs of stabilisation last week as crypto outflows slowed sharply to $187 million, according to the latest CoinShares weekly report, despite continued pressure on crypto prices.

- Crypto fund outflows slowed sharply to $187 million, signaling a deceleration in selling pressure despite ongoing price weakness.

- Bitcoin led weekly outflows with $264 million, while several altcoins, including XRP, Solana, and Ethereum, attracted fresh inflows.

- Elevated trading volumes and selective regional inflows, particularly in Europe, point to early signs of market stabilisation.

While fund flows often move in tandem with price action, CoinShares noted that changes in the pace of flows have historically been more telling, frequently signalling potential inflection points in investor sentiment.

The recent deceleration suggests the market may be approaching a near-term bottom.

Bitcoin sees outflows as altcoins attract interest

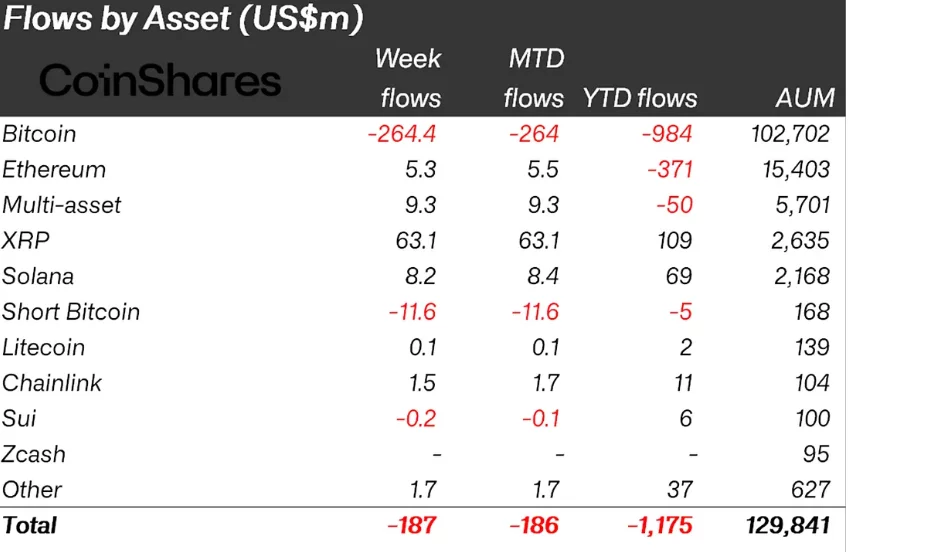

At the asset level, Bitcoin (BTC) remained the main source of negative sentiment, with weekly outflows of $264.4 million, extending its year-to-date outflows to $984 million. Short Bitcoin products also recorded outflows of $11.6 million, suggesting reduced demand for bearish positioning.

In contrast, several altcoins attracted fresh inflows. XRP led the pack with $63.1 million in weekly inflows, bringing its year-to-date total to $109 million. This makes the Ripple token (XRP) the strongest-performing asset on a flows basis so far this year.

Solana (SOL) and Ethereum (ETH) also saw inflows of $8.2 million and $5.3 million, respectively, while multi-asset products added $9.3 million.

Flows remained geographically uneven. European markets showed pockets of strength, with inflows into Germany ($87.1 million) and Switzerland ($30.1 million), while Canada ($21.4 million) and Brazil ($16.7 million) also recorded gains.

CoinShares said the combination of slowing outflows, elevated trading volumes, and selective inflows into altcoins and European products points to a market that may be stabilising, even as price uncertainty persists.

Assets under management fall, trading activity surges

Total assets under management (AuM) across digital asset investment products declined to $129.8 billion, the lowest level since March 2025, following the latest market correction. That period also coincided with a local low in crypto prices.

Despite the drawdown in AuM, trading activity surged. ETP trading volumes hit a record $63.1 billion for the week, surpassing the previous high of $56.4 billion recorded in October, pointing to elevated investor engagement amid market volatility.

You May Also Like

‘Scam’ claims spread after Trump’s Super Bowl crypto donation pitch

VIPRE Security Group Positioned as a Leader in the SPARK Matrix™: Enterprise Email Security, 2025 by QKS Group