Alternative Investment Industry Statistics 2026: How the Wealthy Diversify Now

In recent years, alternative investments have gained significant attention, primarily as a hedge against market volatility and inflation. Investors are looking beyond traditional stocks and bonds, seeking more diverse asset classes to balance risk and return. From hedge funds to private equity, real estate to digital assets, alternative investments are shaping the future of global finance. In this evolving landscape, understanding the key statistics and trends today can provide valuable insights into where the industry is headed.

Editor’s Choice

- Global alternative investments AUM is projected to exceed $33 trillion in 2025, continuing robust expansion into 2026.

- Private markets AUM has grown to over $20 trillion globally, cementing alternatives as a core pillar of portfolios.

- Private equity AUM is on track to approach $12 trillion by 2030, with a cautious recovery phase starting in 2026.

- Private credit AUM is forecast to reach $4.5 trillion by 2030, roughly doubling current levels as demand rises.

- Infrastructure AUM is expected to nearly triple to $3 trillion by 2030, supported by energy transition and digital infrastructure.

- Demographic shifts and structural trends are driving rapid growth in private markets, with projected PE IRRs of about 12.2% through 2030.

Recent Developments

- Private equity fundraising reaches $310 billion across 388 funds through Q3.

- Global PE realization value hits $905 billion by end-September.

- Venture capital fundraising totals $64.4 billion in the first three quarters.

- Real estate tokenization market size approaches $3.8 billion.

- Tokenized real estate grows 245% year-over-year to $15.7 billion market cap.

- Alternative assets AUM projected to reach $23.21 trillion.

- Private equity fundraising totals $735.3 billion, the lowest since 2020.

- Corporate venture capital funding doubles to $129 billion in H1 across 2,474 deals.

- MENA venture funding reaches $6.6 billion YTD.

Investments Market Growth Statistics

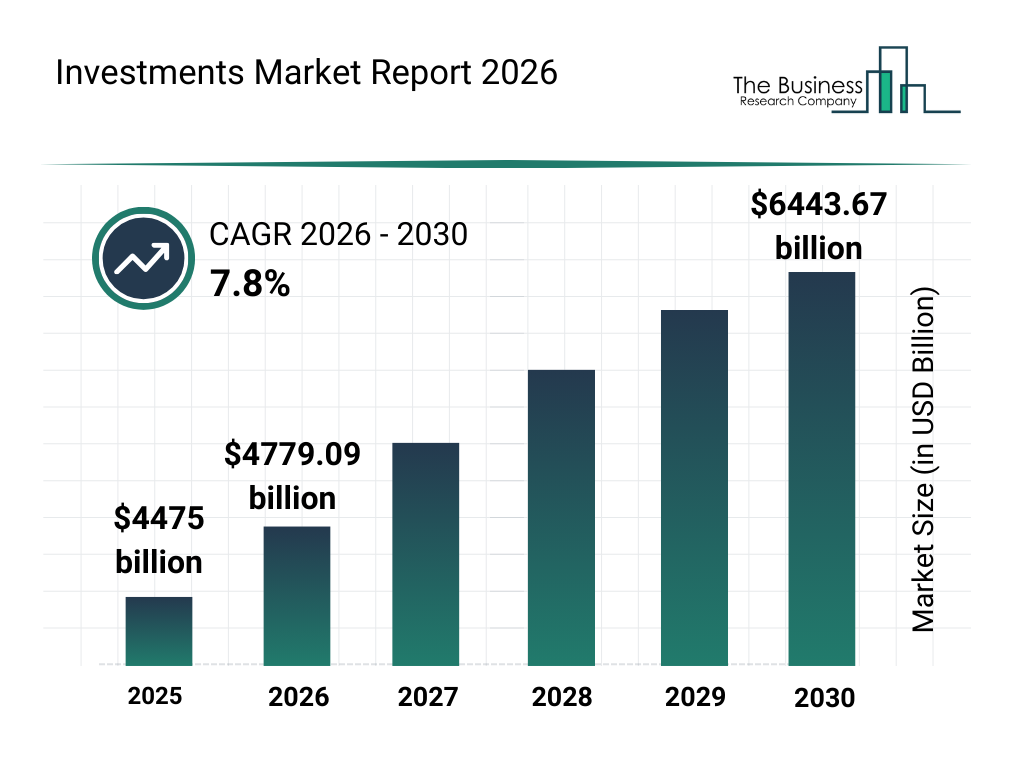

- The global investments market was valued at $4,475 billion in 2025, reflecting a strong base level of institutional and retail investment activity.

- Market size increased to $4,779.09 billion in 2026, highlighting continued capital inflows despite global economic volatility.

- The investment market is estimated to reach approximately $5,150 billion in 2027, signaling steady year-over-year expansion.

- In 2028, tthe otal market value is projected to rise to around $5,600 billion, driven by growing participation in alternative and digital investment products.

- The market is forecast to climb to nearly $6,020 billion in 2029, supported by long-term asset allocation shifts and diversification strategies.

- By 2030, the global investments market is expected to reach $6,443.67 billion, underscoring sustained growth momentum.

- Overall, the market is projected to grow at a 7.8% CAGR from 2026 to 2030, indicating robust and consistent expansion over the forecast period.

(Reference: The Business Research Company)

(Reference: The Business Research Company)

Market Size and Asset Classes

- Hedge funds are expected to manage around $5.4 trillion by 2026, reflecting continued net inflows from private banks and institutional allocators.

- Private equity AUM is on track to surpass $12.5 trillion by 2026, growing at a mid‑single‑digit annual pace versus 2025 levels.

- Real estate’s share of the alternative investment market is set to stabilize near 21.5–22% in 2026, backed by strong rental demand and low vacancy rates.

- Venture capital in tech‑focused sectors may deliver aggregate deployment of roughly $450–500 billion in 2026.

- Commodities are forecast to account for about 5.7–6% of alternative assets by 2026, as investors add exposure for inflation and diversification.

- Infrastructure investments are expected to reach $1.8–1.9 trillion in AUM by 2026, driven by renewable energy, data centers, and grid‑upgrade programs.

Hedge Fund and Private Equity Trends

- Hedge funds are projected to return around 9.1–10.5% in 2026, slightly above risk‑free rates and prior‑cycle averages.

- Long/short equity strategies are expected to deliver roughly 10.8–11.5% annual returns in 2026, remaining among the top‑performing hedge‑fund mandates.

- Global private equity fundraising is forecast to rebound to $800–850 billion in 2026.

- Buyout funds are estimated to keep about 60–62% of all private equity capital raised in 2026, maintaining leadership in the PE landscape.

- Venture capital inflows are expected to reach $370–390 billion in 2026, supported by continued demand for AI, biotech, and climate‑tech deals.

- Distressed‑asset and special‑situations strategies are anticipated to manage nearly $400 billion in AUM by the end of 2026.

- Private equity secondaries are on track to raise around $100–110 billion in 2026, extending growth from the $90–100 billion range in 2025.

Expected Changes in Alternative Investment Exposure

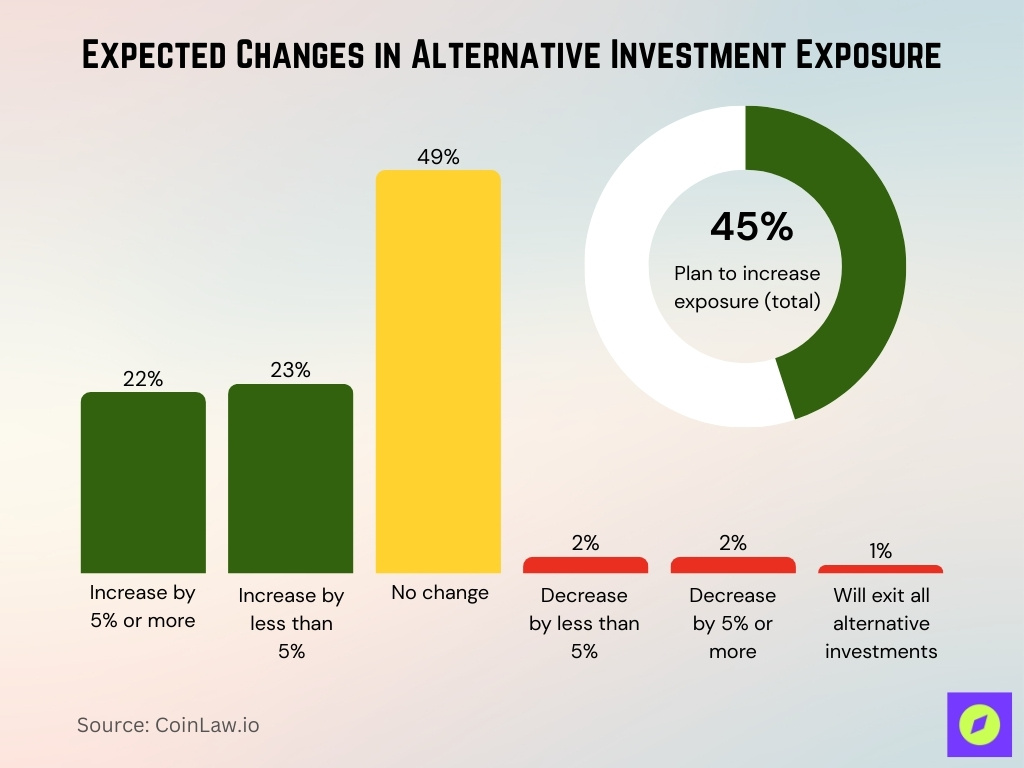

- Nearly half of investors (49%) expect no change in their alternative investment exposure in 2026, indicating a broadly stable allocation strategy.

- A significant 45% of respondents plan to increase their exposure to alternative investments in 2026, highlighting continued confidence in non-traditional asset classes.

- Among investors with increasing allocations, 22% expect to raise exposure by 5% or more, signaling strong conviction in alternative assets.

- An additional 23% plan to increase exposure by less than 5%, suggesting gradual and measured portfolio expansion.

- Only 2% of respondents anticipate a decrease of less than 5% in alternative investment exposure, reflecting limited downside repositioning.

- Another 2% expect to reduce exposure by 5% or more, indicating minimal large-scale pullbacks.

- Just 1% of investors plan to exit all alternative investments in 2026, underscoring the sector’s resilience and long-term appeal.

(Reference: Wealth Management)

(Reference: Wealth Management)

Real Estate and Infrastructure Investments

- Global real estate investment is expected to surpass $1.0 trillion in 2026, reflecting a roughly 15% increase from 2025.

- Commercial real estate is forecast to retain about 60–62% of total real estate deals in 2026, anchored by logistics, data centers, and prime office.

- Green‑building investments worldwide are on pace to grow approximately 26–30% by 2026, outpacing broader construction‑sector trends.

- Global green‑building market revenue is projected to reach around $620–650 billion by 2026, before accelerating toward nearly $960 billion by 2030.

- Listed real estate investment trusts (REITs) are anticipated to deliver around 5.5–7.0% average total returns in 2026, depending on sector and region.

- Infrastructure funds’ assets under management are set to hit $1.87 trillion by 2026.

- Emerging‑market green‑building investment is expected to approach $24 trillion over the coming decade, with a significant portion deployed by 2026.

- Affordable‑housing investment in advanced markets is forecast to rise 17–20% in 2026, supported by expanded tax‑credit allocations and public–private programs.

Cybersecurity and Digital Transformation Risk

- Over 40% of alternative‑investment firms are expected to report at least one significant cyber incident in the last year by 2026.

- Global cybersecurity spending in the financial sector is projected to rise to around $330–340 billion in 2026.

- The global cyber‑insurance market is forecast to grow to roughly $33 billion in 2026, expanding from about $26.3 billion in 2025.

- AI and machine‑learning adoption in portfolio and risk‑management workflows is expected to reach nearly 70% of investment management firms by 2026.

- Around 30–35% of alternative investment firms are likely to be using blockchain‑based systems for auditability or tokenized assets by 2026, versus 26% in 2025.

- Regulators estimate that over 55% of financial firms will face material increases in cybersecurity compliance and audit costs by 2026.

- Insider‑related events are projected to be flagged as the primary breach vector in about 58–60% of financial institutions by 2026.

Breakdown of Total Alternative Investment Assets

- Private Equity reaches $9.8 trillion, holding 44% of total alternative assets.

- Hedge Funds grow to $5.2 trillion, comprising 23% of the market.

- Real Estate investments hit $4.1 trillion, accounting for 18% share.

- Private Debt expands to $1.8 trillion, representing 8% of alternatives.

- Natural Resources valued at $1.5 trillion, equaling 7% of total.

- Infrastructure assets total $1.4 trillion, making up 6% portion.

Evolving Industry Landscape and Associated Risks

- Around 22–24% of traditional asset managers are projected to offer alternative investment products by 2026.

- Roughly 80% of investors are expected to explicitly integrate ESG or sustainability factors into allocations by 2026.

- About ESG‑oriented assets under management are forecast to grow to $45–46 trillion in 2026, from roughly $41 trillion in 2025.

- Over 40% of investors are anticipated to adjust portfolios in response to geopolitical tensions in 2026.

- Approximately 25–30% of firms are expected to materially reduce exposure to high‑carbon or hard‑to‑abate industries by 2026 due to climate‑risk pressures.

- Around 51–53% of fund managers are likely to rank regulatory and compliance burdens as a top‑three operational risk in 2026.

- Non‑institutional capital inflows into alternatives are projected to rise about 23–25% in 2026.

Drive Demand in New Channels

- Over 40% of alternative assets are accessible to retail investors via digital platforms.

- Alternative investments see a sharp increase in popularity with retail investors.

- Tokenized asset market projected to reach $400 billion.

- On-chain RWA locked value could exceed $100 billion by the end of the year.

- The online investment platform market is expected to hit $6.6 billion by 2030 due to growth.

- The crowdfunding market is projected to reach $31,187 million.

- ESG investing market is valued at $45.61 trillion.

- Equity investments hold 38.09% share in the ESG market.

Regulatory and Risk Considerations

- 88% of alternative fund managers expect rising compliance risk over the next two years.

- 67% of firms faced risk and compliance fines or sanctions in the last two years.

- 64% report that compliance teams are under-resourced.

- New AML rules apply to all RIAs, ERAs, and unregistered investment firms from January 1.

- 34% feel compliance teams are hugely under-resourced.

- 9% received regulator information requests or visits recently.

- 81% of asset managers integrate sustainability risks per ESMA CSA findings.

- CIRCIA mandates cyber incident reporting with multimillion-dollar penalties.

Performance and Returns in a High-Interest Environment

- Alternative investments deliver average macro hedge fund returns of 11.5% through Q3.

- The private equity diversified global buyout index outperforms public equity by 500bps per annum over the past decade.

- Private credit U.S. senior-secured direct lending yields around 200bps above leveraged loans.

- Hedge funds’ average tier-two multi-strategy return 7.7% over the first three quarters.

- Private equity top quartile sector specialist funds IRR 24.5% for 2006-2020 vintages.

- Infrastructure funds like Quant Infrastructure 27.15% over the last 10 years.

Technology Integration and Innovations

- 70% of buy-side firms employ AI to support front office operations.

- 51% believe alternative investments offer the greatest tech innovation opportunity.

- 68% of hedge funds employ AI for market analysis and trading strategies.

- 72% of alternative asset managers integrate AI-based data analytics.

- Two-thirds of investment firms use AI to boost efficiency.

- Robo-advisors‘ total AUM reaches $7 trillion, projected by 2029.

- Vanguard Digital Advisor manages over $311 billionin AUM.

- 81% of firms pursue fintech alliances for alternative assets.

- Smart contracts reduce deal timelines from weeks to days.

Frequently Asked Questions (FAQs)

India’s alternative investment sector grew at a 31.24% CAGR over the last 10 years.

Apollo’s AUM grew to $938 billion in early 2026.

Blackstone had approximately $1.2 trillion in total assets under management.

Conclusion

As we move further, the alternative investment landscape continues to evolve, driven by technological innovations, shifting regulatory frameworks, and a growing focus on ESG investing. Investors are increasingly looking towards alternative assets to diversify their portfolios and enhance returns, especially in a high-interest-rate environment. It is clear that the sector will play an even more critical role in the broader financial ecosystem in the years to come.

The post Alternative Investment Industry Statistics 2026: How the Wealthy Diversify Now appeared first on CoinLaw.

You May Also Like

STX Technical Analysis Feb 10

Omdia: Mainland China’s cloud infrastructure market accelerates to 24% growth in Q3 2025