Annuity Industry Statistics 2026: Shocking Growth

The annuity market is poised for a landmark this year. With increasing life expectancies, a volatile economy, and more people looking for secure retirement income, annuities have become an essential tool for financial planning. As we step into this new era, the annuity landscape is rapidly evolving, setting new records and reshaping the financial world. In this article, we’ll explore the key statistics and trends that define the annuity industry today, providing insights into its current growth, market dynamics, and the leading players.

Editor’s Choice

- Fixed-Indexed Annuities (FIA) are expected to be around $126 billion.

- Variable Annuities (VA) are forecasted to continue the upward trend beyond the $47 billion YTD pace.

- Registered Index-Linked Annuities (RILA) sales to exceed $75 billion.

- Income Annuities are influenced by demographics and rates amid overall growth.

- Digital platforms are driving efficiencies in the sales process.

- Approximately 68% of financial advisors recommend annuities.

Recent Developments

- Fixed-rate deferred annuity (FRD) sales are expected to decline amid interest rate cuts.

- FRD sales are projected to moderate from the peak but remain above historical norms.

- ESG-linked annuities are gaining traction with growing demand for sustainable options.

- AI is transforming the annuity market via personalization and fraud detection.

- Fee-based annuities doubled in sales since 2020, poised for expansion.

- SECURE 2.0 Act raises QLAC cap to $200,000 indexed for inflation.

- 50 states implementing best-interest standards for annuity sales.

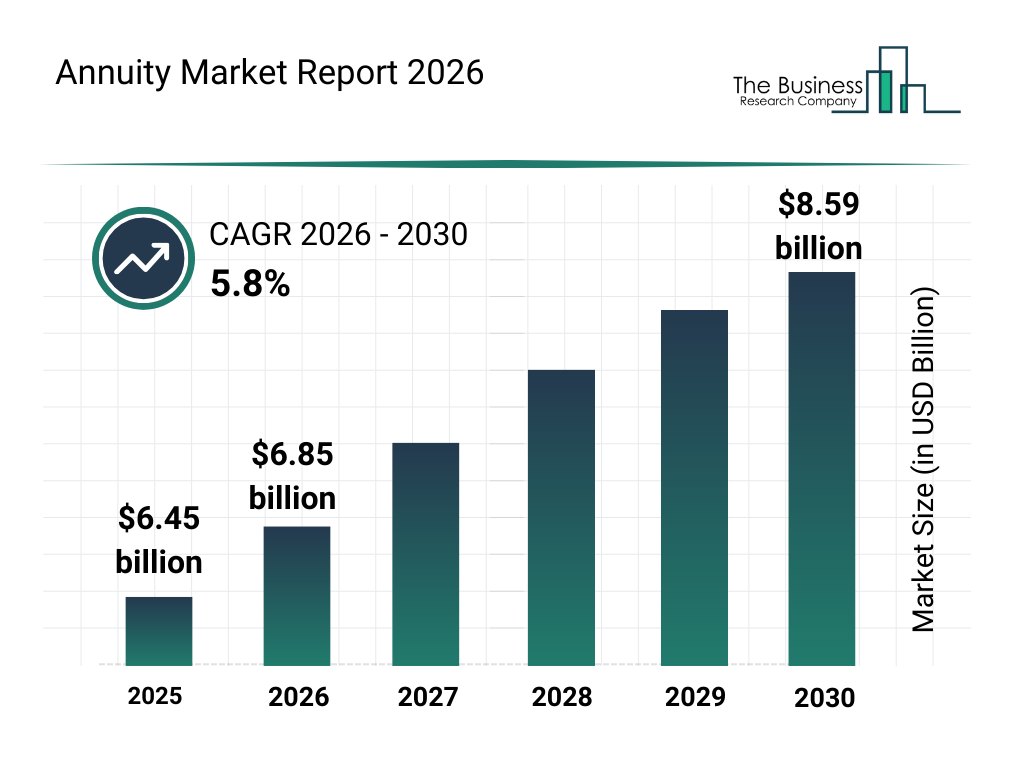

Annuity Market Growth Outlook

- The global annuity market was valued at $6.45 billion in 2025, reflecting steady demand for long-term retirement income products.

- In 2026, the market expanded to $6.85 billion, driven by rising retirement planning and income security needs.

- By 2027, the annuity market size reached approximately $7.25 billion, supported by the growing adoption of fixed and indexed annuity products.

- The market continued its upward trajectory in 2028, climbing to around $7.75 billion as insurers diversified product offerings.

- In 2029, the total annuity market value increased further to about $8.15 billion, reflecting sustained investor confidence.

- By 2030, the annuity market is projected to reach $8.59 billion, growing at a 5.8% CAGR from 2026 to 2030, signaling strong long-term expansion.

(Reference: The Business Research Company)

(Reference: The Business Research Company)

Annuity Sales Channels

- Independent broker-dealers 24% of total sales.

- Independent agents 22% market share.

- 45% insurers rank RIAs top growth channel.

- Digital platforms 35% of sales.

- Financial advisors influence 68% purchases.

- Equitable digital sales 45% via platforms.

- Hybrid models 15% of sales.

- Direct-to-consumer growth 10%.

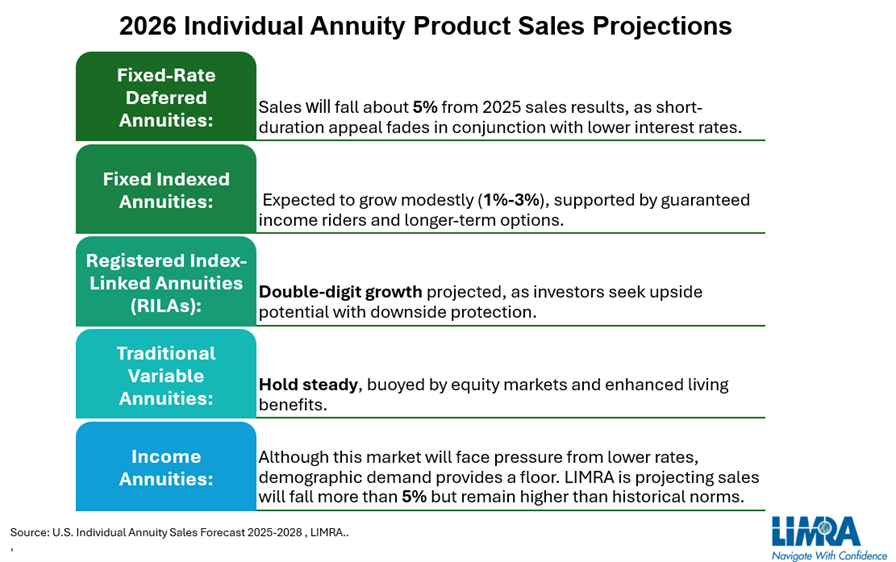

Individual Annuity Product Sales Outlook

- Fixed-Rate Deferred Annuities are projected to see sales decline by about 5% in 2026, as demand for short-duration products weakens amid lower interest rates.

- Fixed Indexed Annuities are expected to record modest growth of 1%–3%, supported by guaranteed income riders and increased interest in longer-term annuity options.

- Registered Index-Linked Annuities (RILAs) are forecast to achieve double-digit growth, driven by investors seeking upside market participation with downside protection.

- Traditional Variable Annuities are likely to hold steady in 2026, buoyed by equity market performance and the availability of enhanced living benefits.

- Income Annuities may experience sales pressure, with volumes expected to decline by more than 5%, yet remain above historical norms due to strong demographic-driven demand.

(Reference: LIMRA)

(Reference: LIMRA)

Fixed Indexed Annuities Performance

- FIA sales projected to exceed $126 billion.

- Athene leads the FIA market with over $13 billion in sales.

- 78% of FIA contracts include guaranteed income riders.

- Average FIA crediting ~1%-7% for risk-controlled indexes.

- Equity-linked indexes yield 16%-28% pre-cap returns.

- FIA sales up 34% YTD to $95.1 billion Q3.

- Market-linked bonuses are popular in new FIA contracts.

Top Reasons for Purchasing a Payout Annuity

- Regular monthly income is cited by 22% of buyers.

- Safe investment for retirement motivates 18% of purchasers.

- Advisor recommendations influence 17% of decisions.

- Guaranteed lifetime income appeals to 13% of buyers.

- Employer-provided annuities account for 7% of purchases.

- Financial stability drives 65%, prioritizing income security.

- Predictable returns are sought by 42% of retirement planners.

Registered Index-Linked Annuities Surge

- RILA sales projected to exceed $75 billion.

- Q3 sales hit record $20.7 billion, up 20% YoY.

- YTD Q3 sales reach $57.4 billion, 19% growth.

- Equitable leads with 22% market share.

- Buffer levels are popular at 10%-20% downside protection.

- Cap rates up to 10% on 6-year Allianz terms.

- 5-year contracts favored for balanced growth-protection.

- H1 sales $37 billion, up 20% YoY.

Top-Performing US Annuity Companies

- Athene leads overall with $26.8 billion YTD Q3 sales, 74% top 20 market share.

- New York Life is second at $24.8 billion total, with $19.8 billion fixed annuities.

- Jackson National tops variable annuities with $9.6 billion in sales.

- Corebridge Financial ranked third overall, with $20.6 billion, $16.3 billion fixed.

- Nationwide is strong in FIAs at $6.9 billion in indexed sales.

Income Annuities Statistics

- DIA YTD sales $3.4 billion, down 10%.

- SPIA YTD sales are stable at prior year levels.

- QLAC limit increased to $210,000.

- SPIA age 60 monthly payout $580 per $100k.

- SPIA age 70 payout reaches $700+ per $100k.

Frequently Asked Questions (FAQs)

RILA sales were $20.7 billion in Q3 2025, 20% higher year‑over‑year and about 20× the sales from a decade ago.

Industry forecasts indicate annuity sales will remain near 2025’s record highs through 2026, supported by ongoing retirement income demand.

Individual annuity sales for the first three quarters of 2025 grew by 4.4%.

Conclusion

The annuity industry is stronger than ever, with record sales, innovative products, and digital advancements shaping its future. From fixed-indexed annuities to registered index-linked annuities, the demand for secure, lifetime income options continues to grow. As consumers look for stability and protection in uncertain economic times, annuities remain a key solution for retirement planning. With rising interest rates, new digital platforms, and a shift toward sustainable investments, the annuity landscape is set to continue its impressive expansion, offering investors a diverse range of options to meet their long-term financial goals.

The post Annuity Industry Statistics 2026: Shocking Growth appeared first on CoinLaw.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

Vàng Cán Mốc Lịch Sử 5.000 USD: Khi Dự Báo Của CEO Bitget Gracy Chen Trở Thành Hiện Thực Và Tầm Nhìn Về Đích Đến 5.400 USD