Bitcoin Technical Outlook: Key Levels, Resistance Zones, and Why $72,500 Matters

Bitcoin has entered a recovery phase after bouncing from its $60,500 trough, but technical indicators continue to show a market struggling to regain bullish control.

The price has stabilized near the $70,000 level after reclaiming the $68,800 resistance zone. Bitcoin is currently trading above the 100-hour simple moving average, a short-term bullish signal, though upside momentum remains limited.

Trend Structure Remains Bearish

Despite recent gains, the broader technical structure remains bearish. Bitcoin continues to trade within a falling trend channel on the medium- to long-term timeframe. According to InvestTech, falling trend channels typically reflect weakening buying interest and negative price development.

The overall trend will remain bearish until Bitcoin can reclaim the 200-day exponential moving average, currently located near $95,700.

Key Resistance Levels

Source: InvestTech

Source: InvestTech

Bitcoin is facing significant resistance in the $72,000–$72,500 zone. This area coincides with the 61.8% Fibonacci retracement of the decline from the $78,988 high to the $60,500 low.

A confirmed breakout above $72,500 could open the door to further upside, with potential resistance levels at:

- $74,650

- $75,880

- $76,500

- $77,200

However, sellers remain active in this range, repeatedly rejecting attempts to push prices higher.

Support Levels to Watch

On the downside, immediate support lies at $69,400, followed by stronger levels at:

- $68,500

- $67,600

- $66,500

The $65,000 level remains the principal support zone. A sustained move below this level would significantly weaken the short-term outlook and make a recovery more difficult.

Indicators and Momentum

On the daily chart, the Relative Strength Index (RSI) is rebounding from deeply oversold conditions and currently sits near 32.5, suggesting that selling pressure may be easing. Meanwhile, the MACD remains in bearish territory, although the narrowing gap between signal lines indicates that downward momentum is losing strength.

On shorter timeframes, the hourly RSI has moved above 50, while the hourly MACD shows waning bearish momentum. A rising channel has formed on the hourly BTC/USD chart, with support near $68,800.

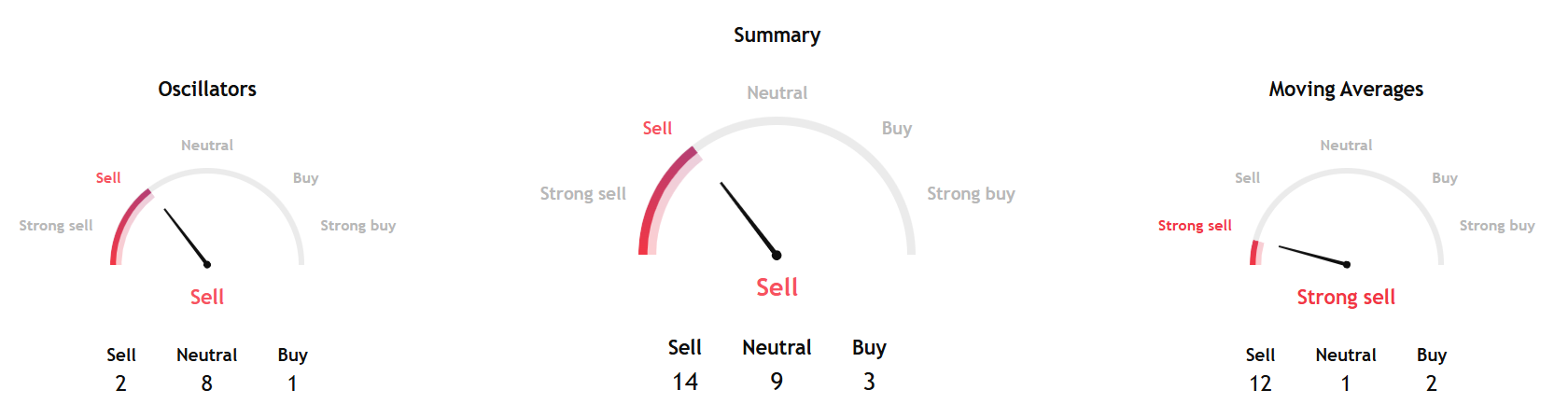

TradingView’s weekly technical summary continues to flash a sell signal across moving averages, oscillators, and pivot levels.

Source: TradingView

Source: TradingView

Scenario Outlook

If Bitcoin can hold above $68,800 and successfully break through the $72,500 resistance zone, a short-term move toward $74,750 — and potentially higher — remains possible.

Failure to clear resistance, however, could trigger another leg lower, with price potentially revisiting the $65,000–$60,000 support range.

For now, technicals suggest that while downside momentum is weakening, the broader trend remains bearish until proven otherwise.

Separately, InvestTech's Algorithmic Overall Analysis and recommendation for one to six weeks gives a negative score.

The research firm said, "Bitcoin is in a falling trend channel in the medium-long term. Falling trends indicate that the currency experiences negative development and falling buying interest among investors. There is no support in the price chart, and further decline is indicated. In case of a positive reaction, the token has resistance at $86,000."

You May Also Like

YZi Labs Binance Deposit: A $6.63M Signal That Could Shake the ID Token Market

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more