Chainlink (LINK) Price: Why This Bear Market Is Different According to Co-Founder

TLDR

- Chainlink co-founder Sergey Nazarov says this crypto market downturn differs from previous bear markets because there have been no major institutional collapses like FTX

- Tokenized real-world assets have grown 300% over the past year despite falling crypto prices, showing standalone value beyond speculation

- Crypto market capitalization dropped 44% from its October high of $4.4 trillion, losing nearly $2 trillion in four months

- Chainlink price fell 67% since October and trades below $9, approaching a key $8 support level that could determine the next move

- Exchange reserve data shows LINK holders are not aggressively selling, with declining balances suggesting long-term holders are maintaining positions

Chainlink co-founder Sergey Nazarov says the current crypto market downturn stands apart from previous bear cycles. The blockchain oracle network creator pointed to two key differences in a post on X on Tuesday.

The crypto market has lost nearly $2 trillion since October. Market capitalization fell 44% from its all-time high of $4.4 trillion. Despite the steep decline, Nazarov expressed confidence in the industry’s progress.

The first major difference involves institutional stability. Unlike the 2022 cycle that saw FTX collapse and crypto lending platforms fail, this downturn has not triggered major institutional failures. Nazarov said there have been no large risk management failures leading to widespread systemic risks.

The second factor centers on real-world asset tokenization. RWA growth continues regardless of crypto price movements. According to RWA.xyz, tokenized real-world asset value increased 300% over the past 12 months.

Nazarov explained that having real-world assets on-chain provides unique value independent of Bitcoin or other crypto asset prices. On-chain perpetual contracts for traditional commodities also continue growing.

The Chainlink co-founder sees this as proof that blockchain innovation has standalone value beyond speculation. He believes RWAs offer distinct advantages including 24/7 markets, on-chain collateral, and real-time data access.

Market Performance and Technical Levels

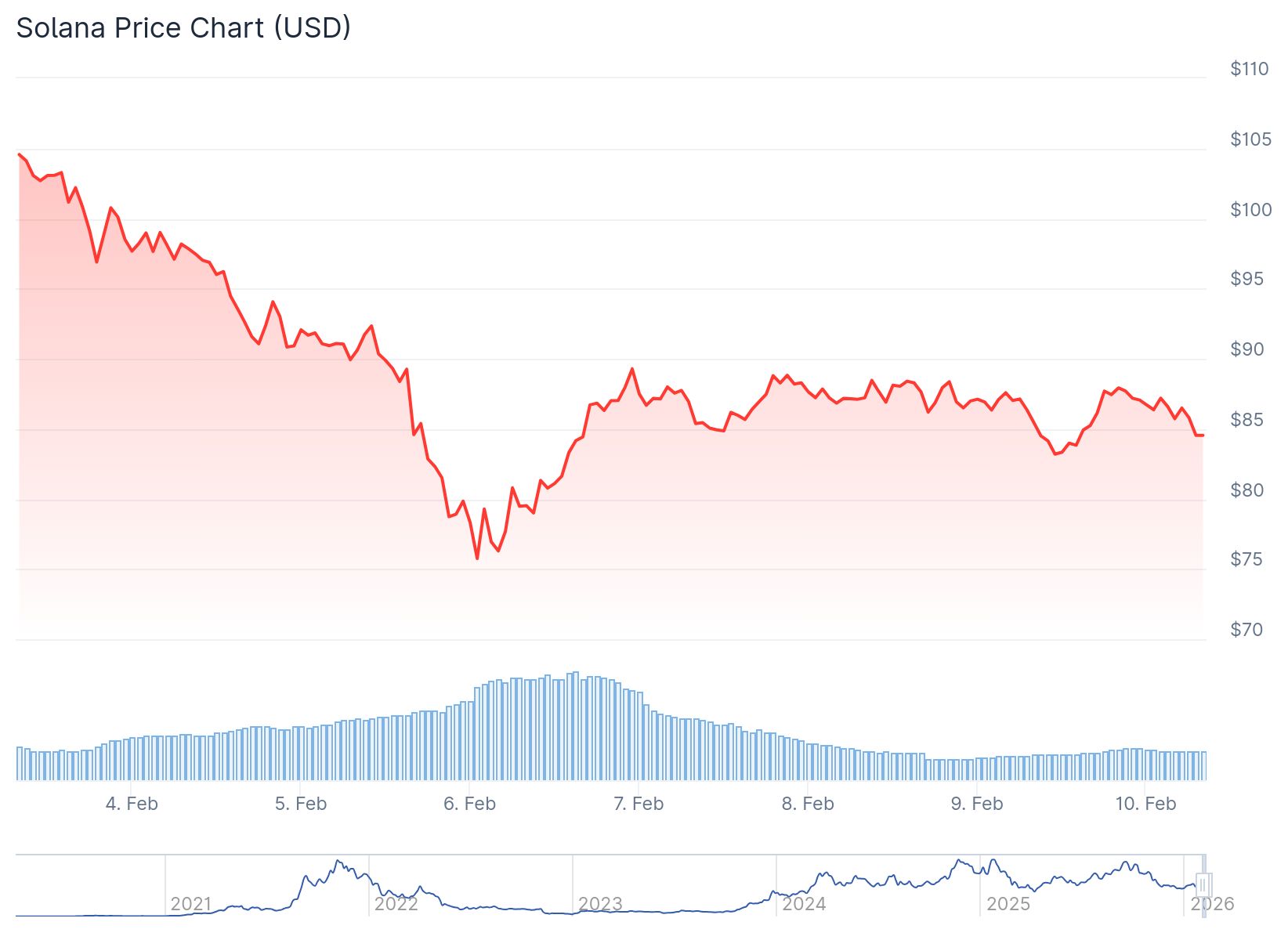

Chainlink price has not reflected the RWA growth momentum. The token dropped 67% since its October peak. LINK trades 83% below its 2021 all-time high at around $8.50.

Chainlink (LINK) Price

Chainlink (LINK) Price

The token declined roughly 3% in the latest session. The move tracked broader market weakness as Bitcoin and major altcoins faced selling pressure. Trading volume remained relatively muted during the pullback.

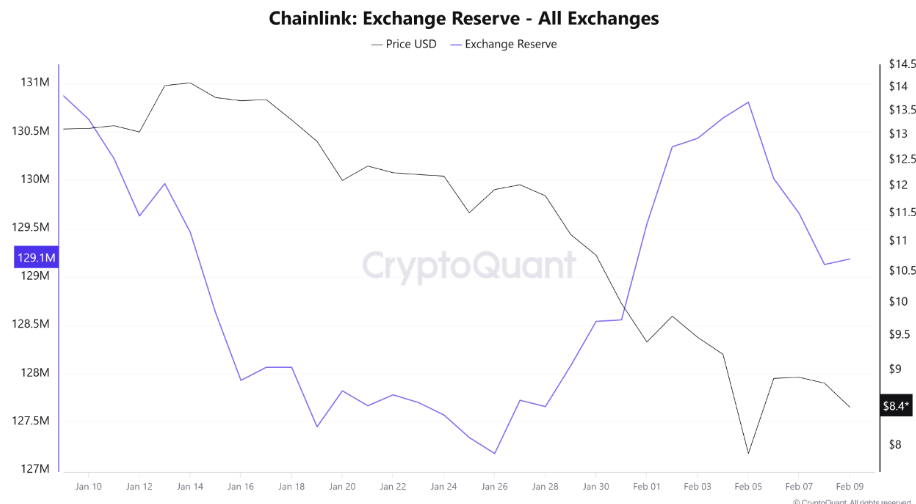

On-chain data from Cryptoquant shows exchange reserves trending lower. LINK balances on centralized exchanges have declined rather than increased. This pattern typically indicates holders are not rushing to sell.

Source; CryptoQuant

Source; CryptoQuant

Historically, sharp price drops combined with rising exchange reserves signal extended downside. That dynamic is absent in current conditions. The data suggests long-term holders maintain positions despite near-term weakness.

Spot volume data reveals cooling trading activity across major exchanges. Large-volume transactions have decreased compared to previous volatile periods. The reduced activity reflects market indecision rather than panic selling.

Critical Support Zone Ahead

Chainlink price now approaches a key demand zone near $8. The pullback has been orderly without printing lower lows on higher timeframes. The broader market structure remains intact for now.

The $8 level represents a make-or-break zone for LINK. A break below could trigger further downside toward $7 and potentially $6. Holding above $8 would keep recovery prospects alive.

LINK is testing this support level without collapsing. The reaction around $8 will determine whether the move becomes a bounce higher or continuation lower. Buyers have stepped back but sellers have not accelerated aggressively.

Nazarov believes institutional adoption will be driven by fundamental utility of on-chain systems. He predicts on-chain RWAs will eventually surpass cryptocurrency in total value. The infrastructure demands will surge as complex RWAs require more sophisticated systems.

Bernstein analyst Gautam Chhugani called this “the weakest Bitcoin bear case in its history” in a Monday note. The analysts stated the current price action represents a crisis of confidence with nothing fundamentally broken. Jeff Mei from BTSE exchange noted this sell-off differs because it was caused largely by non-crypto catalysts including AI tech boom concerns and Federal Reserve chair appointment speculation.

The post Chainlink (LINK) Price: Why This Bear Market Is Different According to Co-Founder appeared first on CoinCentral.

You May Also Like

Young Republicans were more proud to be American under Obama than under Trump: data analyst

Disney Pockets $2.2 Billion For Filming Outside America