Ethereum Is Repeating a 2019 Pattern Most Investors Are Ignoring

According to Michaël van de Poppe, Ethereum may be repeating a familiar early-cycle pattern where network growth accelerates well before price responds.

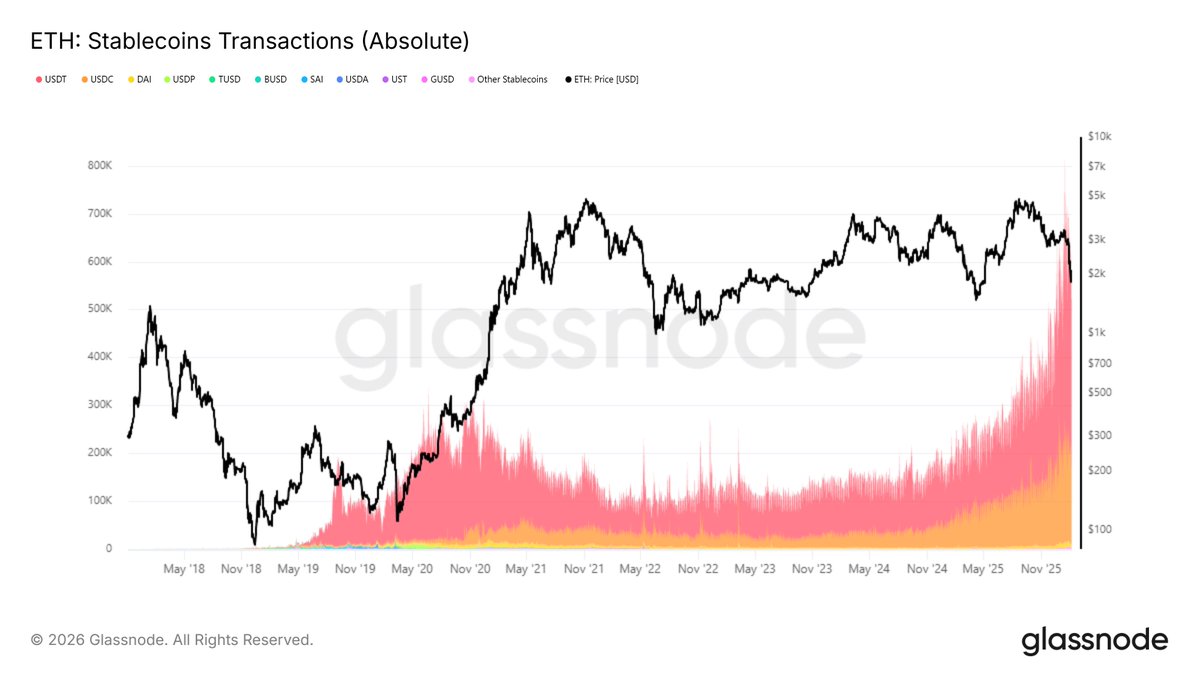

The current divergence between Ethereum’s price performance and stablecoin transaction activity mirrors behavior last observed in 2019, when on-chain usage expanded months ahead of a sustained market reprice.

The key observation is that price often lags fundamentals in the first stage of a growth cycle, only reacting once narrative and capital flows align.

Source: https://x.com/CryptoMichNL/status/2021116927553294475

Source: https://x.com/CryptoMichNL/status/2021116927553294475

What the Chart Shows

The chart plots absolute stablecoin transaction volumes on Ethereum alongside ETH price over time.

- The colored area represents total stablecoin transaction activity across major stablecoins on Ethereum.

- The black line tracks ETH price in USD.

Over the past 18 months, stablecoin transactions on Ethereum have increased by roughly 200%, indicating a sharp rise in on-chain economic activity. During the same period, ETH price is down approximately 30%, highlighting a clear divergence between usage and valuation.

Historical Parallel: Ethereum in 2019

Van de Poppe points to 2019 as a direct comparison. During that period, Ethereum saw little immediate price appreciation despite rising stablecoin usage. Price only began to trend meaningfully higher once stablecoin transaction activity peaked and broader market attention shifted toward Ethereum’s growing role in settlement and liquidity.

In that cycle, price followed narrative, not the other way around. Network activity laid the groundwork first, while valuation adjusted later.

Structural Interpretation

Stablecoin transactions are a proxy for economic throughput on Ethereum. They reflect settlement demand, liquidity movement, and capital rotation across DeFi, exchanges, and on-chain applications. A sustained rise in this metric suggests that Ethereum is increasingly used as financial infrastructure, regardless of short-term price action.

The current setup shows expanding on-chain utility without corresponding price confirmation. Historically, this configuration has preceded periods where price catches up to fundamentals once sentiment and positioning shift.

Market Context

The lack of immediate price response is also psychological. As van de Poppe notes, the market often struggles to price in early-stage growth when recent price performance has been weak. This disconnect can persist until a narrative catalyst forces reassessment.

In the present case, Ethereum’s growing stablecoin throughput contrasts sharply with negative price momentum, creating a tension similar to earlier accumulation phases.

The post Ethereum Is Repeating a 2019 Pattern Most Investors Are Ignoring appeared first on ETHNews.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Xenea Wallet Daily Quiz 11 February 2026: Claim Your Free Crypto Coins Now