Ethereum Exit Queue Hits Peak High Since 2022 Proof-of-Stake Transition

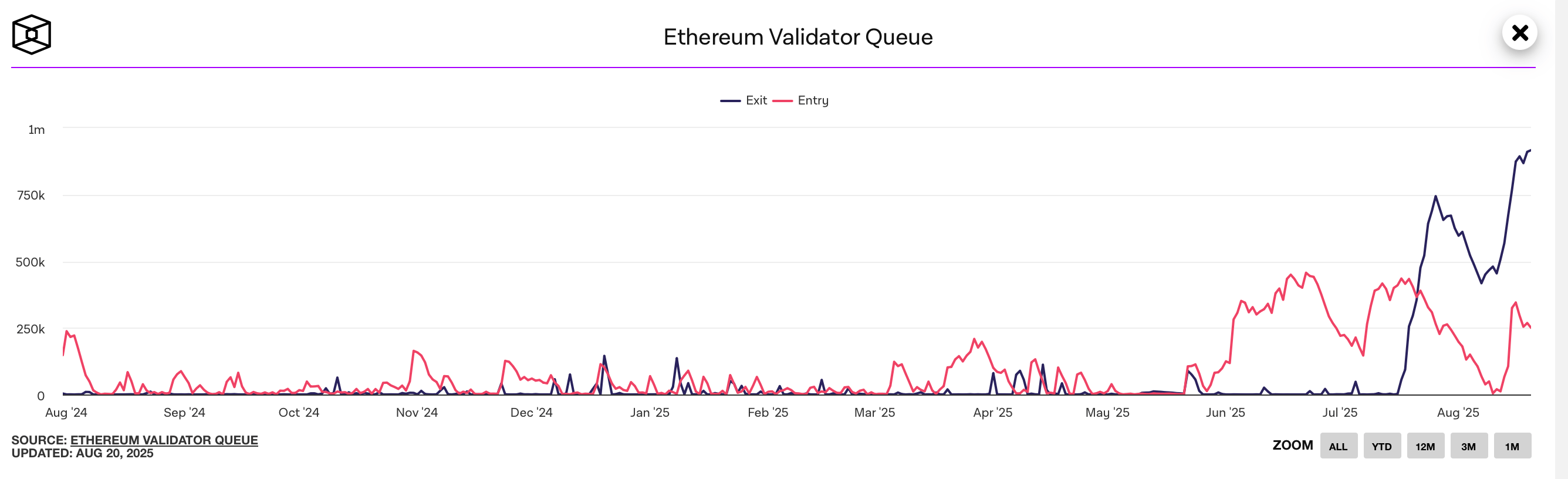

This week, Ethereum’s validator exit line hit a record, the biggest since the network shifted to proof-of-stake (PoS) in 2022.

Validator Exit Wait Tops Two Weeks as Ethereum Queue Reaches New High

As of Aug. 20, 2025, roughly 898,000 to 916,000 ethereum ( ETH) is now queued to leave staking—about 28,000 to 28,600 validators at 32 ETH apiece—worth about $3.8 billion to $4.0 billion with ETH prices near $4,200 to $4,300 per coin.

The wait for full withdrawal has stretched to about 15 to 16 days when factoring in a withdrawal-sweep delay of roughly 9.4 days. Processing is pinned at protocol capacity, with exits effectively capped near 1,875 validators per day to keep the network steady.

Source data: theblock.co data page.

Source data: theblock.co data page.

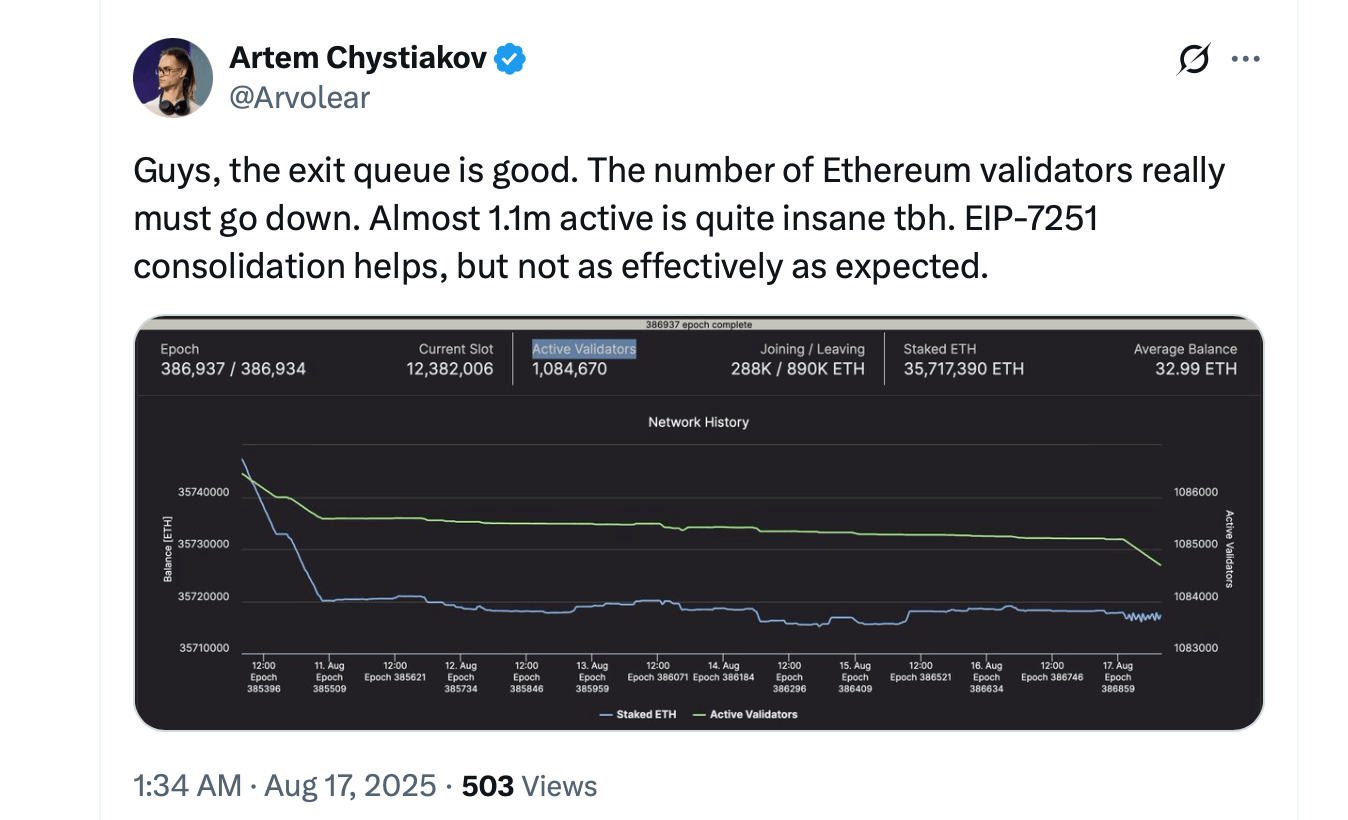

The queue swelled in recent weeks: late July showed about 520,000 ETH waiting, climbing to roughly 693,000 ETH by July 25, about 809,000 ETH by Aug. 15, and topping out near 910,461 ETH on Aug. 18–19 before hovering around record marks of above 916,000 on Aug. 20. The subject is also a hot topic on social media channels like X.

Although exits sped up, staking did not stop. An entry queue of about 230,000 to 268,000 ETH—with a three- to four-day wait—signals steady interest in joining the validator set even as withdrawals rise. Many believe the main driver behind this trend is ETH’s price, with a growing number of holders opting to cash out.

Altogether, Ethereum’s active validator count sits near 1.08 million, with about 35.5 million to 35.6 million ETH staked—around 29% of the circulating supply—forming the base from which the exit churn limit is calculated. The protocol’s guardrails scale with the active validator total to avoid abrupt shifts in the set.

Over the past week, net staked ETH fell by roughly 43,900 ETH (about $178 million), yet total staked balances remain broadly steady as entry and exit flows offset. The figures show no clear increase in exchange inflows that would point to immediate, large-scale selling. At press time, ETH is exchanging hands for around $4,278 per coin.

Many observers tie the elevated queue to several forces—profit-taking after ETH’s price strength, validator consolidation, rotation into restaking and liquid restaking tokens, and liquidity prep around potential staking-enabled products—all within the protocol’s planned exit constraints.

In short, the record exit queue reflects Ethereum’s throttled withdrawal design: processing runs at capacity, entry demand persists, and staking participation stays high even as withdrawals make their way through the system.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

Why Are Disaster Recovery Services Essential for SMBs?