Wall Street Pepe Pumps 40% Following Solana Debut

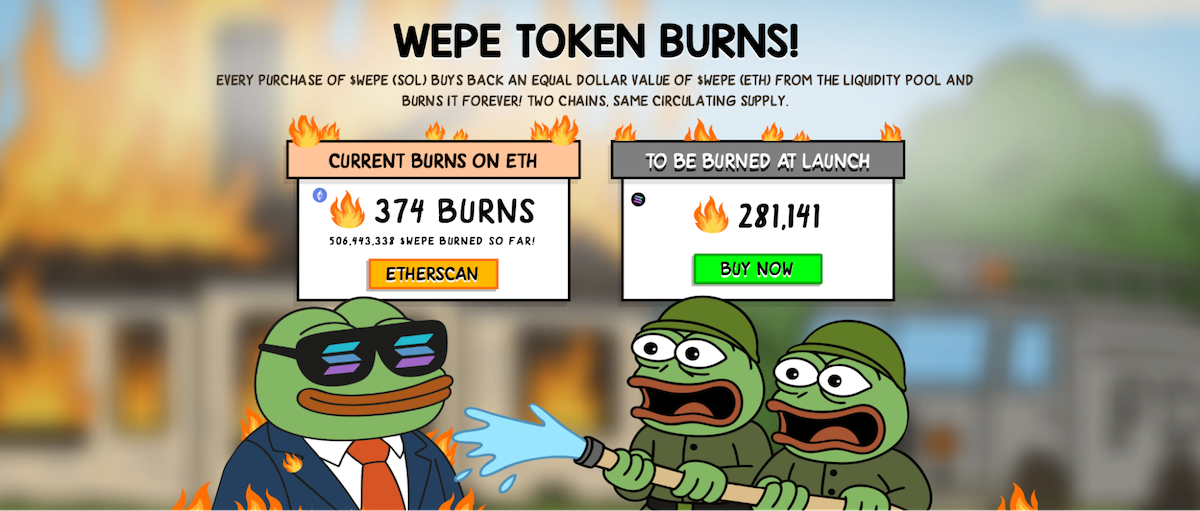

Wall Street Pepe (WEPE) has torched over 500 million tokens on Ethereum (ETH) as it makes its official debut on Solana.

The burn is baked into WEPE’s dual-chain mechanics, designed to gradually migrate supply and presence to the meme coin capital.

Every SOL WEPE allocation is matched by an ETH WEPE burn, tightening supply and laying the groundwork for the frog’s eventual launch on Solana.

That 500,000,000 token burn is a blazing kickoff, and it couldn’t come at a better time. The Solana pivot solidifies WEPE’s position in the meme coin epicenter, while also laying the groundwork for smoother NFT integrations in the future.

For now, the community gets its first taste with the August 22 free-mint NFT collection on Ethereum, a drop that was designed by the WEPE Army itself.

True to form, the migration mirrors WEPE’s ethos: built by the people, for the people. The NFTs were demanded by the community, and now the chain move itself shows who’s really steering the ship.

In short, the Army is in control, and that’s also reflected in WEPE’s 40.94% surge in the past 24 hours.

One large holder who offloaded heavily on Tuesday was already back accumulating on Wednesday, a move that speaks for itself.

Source: TradingView

Why is Wall Street Pepe burning WEPE tokens?

Wall Street Pepe’s move to Solana comes with a built-in balancing act, where the hard cap of 200 billion WEPE tokens remains unchanged.

This balancing act – the token burns – ensures ETH holders don’t get diluted. In fact, it concentrates value across the fixed supply, since, as mentioned, every new mint on Solana is offset by a permanent burn on Ethereum.

And since launching on Tuesday, over 500 million WEPE have already been bought and burned on Ethereum. It’s the clearest signal yet that demand for Solana WEPE is fueling real supply destruction on ETH.

During the current early access phase, purchases with ETH automatically trigger real-time buy-and-burns of WEPE on Ethereum. Purchases made with SOL, USDC, or a card are matched by scheduled burns at the Token Generation Event (TGE), when the equivalent amount of SOL WEPE is minted and airdropped.

This ensures the peg between ETH WEPE and SOL WEPE stays intact. With centralized exchanges listing WEPE under one ticker, any short-term price gap between chains is quickly leveled out by traders through arbitrage.

Post-TGE, the same mechanics continue: every SOL-side allocation will always be neutralized by live burns of ETH WEPE. The result is a fixed-supply system that preserves value for holders while gradually shifting more liquidity and utility onto Solana.

Nonfungible Tokens Will Soon Move to Solana Too?

As mentioned, the suited frog’s first NFT collection drops on Ethereum, staying true to the chain where WEPE was born.

While the token supply begins its migration to Solana, the NFTs give ETH holders another way to rep the brand without missing out on the culture.

The 5,000-piece free mint is allocated as follows:

- 1,000 spots for Alpha Chat members

- 1,500 spots for QuestN participants

- 1,000 spots for community activations

- 1,000 spots for partnerships and cross-community collabs

- 500 NFTs reserved for the team vault and future rewards (TBC)

What makes it different? These NFTs were dreamt up by the community itself as another way to flex WEPE loyalty. Each NFT unlocks access to the Alpha Chat, inner-circle perks, and exclusive events – pulling the army even closer into the project.

The collection launches this Friday, and if you’re on the whitelist, you’re in for a true free mint.

And while this drop lives on Ethereum, the team has hinted that future NFT integrations – from gamified mechanics to token-gated tools – could eventually find a smoother home on Solana’s faster, lower-cost rails.

Here’s How to Secure Your SOL WEPE Allocations

The WEPE (SOL) early access phase is live, with allocations priced at $0.001 per token ahead of TGE. This lets users lock in their Solana-based WEPE before launch.

Allocations can be secured using ETH, SOL, USDT, or USDC through their favorite wallet – including Best Wallet (BEST), often ranked among the best crypto wallets in the space.

Card payments are also supported. After TGE, ETH WEPE holders will be able to swap 1:1 for the Solana version at no cost.

Follow Wall Street Pepe on X and Telegram for updates.

Visit the Wall Street Pepe website.

nextThe post Wall Street Pepe Pumps 40% Following Solana Debut appeared first on Coinspeaker.

You May Also Like

BlackRock boosts AI and US equity exposure in $185 billion models

China Bans Nvidia’s RTX Pro 6000D Chip Amid AI Hardware Push