Google Searches for ‘Privacy Coins’ Reach an All-Time High; Price Follows

The mindshare and interest in privacy solutions appear to be rising worldwide, which includes privacy-enhancing cryptocurrencies. Bitcoin first gained popularity among privacy and encryption advocates known as cypherpunks, thanks to its pseudonymous accounts—later losing this appeal with the surge of advanced chain analysis tools. In this context, a few privacy-focused cryptocurrencies have surged, addressing this specific demand at the protocol level.

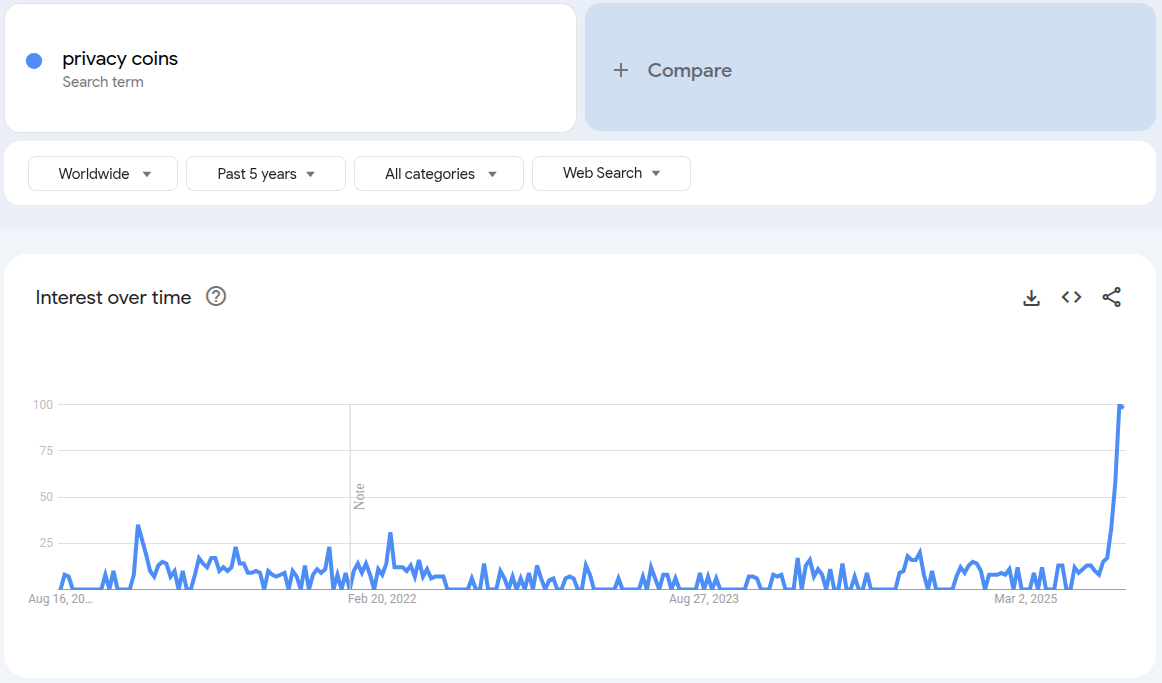

According to data from Google Trends on August 20, searches for the keyword “Privacy Coins” jumped significantly worldwide, reaching an all-time high marked by 98 points in the five-year timeframe. This is a contrasting metric to the recent plunge in “alt season” searches.

Global interest in “privacy coins” in the past five years from August 20, 2025 | Source: Google Trends

On that note, Vlad, host of the Bitcoin Takeover (BTCTKVR) podcast, commented this rise in interest “was obvious.” In a post on X, Vlad foresees “a massive exodus towards anything that offers financial privacy,” adding that this is not a matter of “if” but “when.” He mentions that there are “many Bitcoin OGs” interested in privacy coins like Monero, Zcash, Zano, and Beam “these days,” proving his point.

More Metrics: Shielded Zcash, Price Analysis

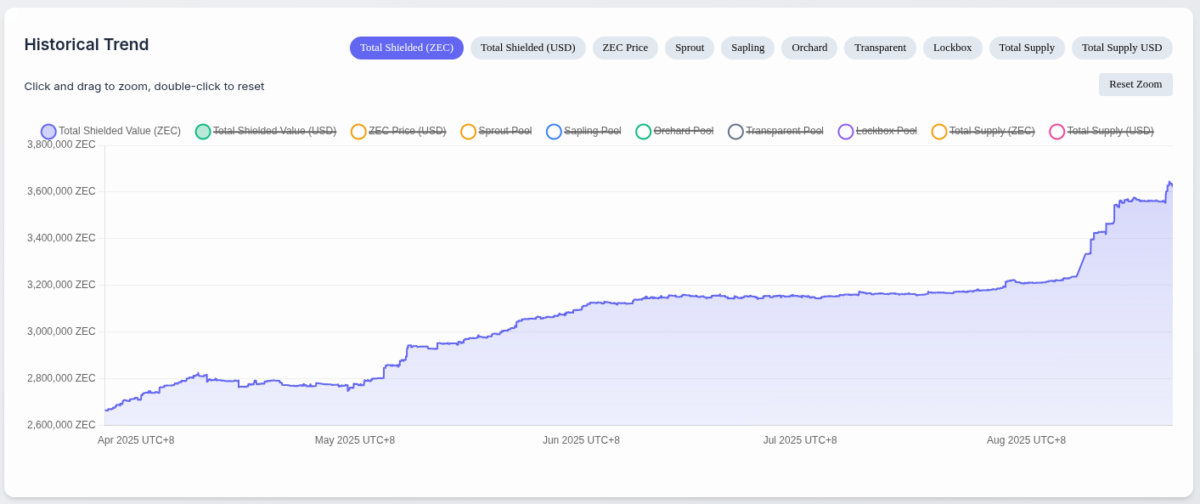

Another interesting metric that reached an all-time high and reflects the growing demand for privacy coins and privacy-enhancing technology is the total supply of shielded ZEC. Zcash is the second most popular privacy cryptocurrency by market cap, which gives users the choice of using transparent or shielded (privacy-enhancing) addresses.

Data from the Zcash Dashboard retrieved by Coinspeaker shows shielded Zcash ZEC $39.32 24h volatility: 12.0% Market cap: $638.29 M Vol. 24h: $111.82 M peaked at over 3,645,047 ZEC (approximately $140 million) on August 20. With that, the percentage of shielded Zcash over its total supply is 22.32%, showing rising interest in the privacy feature while holding and using the coin.

Historical trend of shielded Zcash supply as of August 20, 2025 | Source: Zcash Dashboard

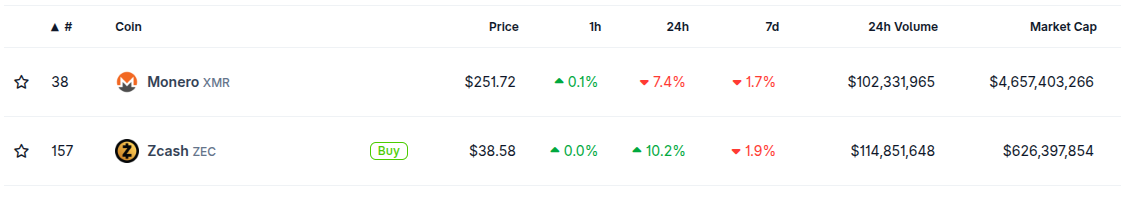

ZEC is up 10.2% in the last 24 hours, according to the CoinGecko index, following this trend. On the other hand, Monero XMR $259.9 24h volatility: 3.6% Market cap: $4.79 B Vol. 24h: $111.33 M is down 7.4% despite the growing interest in privacy solutions due to the challenges Monero currently faces related to Qubic Pool’s selfish mining attacks, as Coinspeaker reported.

Privacy coins category price index on August 20 | Source: CoinGecko

Besides privacy coins, other examples of privacy-enhancing technologies are also seeing an increase in mindshare, especially on X. VPN providers like Mullvad, Nym, and Proton; Brave browser; private AI, as teased by the Near protocol; and others like Railgun for Ethereum or the eERC token standard for Avalanche are a few notable use cases leading the privacy race.

nextThe post Google Searches for ‘Privacy Coins’ Reach an All-Time High; Price Follows appeared first on Coinspeaker.

You May Also Like

BlackRock boosts AI and US equity exposure in $185 billion models

China Bans Nvidia’s RTX Pro 6000D Chip Amid AI Hardware Push