Ethereum Captures Investor Frenzy, Overtakes Bitcoin With Nearly $3-B Surge

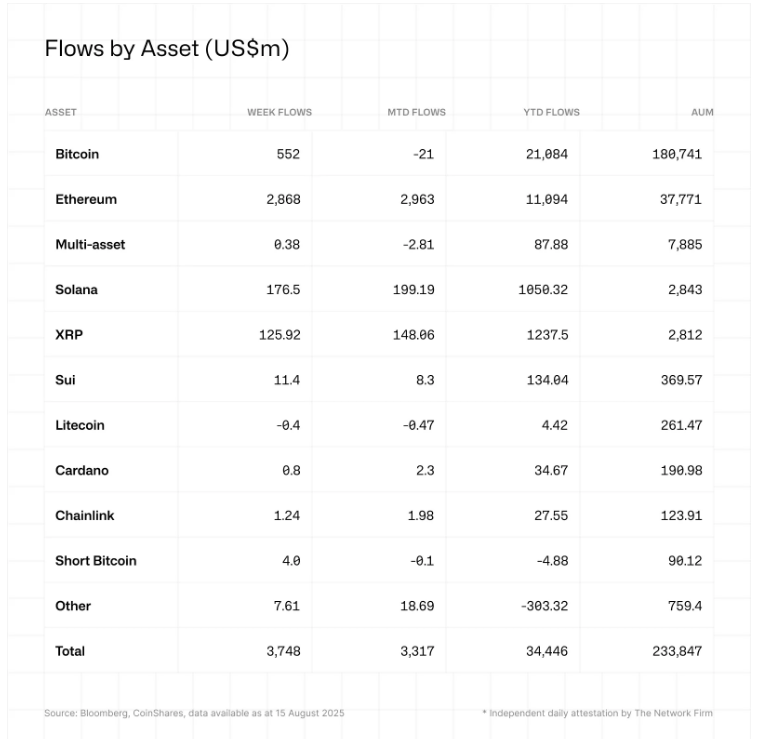

Digital-asset investment products pulled in $3.75 billion last week, lifting assets under management to $244 billion on August 13.

The total ranks among the largest weekly inflows seen recently, CoinShares data shows. Prices rose, but the main driver was money moving into funds rather than a broad retail rush.

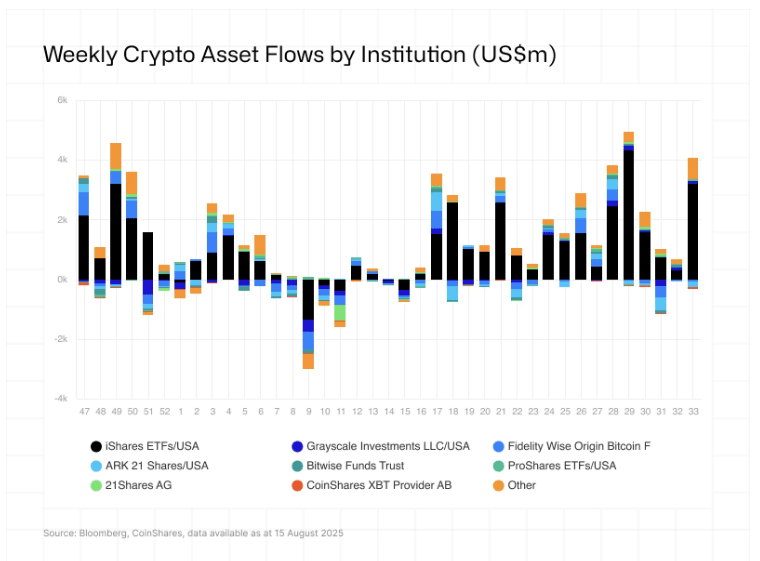

Concentrated Flows From A Single Product

Based on reports from CoinShares, almost all of the inflows came through one provider. The US accounted for $3.73 billion, almost the entire week’s total.

Canada added $33.7 million, Hong Kong close to $21 million, and Australia $12 million. By contrast, Brazil and Sweden recorded outflows of $10.6 million and $50 million.

Market participants say the bulk of the cash was funneled into a single iShares product, which helps explain how a relatively narrow set of flows moved overall AUM so sharply.

Ethereum Draws The Most Money

Ethereum attracted the lion’s share of last week’s inflows at $2.87 billion, or 77% of the total. That brings year-to-date net inflows into ETH to about $11 billion.

Ethereum now makes up nearly 30% of assets under management, versus Bitcoin’s 11.6%. Bitcoin’s weekly intake was $552 million.

Other moves included Solana taking $176.5 million and XRP adding $126 million, while Litecoin and Ton showed small outflows of $0.4 million and $1 million, respectively. These numbers point to a clear shift in where institutional money is parked this week.

Corporate Holdings And Supply Notes

Corporate Holdings And Supply Notes

Reports have disclosed that more than 16 companies have added Ethereum to their balance sheets, according to CryptoQuant.

Together they hold about 2.45 million ETH, valued at roughly $11 billion, and those coins are effectively out of circulation while locked in treasuries or cold storage.

It’s worth noting that Ethereum does not have a fixed supply like Bitcoin; about one million ETH was added to supply last year, and supply dynamics can vary with network activity.

Futures open interest sits near $38 billion, a sizeable figure that raises the chance of swift price moves when positions are closed.

Large, concentrated holders and sudden shifts in futures positions have shown they can push prices sharply in either direction.

For now, this is a flow-driven event more than a broad retail surge. If the same product keeps taking in large sums, it will keep adding upward pressure.

At the same time, thin liquidity and big positions can flip gains into losses fast. Investors and traders should keep an eye on weekly fund flows, futures open interest, and on-chain movements to see whether the trend spreads beyond a few big buyers.

Featured image from Meta, chart from TradingView

You May Also Like

BlackRock boosts AI and US equity exposure in $185 billion models

China Bans Nvidia’s RTX Pro 6000D Chip Amid AI Hardware Push