Ethereum (ETH) Price: Whales Snap Up Half a Million Tokens During Market Crash

TLDR

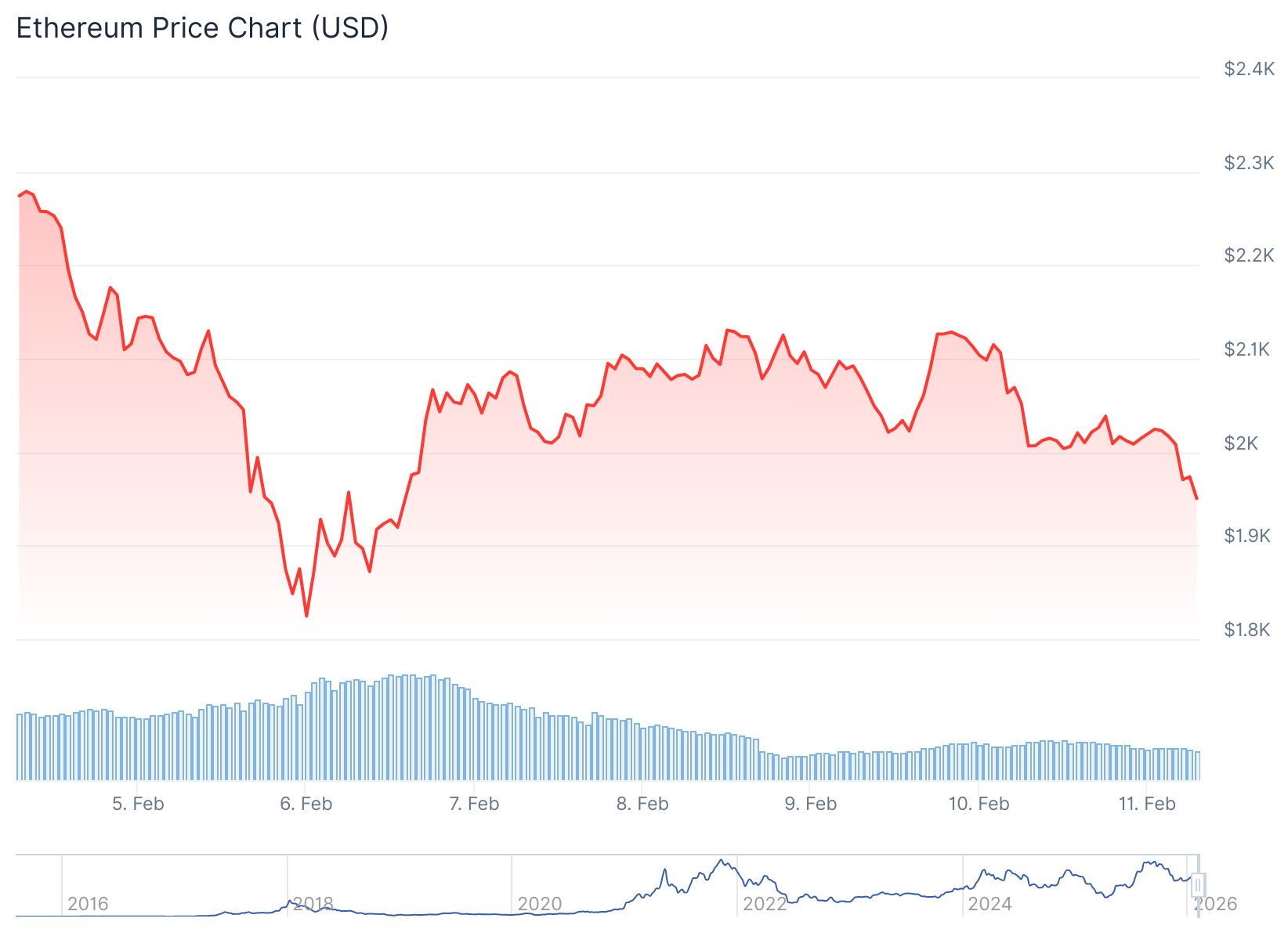

- Ethereum dropped to $1,736 and continues struggling to hold above $2,000, down 31% year-to-date in 2026

- Whale wallets accumulated over 520,000 ETH between February 4-8 while retail investors sold 233,000 ETH during the same period

- Onchain data shows major demand zones clustered between $1,300 and $2,000, with potential support at $1,237

- Exchange withdrawals hit their highest level since October 2025, with over 220,000 ETH leaving exchanges

- Price patterns mirror 2021-2022 cycles, suggesting an extended consolidation phase lasting up to 12 months before recovery

Ethereum price fell to $1,736 recently and continues to trade below the $2,000 mark on Tuesday. The token has dropped 31% year-to-date in 2026.

Ethereum (ETH) Price

Ethereum (ETH) Price

Between February 4 and 8, whale wallets holding 10,000 to 100,000 ETH bought more than 520,000 tokens. This happened as the price crashed below $1,800 and then recovered above $2,000.

During the same timeframe, retail investors sold 233,000 ETH. Wallets holding 100 to 1,000 ETH and 1,000 to 10,000 ETH distributed these tokens.

Source: CryptoQuant

Source: CryptoQuant

This marks the first time since the start of the year that whale buying pressure exceeded retail selling. Historical data shows prices often recover when retail selling weakens and whales continue purchasing.

Exchange data shows Ethereum withdrawals reached their highest level since October 2025. Net outflows exceeded 220,000 ETH from exchanges.

Binance recorded daily net outflows of around 158,000 ETH on Thursday. This represents the largest single-day outflow since August 2025.

These withdrawals happened while ETH traded between $1,800 and $2,000. The movement suggests accumulation or investors moving tokens to cold storage at these price levels.

Price Patterns Point to Extended Consolidation

Analysis of price patterns shows similarities between current market action and the 2021-2022 cycle. In 2021, ETH spent 12 months consolidating around $1,730 and $885.

The recent drop toward $1,730 may represent a “first low” rather than a final bottom. Price could continue ranging from $1,300 to $2,000 in the coming months.

Onchain cost basis data shows large supply clusters above current prices. The $2,822 level accounts for 5.86% of ETH supply. The $3,119 level holds 6.15% of supply.

Below current prices, clusters appear at $1,881 with 1.58 million ETH. Another cluster sits at $1,237, creating potential demand zones if prices continue falling.

The liquidation heat map shows $4 billion to $6 billion in long liquidations at risk between $1,455 and $1,700. Over $12 billion in short liquidity stacks up to $3,000.

Market Indicators Show Mixed Signals

The Net Taker Volume on Binance returned to negative territory after briefly turning positive in January. This indicates short positions are building up again.

The metric tracks the difference between buyers and sellers using market orders for ETH futures. Negative readings suggest more traders are betting on price declines.

Ethereum saw $61.9 million in liquidations over the past 24 hours. Long liquidations accounted for $46.5 million of this total.

ETH faces resistance around $2,100 after seeing a rejection at that level. A decline below $2,000 could push the price toward support at $1,740.

The Relative Strength Index and Stochastic Oscillator remain near oversold territory. These indicators point to dominant bearish momentum in the market.

ETH trades below the average cost basis of investors at $2,310. The token also sits below the realized price of whale holders.

The Coinbase Premium has stayed at a discount since December. This indicates continued selling pressure from US-based investors.

Stablecoin transaction volume on Ethereum has increased 200% over the past 18 months. This growth comes even as ETH price remains 30% lower than previous highs.

The post Ethereum (ETH) Price: Whales Snap Up Half a Million Tokens During Market Crash appeared first on CoinCentral.

You May Also Like

Kalshi debuts ecosystem hub with Solana and Base

Stronger Euro seen as disinflationary but manageable – Nomura