Bitcoin Hyper Presale Blasts Past $11M as Investor Demand Surges

Yet for all its dominance, $BTC is still often branded as little more than ‘digital gold’: a store of value, but not a currency you’d actually use in day-to-day transactions. High fees and sluggish speeds have made it impractical for payments, DeFi, or the kind of dApp ecosystems thriving on Ethereum or Solana.

The question is simple: can this Layer-2 ecosystem finally make Bitcoin usable at speed and scale? Judging by the presale frenzy, plenty of traders think so.

The Problem Bitcoin Faces

Bitcoin may be the biggest name in crypto, but its underlying technology hasn’t kept up with the pace of modern demand.

The network processes around 7 transactions per second (TPS), a figure that pales in comparison to Solana’s recently reported ATH of 107K+ TPS capacity.

For a protocol designed as ‘peer-to-peer electronic cash,’ those numbers are hard to reconcile.

Source: @AltCryptoGems on X

When activity spikes, things get even worse. During the 2024 Runes launch, average Bitcoin fees shot above $120+ per transaction, pricing out casual users and making small transfers impractical. The blockchain quickly becomes congested, leaving anyone trying to move funds stuck in a backlog of unconfirmed transactions.

Unlike Ethereum, which runs everything from lending protocols to stablecoin infrastructure, or Solana, where sub-second trades enable thriving meme coin ecosystems, Bitcoin has largely remained passive as a vault for value rather than a platform for innovation.

That leaves Bitcoin in an odd position. It commands unmatched trust, liquidity, and brand recognition, yet it lacks the technological rails to support the kind of on-chain economy that drives adoption elsewhere.

For many, $BTC has become something you hold, not something you use. And in a market where utility often defines momentum, that gap has only grown more obvious.

Bitcoin Hyper’s Solution – A Game-Changing Layer-2

Bitcoin Hyper ($HYPER) isn’t just another side chain bolted onto Bitcoin. It will be directly tied to the Bitcoin blockchain for security, while unlocking a new execution layer for speed and functionality.

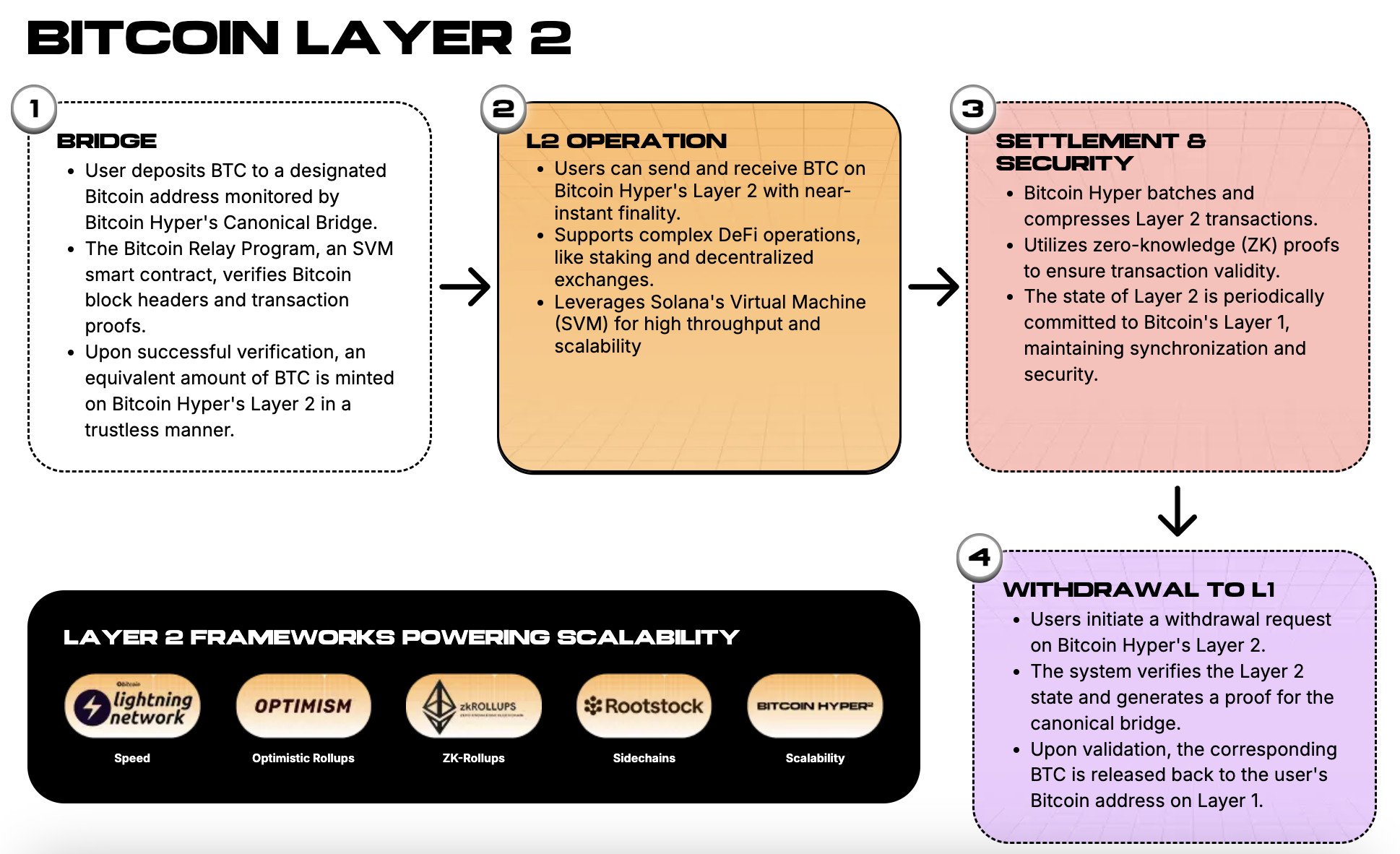

Here’s how it works in practice:

- Bridge In – Send $BTC to a deposit address. A smart contract verifies the transaction on Bitcoin’s base layer and mints the same amount on Bitcoin Hyper.

- Layer-2 Activity – On Bitcoin Hyper, those tokens can be moved instantly, traded, staked, or plugged into DeFi tools with sub-second settlement times and near-zero fees.

- Secure Settlement – Using zero-knowledge proofs, Hyper batches and validates transactions, committing them back to Bitcoin’s Layer-1. This keeps the system trustless and synced with Bitcoin itself.

- Bridge Out – When you want your $BTC back, withdraw it to the main chain, with everything cryptographically checked along the way.

Bitcoin Hyper integrates the Solana Virtual Machine (SVM), which has already proven itself capable of handling thousands of TPS at lightning speed. That means Bitcoin Hyper inherits both Bitcoin’s security and Solana’s throughput.

What $HYPER Unlocks

The result is a playground of new possibilities. Remittances and micro-transactions become cheap and instant, no longer blocked by ridiculously high fees.

DeFi protocols like lending, borrowing, and yield farming can exist on Bitcoin’s rails for the first time. Even meme coins, DAOs, and NFTs become viable, something that has so far thrived on $ETH and $BNB but never on Bitcoin itself.

If it works, Bitcoin’s dominance could extend far beyond being a store-of-value. It could finally become the backbone of the broader crypto economy, not just its reserve currency.

The Financial Side – Presale, Tokenomics, and Staking

The numbers tell their own story. The Bitcoin Hyper presale has already topped $11M, with tokens priced at $0.012765. That kind of early traction puts it among the more eye-catching crypto launches of 2025.

To join the presale, check out our how to buy Bitcoin Hyper guide.

One of the main drawcards is the 100% staking APY offered to presale buyers. While those returns won’t last forever, they give early holders immediate yield while waiting for a potential exchange listing

The token itself is designed to power the Bitcoin Hyper ecosystem: gas fees, staking, governance, and access to new launches all run on $HYPER.

For many investors, the pitch is clear – the Bitcoin brand plus Solana-level speed could be a rare combination in crypto.

Take a look at our full Bitcoin Hyper ($HYPER) price prediction for more insights.

Final Thoughts – Can Bitcoin Finally Break Its Limits?

Bitcoin Hyper is making a bold promise: to turn the world’s most valuable crypto from a slow, fee-heavy ‘digital gold’ into a high-speed, low-cost execution layer.

By addressing Bitcoin’s biggest weaknesses (scalability and usability), it’s opening the door to payments, DeFi, and even meme coin culture directly on Bitcoin rails.

$HYPER’s $11M+ presale raise shows there’s no shortage of appetite for this vision, but the real test lies ahead. Execution, developer adoption, and sustained demand will decide whether Hyper becomes a pillar of the Bitcoin ecosystem or fades as just another hyped-up presale.

Still, the premise is hard to ignore. If Bitcoin has reached #1 status with limited functionality, what happens if it actually becomes fast, cheap, and fully usable? Bitcoin Hyper is trying to answer that.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Fed Decides On Interest Rates Today—Here’s What To Watch For