BlockDAG Price Prediction 2026 & Beyond: Can BDAG Rival DeepSnitch AI’s 300x ROI as Pepe Heimer Gains Ground?

The US White House held yet another meeting between crypto and bank representatives to discuss the crypto market structure bill. While these representatives indicated that the meeting was ‘productive,’ an agreement on the stablecoin provisions has yet to be reached.

However, the productive talks bring a deal closer as markets await a clear regulatory framework. Meanwhile, degens have eyes set on the BlockDAG price prediction for 2026 as they target to rotate into crypto presales for higher upside potential.

A new AI crypto, DeepSnitch AI (DSNT), is also turning heads across the crypto market. Despite being in the fifth presale stage, this crypto has scooped up over $1.56 million, with the price now at $0.03906.

Additional FOMO into this market intelligence platform could drive DeepSnitch AI towards the 300x ROI play.

Crypto market structure bill White House talks ‘productive’ but no deal yet

In a post on Tuesday, Stuart Alderoty, Ripple’s legal chief and one of the crypto and bank White House meeting attendees, wrote that the meeting was productive and that a ‘compromise is in the air’.

Stuart further urged representatives to move quickly to deliver a win for crypto consumers and America. Momentum to pass the bill was lost after Coinbase pulled its support for the bill. However, with positive talks, as hinted by Stuart, an agreement could come soon, pushing Congress to pass the bill.

BlockDAG price prediction and two competitor presale cryptos targeting a moonshot

1. DeepSnitch AI: Is the 300x rally on the horizon?

DeepSnitch AI gives retail investors the right tools to beat market volatility. By leveraging five AI agents, this platform delivers clear and profit-ready insights before the rest of the market gets access.

A tool like SnitchFeed, for instance, watches social channels to flag sentiment changes, allowing you to catch the narrative before the crowds flock in. SnitchScan, on the other hand, acts as a safety layer, flagging common risks.

This value proposition has made DeepSnitch AI a top crypto presale alongside BDAG as degens explore the BlockDAG price forecast.

Currently, DeepSnitch AI is priced at $0.03906 with over $1.56 million raised in the ongoing funding round.

The project is also offering limited-time VIP bonuses. On a $5k budget, for instance, you would normally get roughly 128k tokens. However, the 50% DeepSnitch AI bonus pushes the number of tokens to roughly 192k, increasing your chances of making more gains once the price jumps.

2. BlockDAG price prediction for 2026 & beyond

BlockDAG is an L1 blockchain that integrates Directed Acyclic Graph (DAG) architecture with Proof-of-Work (PoW). By doing so, this blockchain powers parallel transaction processing, high throughput, and boosts scalability.

At the moment, BlockDAG is in the presale stage, priced at $0.00025 per the BDAG token outlook on the official website. Only 83.65 million tokens are remaining, meaning early participants have the last call to buy BDAG now before the price rallies.

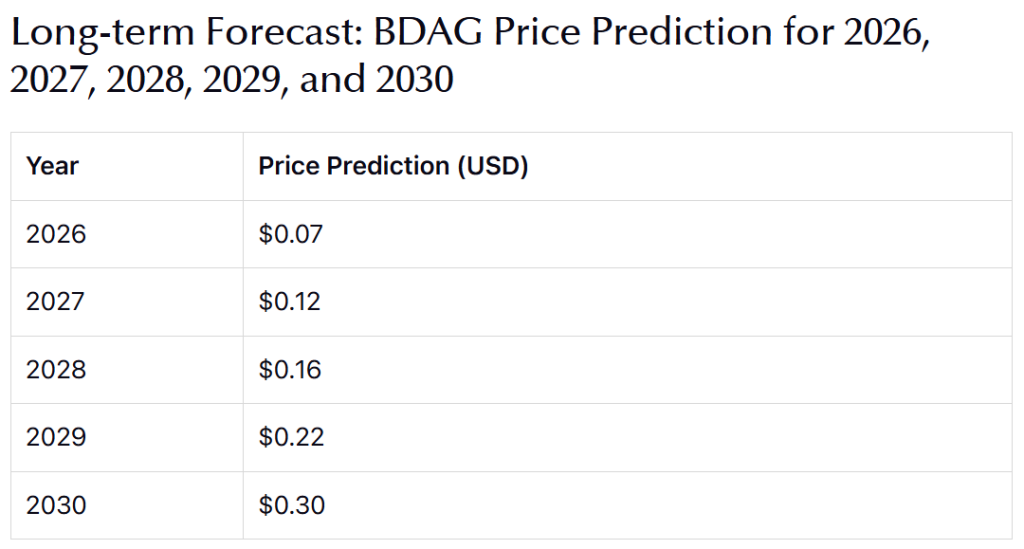

According to the recent BlockDAG price prediction, this crypto is expected to reach an average price of $0.07 by December 2026. Additionally, a BlockDAG future value of about $0.30 is expected by 2030.

3. Pepe Heimer price prediction for 2026

Pepe Heimer (PEHEM) is a new meme coin project integrating powerful AI tools with decentralized finance (DeFi). This crypto is characterized as a layer 2 blockchain offering real utility and solutions across the market.

PEHEM blends the viral “Pepe the Frog” meme with the persona of J. Robert Oppenheimer. Currently, this project is in the presale stage, going for $0.015 per token. The project has raised over $60 million, with investors expecting it to reach as high as $1 in 2026, rivaling DeepSnitch AI and the BlockDAG price forecast in 2026.

Final verdict

The BlockDAG price prediction suggests that BDAG could reach an average price of $0.07 in 2026 and as high as $0.30 by 2030 as the launch nears. However, DeepSnitch AI is expected to give more returns this year, considering its clear utility.

Many are, in fact, speculating that DeepSnitch AI could give up to 300x returns in 2026 alone. This prediction stems from its early stage, strong presale momentum, and staking, which is reducing the supply significantly.

Visit the official website for more information, and join X and Telegram for community updates.

FAQs

1. How high will BDAG reach in 2026?

According to the latest BlockDAG price forecast, BDAG could reach as high as $0.07 in 2026. However, DeepSnitch AI is expected to rally up to 300x, making it the better option for lucrative gains this year.

2. Will BlockDAG reach $10?

Reaching $10 is achievable for BlockDAG, especially if the BDAG token outlook continues to remain bullish. Nonetheless, stronger adoption will be required to reach this milestone. DeepSnitch AI might reach $10, having already expressed strong adoption from investors.

3. Does BlockDAG have a future?

The BlockDAG price prediction hints at a bullish future for BDAG, with the BlockDAG future value set to reach as high as $0.30 by 2030. On the other hand, degens target DeepSnitch AI’s 300x ROI play in 2026.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post BlockDAG Price Prediction 2026 & Beyond: Can BDAG Rival DeepSnitch AI’s 300x ROI as Pepe Heimer Gains Ground? appeared first on CaptainAltcoin.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For