Top 1000x Presale: IPO Genie ($IPO) Opens $3T Private Markets

A 1000x claim sounds loud. Still, smart crypto buyers know one thing comes first: the math, the product, and the reason it should exist. That is why IPO Genie ($IPO) is getting attention in AI presales of 2026 conversations. It is not just selling a token. In fact, it is selling a way for regular investors to take part in private-market style deal access with a low entry point

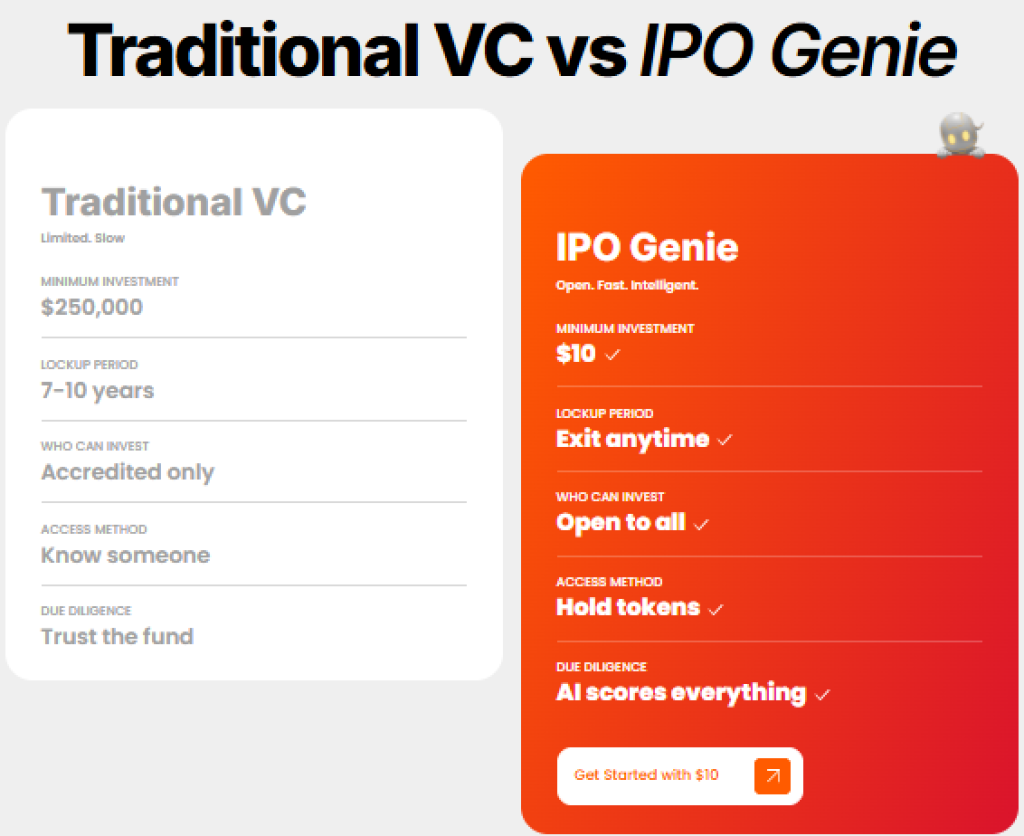

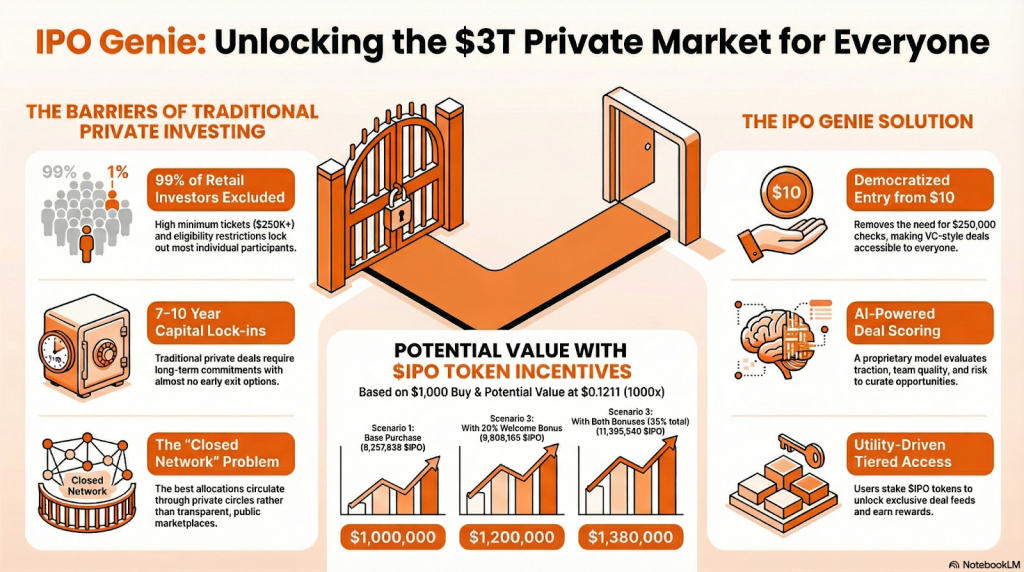

Traditionally, private deals have been a gated club. However, only about 1% of retail investors get real access, while the other 99% watch from the outside. IPO Genie brings the $3T private market access to everyone, starting from as little as $10, with token-based tiers, staking, and on-chain tracking.

Moreover, the token incentives are the fuel that can push conversions when the story matches what the buyer wants: early entry, clear rules, and a reason to hold.

Why IPO Genie Fits in the AI Presale 2026

Many AI crypto presales talk about “tools” in vague terms. IPO Genie pushes a direct use case: token holders get tiered access, staking rewards, and governance tied to a deal pipeline that is screened using an AI scoring process.

However, what makes it easy to understand is the flow:

- Hold or stake $IPO to access tiers

- See curated opportunities

- Take part through smart-contract-based steps

- Track progress and community actions inside the Web3 platform concept

So, $IPO is a key for access plus a rewards layer, not just a ticker for early participants.

Why Private Deals Feel Locked Behind a Gate

Private-market investing has traditionally been built for institutions and high-net-worth circles, mainly because of structural barriers:

- High minimum tickets: many private deals require large upfront checks $250K – $1M+ (often far beyond what retail can allocate).

- Long holding timelines: capital is commonly tied up for 7-10 years, with limited or no exit options before a liquidity event.

- Eligibility restrictions: Access is frequently limited to accredited or professionally qualified 97% investors, which excludes most retail participants.

- Network-only access: the best allocations often circulate through closed networks rather than public marketplaces.

- Low transparency: retail investors typically can’t see full deal flow, allocation logic, or consistent performance reporting.

This is the gap IPO Genie claims to target, using token-based tiers, staking, and on-chain tracking to make access more open and easier to follow.

The “1000x” Math From the Current Presale Price

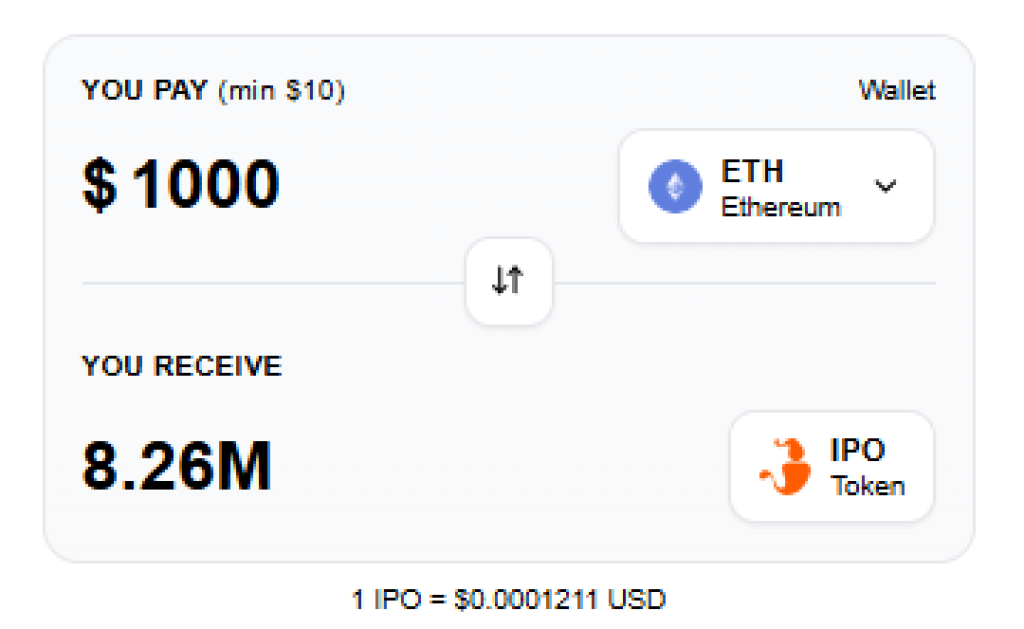

The IPO Genie presale price shared for this calculation is $0.0001211 per $IPO. If the $IPO price reaches 1000x, what would the return be:

$0.0001211 × 1000 = $0.1211 per $IPO

Here is the real calculation for investors who want to know what they actually receive for a real purchase. For example, if you invest the $1000, then what would you receive:

- Tokens without bonuses:

$1,000 ÷ $0.0001211 = 8,257,638.32 $IPO

Right now, IPO Genie offers the 20% welcome bonus and 15% referral rewards. So the token count changes if an investor qualifies for these incentives.

Bonus Math Table (Example: $1,000 Buy $IPO)

| Scenario | Tokens received | Value if $IPO hits $0.1211 (1000x) |

| No bonus | $8,257,638 | $1,000,000 |

| 20% welcome bonus | 9,909,165.98 | $1,200,000 |

| 15% referral reward | 9,496,284.06 | $1,150,000 |

| Both bonuses (20% + 15%) | 11,395,540.88 | $1,380,000 |

Still, this is only math; it is not a promise. This table shows what IPO Genie investors would get if they invest in this top crypto presale in Q1 2026. Price outcomes depend on delivery, liquidity, and market demand.

What Investors Check in Crypto Presale Ranking

Presales live and die on trust signals. Most serious buyers look for a crypto presale ranking before investing, and usually check a few practical items.

- Token plan (supply + allocations)

- Team incentives (lockups + vesting)

- Product path (what ships and when)

- Reason to hold (utility beyond hype)

IPO Genie’s positioning highlights presale allocation, staking/community buckets, and a platform roadmap built around tiered access and deal screening. The core question for buyers becomes: Will the platform create real demand from users, not just traders?

So, the platform story is not only “AI.” In fact, it includes tiered access, fund tooling, and deal screening that aims to keep low-quality projects from flooding the feed.

If an investor is searching for the best return presale Q1 2026, this is the checklist that matters more than slogans.

A Real-World Signal of IPO Genie Opens $3T Private Markets Door for 99% Retail Investors

Crypto buyers often ask one blunt question: “Is this pre-IPO theme real, or just marketing?” However, a fresh headline helps ground the story. It shows that the IPO Genie is not just saying it opens $3T private market doors to everyone; in fact, it is a real-world example.

IPO Genie has pointed to active pre-IPO progress as part of its momentum story in early February 2026. At the same time, Redwood AI Corp. received official coverage around its listing on the Canadian Securities Exchange dated February 6, 2026.

Therefore, pre-IPO watchers get a concrete example of how companies can move from early-stage interest into public visibility. It does not mean Redwood AI is an IPO Genie deal. Still, it shows the “before it becomes mainstream” moment is real, and people track it closely.

| Are you looking for access to pre-IPO deals without $250,000 minimus checks? Join 10,000+ investors getting early access to the next SpaceX and Stripe. |

What Makes IPO Genie a High-Potential Presale for Retail Investors

The strongest presales make one promise easy to verify: they remove friction for a real buyer type. IPO Genie targets the retail investor who wants private-market exposure but cannot meet the old barriers.

Key points that match the investor:

- Low entry: the platform messaging highlights access from $10, no need for a $250,000 minimum check as required for traditional VCs.

- A scoring model: deal evaluation is framed around signals like traction, team quality, and risk scoring

- A reason to stake: access tiers and rewards depend on holding behavior

- Exit Anytime: No lock-In

This is why many will place it among the top altcoins to watch when presale season heats up. The idea is simple: if $IPO becomes the access token for curated private-style deal flow, demand can come from users, not only traders.

Why IPO Genie is Considered “Best Crypto to Buy in 2026”

Search terms like best crypto to buy, best crypto to buy now, top crypto to buy, and crypto with the most potential are not just about charts. They often mean: “What has a story that can bring new users?”

IPO Genie’s angle is user-driven:

- People buy $IPO to get tiers

- People stake to keep tiers and earn rewards

- People stay because the deal feed and scoring create reasons to check in again

That is why experts consider it the best crypto for the future to invest in 2026 because the demand is tied to access, not only memes. So, all these factors make the IPO Genie the best crypto presale in trending early-stage opportunities.

Closing Call: A Clear Entry Plan for Serious Presale Buyers

The early presale investors want three things: simple math, a real use case, and a reason to hold through noise. IPO Genie checks those boxes for the retail crowd that has been locked out of private markets for years. Moreover, the current presale math at $0.0001211 makes the 1000x target price easy to understand, which is $0.1211.

Moreover, the best move is always disciplined. A buyer can start small, learn the tier system, and track updates. That is also why AI presales of 2026 research often ends with one practical step: research the project’s own pages and then decide.

For investors who want a presale with a clear access story, a bonus structure, and a product roadmap aimed at real users, IPO Genie stands out as a strong candidate to watch and act on early. AI presale 2026 buyers tend to move before the crowd. This is one of those setups where timing matters.

So, if you want to invest in $3T private markets in 2026, then IPO Genie is the best platform among the best crypto to invest in February 2026. Because it’s a bridge between the blockchain & pre-IPO private market. It helps you to invest through the IPO Genie at a low entry level without a lockup.

Join the Top Crypto Presale for Amazing Rewards!

Official website

Twitter (X)

Telegram

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post Top 1000x Presale: IPO Genie ($IPO) Opens $3T Private Markets appeared first on CaptainAltcoin.

You May Also Like

Ultimea Unveils Skywave X100 Dual: 9.2.6 Wireless Home Theater Launching March 2026

Why The Green Bay Packers Must Take The Cleveland Browns Seriously — As Hard As That Might Be