A comprehensive interpretation of Fluid: After rebranding, will it become the new king of DeFi?

Author: @thedefiedge , Crypto KOL

Compiled by: Felix, PANews

On December 4, Fluid Protocol, a DeFi protocol under the Instadapp team, released a proposal for a rebranding and growth plan, intending to rename the token INST to FLUID and implement a 100% revenue repurchase plan. Fluid plans to launch a series of upgrades in the next 12 months, including launching DEX on L2, upgrading ETH Lite Vault, adding more asset support, and launching DEX v2. Crypto KOL @thedefiedge published an article to interpret Fluid Protocol, the following are the details.

Project name: Fluid

Token: FLUID (formerly INST)

Market value: $362.4 million

TVL: $3.47 billion

Number of holders : 5,823

Track: Defi - Lending + Dex

The project has no venture capital, no marketing hype, no points or gamification, just pure product dominance.

Fluid is the most innovative DeFi protocol this year. Instadapp just completed the rebranding of Fluid and renamed it. This article is a brief report on the protocol.

Imagine having a platform where your lending doesn’t just cost you money, it also makes you money. That’s what makes Fluid unique. Fluid (formerly Instadapp) has been building since 2018 and is no stranger to DeFi innovation.

During the DeFi summer, Fluid managed over $15 billion in TVL, solidifying its position as a key infrastructure player and one of the earliest middleware solutions for DeFi.

Middleware can be thought of as a bridge. It connects users to different DeFi protocols such as Aave, Compound, and Maker, making it easier to access their services from one platform.

Users can manage everything, including lending and earning yield, without having to visit each protocol separately. All of this is done through Instadapp.

Today, Instadapp is being rebranded as Fluid, an ecosystem that combines money markets and DEXs to make liquidity and debt more efficient. It is the core of a suite of four products, including:

- Instadapp Pro: Advanced tools for advanced DeFi users.

- Instadapp Lite: A simplified, user-friendly DeFi gateway.

- Avocado Wallet: The next generation smart wallet that enables seamless cross-chain interaction.

- Fluid Protocol: Combining money markets and DEXs to achieve unprecedented liquidity efficiency.

Fluid aims to make DeFi simpler and more efficient by introducing features like smart collateral and smart debt that can help users make more money and do more with their assets.

Game-Changing Innovation

Smart Collateral: Most lending protocols allow users to deposit collateral, and Fluid allows users to deposit currency pairs such as ETH<>wstETH. Users' collateral can not only support loans, but also earn transaction fees as liquidity in DEX.

Smart Debt: Debt has always been a cost. Fluid turns debt into an asset. Borrowed funds are used as trading liquidity, earning fees, thereby reducing the cost of borrowing for users. In some cases, high trading volume may even mean that users are actually getting paid for borrowing.

Let's understand it through an example:

In the example above, since the transaction APR offsets approximately 5%, the borrowing cost drops to approximately 7.57% (originally 12.44%).

This is a practical application of Smart Debt, where users can earn transaction fees on their borrowing positions, effectively reducing the APY on lending.

Fluid 's Bigger Picture

In the next 2-3 years, DeFi lending will grow to a market opportunity of over $100 billion. Currently, giants like Aave and Compound dominate, but there is room for challengers with new ideas to develop.

Fluid's strength lies in the combination of lending and DEX liquidity. Its liquidity will be enough to challenge Uniswap, and its goal is to reach a market size of US$10 billion by 2025.

Fluid Dex has become the third largest DEX on Ethereum, with a 7-day trading volume of US$428 million and a TVL of US$1.42 billion one month after its launch.

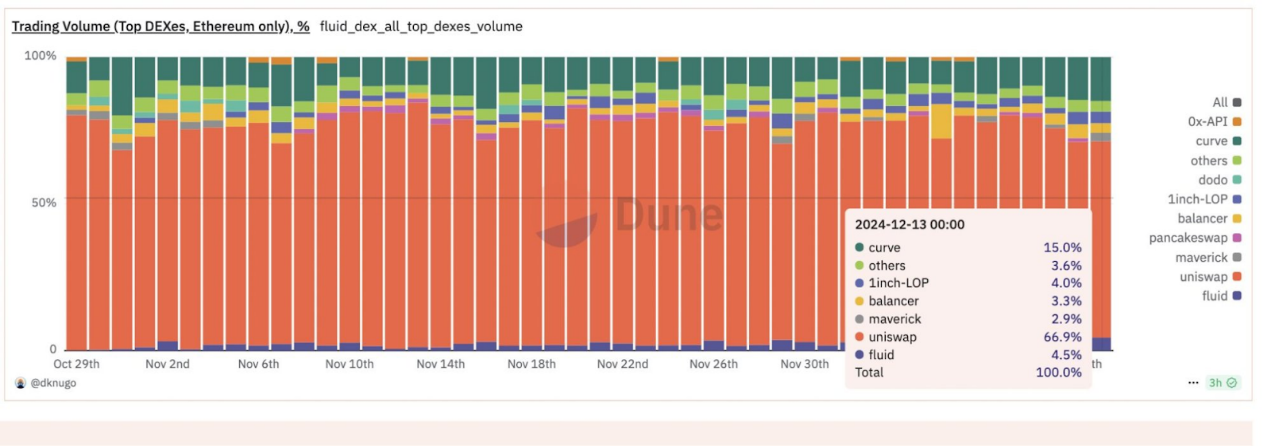

Top 3 Ethereum DEXs by trading volume market share:

- Uniswap: 66.9%

- Curve Finance: 15.0%

- Fluid Dex: 4.5%

Fluid’s Dex trading volume, Dune

Fluid’s DEX allows users to trade smarter. With features such as smart collateral, LPs can use their liquidity positions as collateral to earn trading fees while reducing risk.

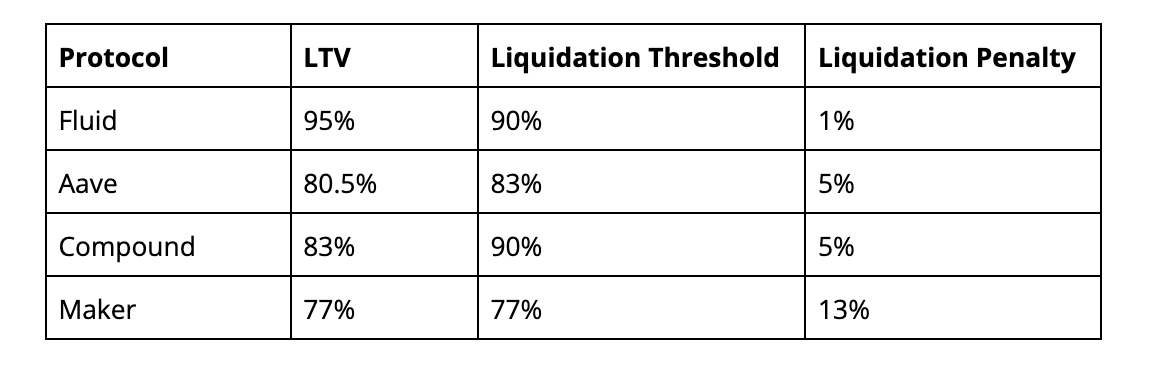

For borrowers, Fluid is more efficient than competitors such as Aave, Compound, and MakerDAO.

For example, Fluid’s wstETH <> ETH token pair has a liquidation penalty as low as 0.1%, making it cheaper and safer for users.

Fluid has already processed over $1 billion in trading volume and plans to expand into derivatives, real-world assets, interest rate swaps, and foreign exchange markets.

On the Ethereum mainnet, the average yield of USDC is 15%, and the average yield of GHO is 14%. The yield of USDC on Base and Arbitrum is about 18%.

With yields like these, it’s no surprise that stablecoins are flocking to the space.

The name change to FLUID is in line with Instadapp’s vision to create a sustainable DeFi ecosystem with strong value accrual for token holders.

Buyback programs and enhanced governance are expected to drive speculative demand and organic growth.

Key Catalyst

- Rename INST to FLUID and perform 1:1 token migration (no dilution).

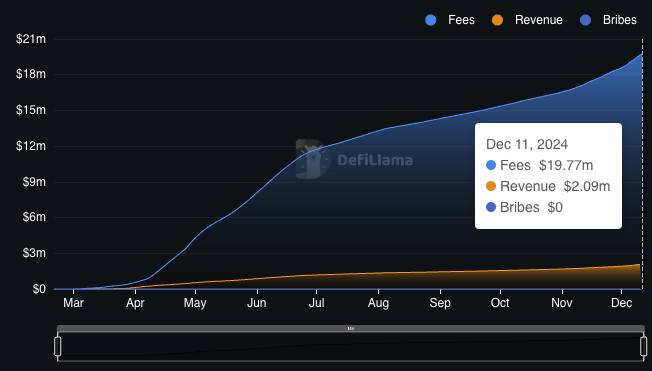

- When annual revenue reaches $10 million per year, the buyback program is initiated, and up to 100% of the revenue can be used.

- Lido Protocol and Fluid strategic partnership proposal.

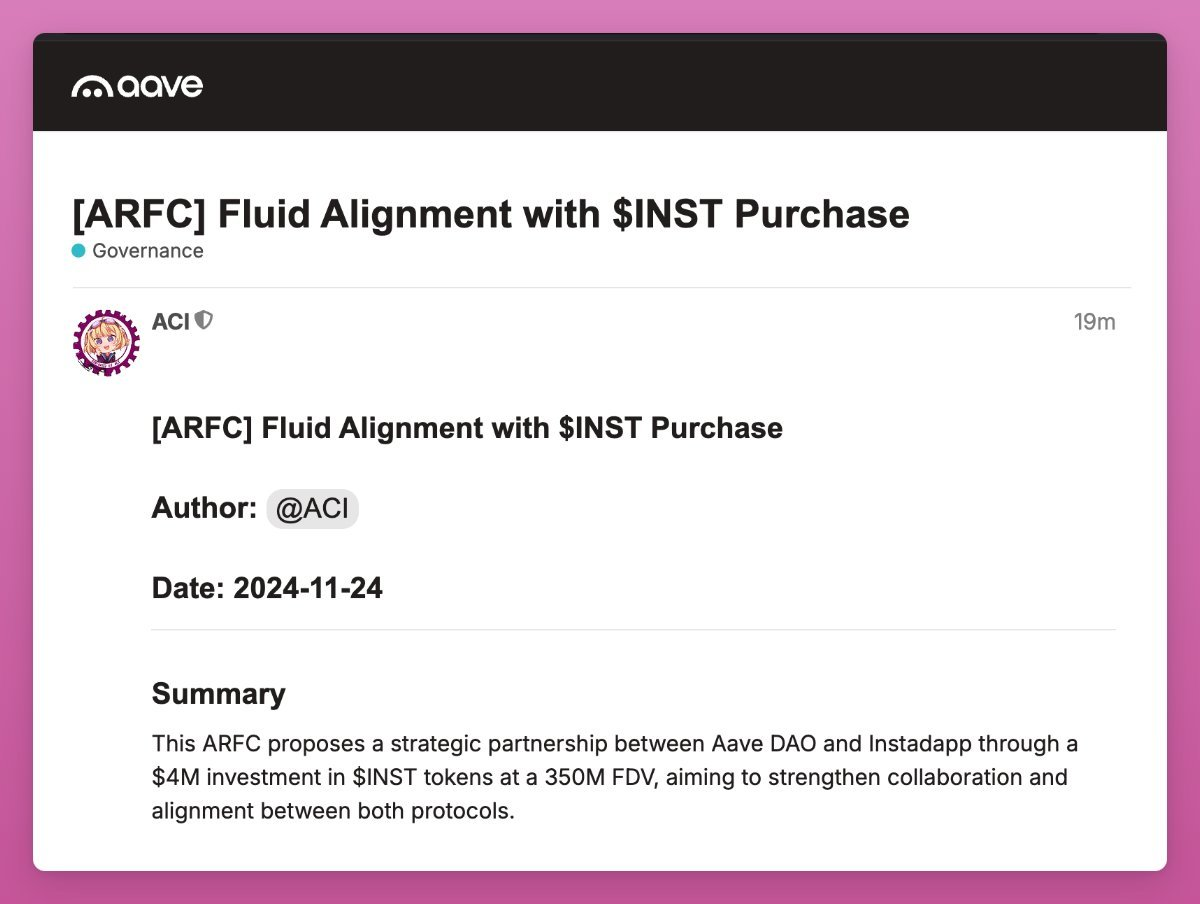

- Aave DAO proposed to acquire 1% of the total supply of INST tokens.

- Expansion: Add support for new markets like derivatives and real-world assets.

- Growth incentives are aimed at a market size of $10 billion by 2025.

- 12% of FLUID is allocated for CEX listing, market making and financing.

- Develop protocol-owned FLUID liquidity on FLUID DEX.

- FLUID will be listed on ByBit and is expected to be listed on more CEXs.

Instadapp is run by a team with over 5 years of experience and is backed by Naval Ravikant, Balaji Srinivasan, Coinbase Ventures, and Pantera Capital, among others.

Team members include @smykjain , @sowmay_jain , @DeFi_Made_Here .

The Fluid Difference

- Committed to security: Instadapp has not been hacked in the past 6 years and has undergone 6 audits to date.

- Revenue Sharing Opportunities: Fluid combines lending and transaction fees to provide users with multiple income streams and drive higher TVL.

Future plans include algorithmic buybacks to reward token holders as the protocol develops.

Roadmap: Fluid is expanding into derivatives, real-world assets, and FX markets. Lending and DEX activity are encouraged, with up to 0.5% of total supply available per month. New token economics such as revenue sharing are designed to attract more users and create value.

Strategic Cooperation:

Lido Alliance has proposed a partnership to drive adoption of wstETH on Fluid, targeting billions of dollars in TVL.

- Lido will provide TVL growth incentives, brand support and drive adoption on L2.

- Fluid will share 30% of the fees from the Instadapp Lite ETH vault and 50% of the fees from the LRT<>wstETH vault.

Wintermute has proposed a 1-year 700,000 INST/FLUID loan with a $10 strike price repayment option to provide liquidity on major DeFi and CEX platforms.

Aave DAO will use GHO to purchase “$4 million worth of INST tokens (approximately 1% of the total INST supply at $350 million FDV)”.

Aave DAO will allocate up to 1/3 of INST tokens via Merit to support GHO pairs on Fluid.

Use Cases of FLUID Token

The FLUID token is not only used for governance, but also plays a core role in the growth and value accumulation of the protocol:

- Revenue sharing: Up to 100% of the protocol revenue will be used for buybacks to support the value of the token

- Governance: Token holders can influence key decisions such as fee structure, use of funds, and future upgrades

- Liquidity Rewards: FLUID will provide incentives for stablecoin lending, DEX activities, and protocol-owned liquidity for token holders.

There haven’t been a lot of exciting changes in DeFi over the past few years. Most protocols have only made minor improvements, and nothing is truly groundbreaking.

Fluid is the first protocol to truly challenge Uniswap. In just one month, Fluid became the third largest DEX on Ethereum, with a weekly trading volume of $428 million.

That’s the key. They did this with just three pools. Imagine what happens when they scale up.

It's not just ordinary users who have noticed this. DeFi institutions including Lido and Aave are lining up to work with Fluid, and people who understand this field are betting heavily on Fluid. Fluid is not just another DEX or lending protocol. With smart collateral, users' assets will not be idle and will earn transaction fees. With smart debt, users' loans can generate income, thereby reducing borrowing costs.

Related reading: TVL increased by 3 times in a month, will the new DeFi player Fluid subvert Aave and Uniswap?

You May Also Like

BlockDAG’s Upcoming Sponsorship, Chainlink’s Hesitant Breakout, and Litecoin’s Flat Growth: Best Long Term Cryptos

Gold rises to near $5,100 as Trump’s tariffs boost haven demand, US-Iran talks eyed