Coinbase and Ripple CEOs Join CFTC Advisory Panel Overseeing Digital Assets

- Among them are the crypto executives Brian Armstrong and Brad Garlinghouse, named by the U.S. Commodity Futures Trading Commission.

- The committee focuses on digital assets’ industry insight to the CFTC for amendments of various regulatory frameworks under U.S. law.

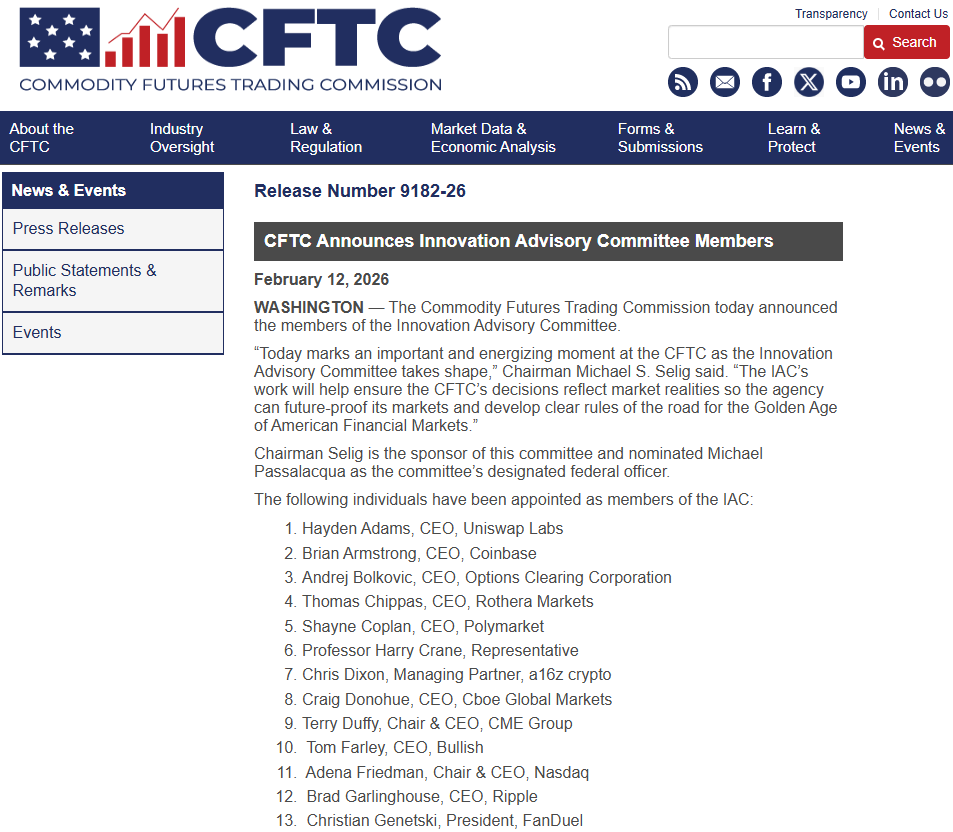

The United States Commodity Futures Trading Commission announced appointments to a new committee that would provide advice on regulatory and industry developments regarding digital assets. Coinbase CEO Brian Armstrong confirmed his position as a member of the committee representing crypto exchange interests. The advisory committee also has Ripple CEO Brad Garlinghouse as a member, offering information from a prominent payments blockchain company. The committee has various members representing companies in digital assets, finance, and blockchain technology. The committee also has members from a company that issues a stablecoin and a derivatives desk manager.

CFTC Chairman Rostin Behnam stated the committee would assist in helping regulators grasp the intricacies of the digital market. The members would contribute their expertise and knowledge from the digital asset marketplace. This advisory committee would meet at least four times in 2026 to discuss the problems regulators face in their work. The CFTC formed the committee through the Digital Commodities Consumer Protection Act’s powers. They would concentrate their focus on market issues such as compliance and risk management.

The committee has executives from companies such as Paxos, Cumberland, Galaxy Digital, among other companies. A representative of the stablecoin issuer has knowledge of liquidity and a framework for redemption. The diversity of the group is evident since there is knowledge on trading platforms, derivatives exchanges, and blockchain operations. The members of the CFTC’s advisory panel are compliance experts and know legal issues. The committee has experts from fintech and blockchain-based think tanks. The experts know derivatives exchanges, clearing operations, and blockchain operations.

Committee Aims and Regulatory Role

The Advisory Group will review options for enhancing digital asset markets under U.S. laws. The members will be able to review the risk issues faced by participants in the digital markets, whether retail or institutional. The members will also give opinions on compliance issues faced and law enforcement. The panel may also discuss transparency issues in digital markets in the U.S. The issue of coordination between U.S. regulatory authorities may also come up.

The committee members may assist the CFTC in oversight roles for new technologies. These could involve data infrastructures and market settlement systems. The contributions from the members to the CFTC may shape the proposals for future rules set forth by the agency.

Highlighted Crypto News:

U.S. Bankers Urge OCC to Slow Crypto Trust Bank Charters

You May Also Like

WLFI Expands Into Forex With World Swap Launch

BUZZ HPC Closes Acquisition of 7.2 MW Toronto Site to Build Data Centre for Sovereign AI Infrastructure

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more