Daily Market Update: Bitcoin Crashes to $65,000 as Tech Stocks Sell-Off

TLDR

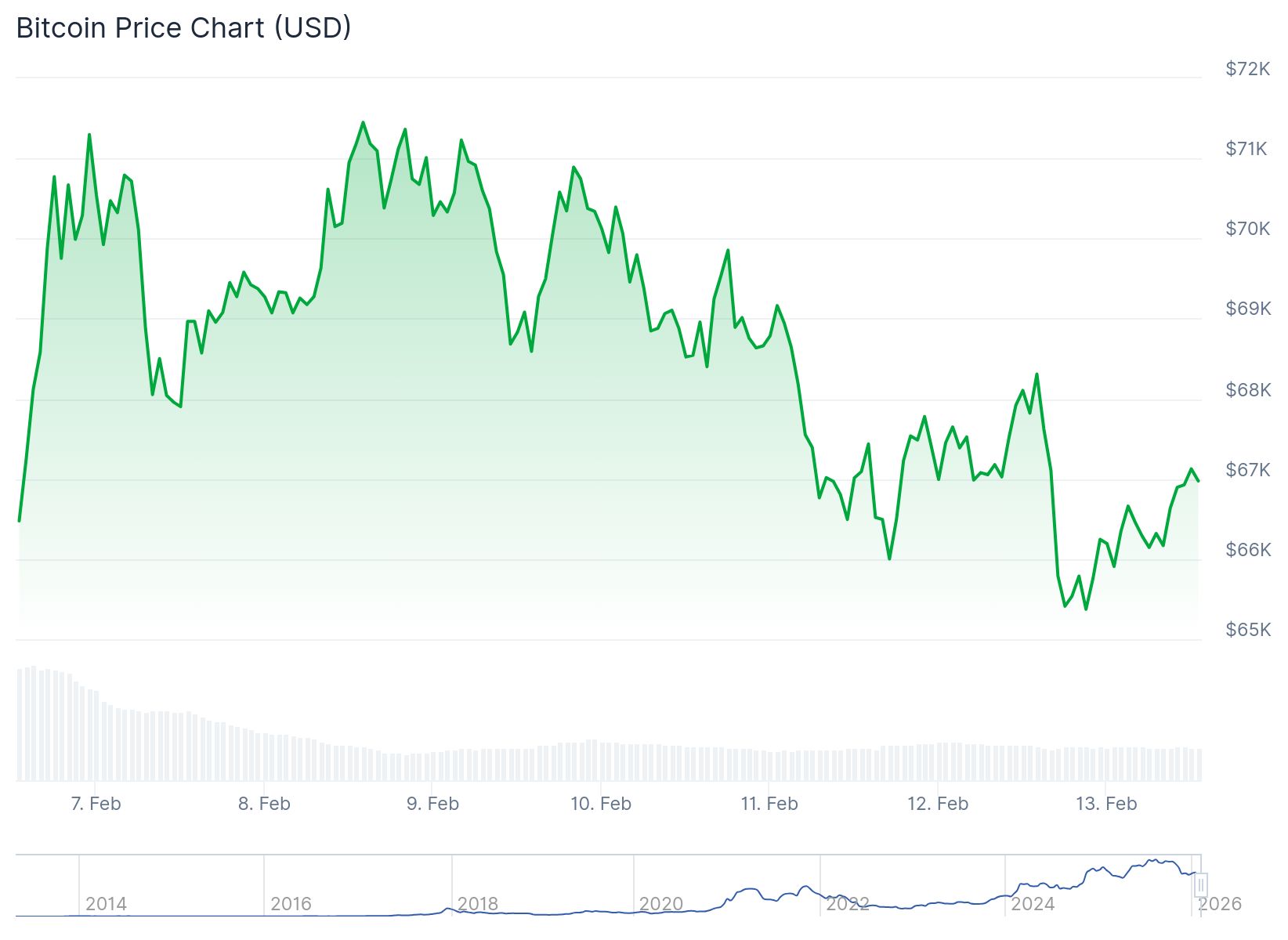

- Bitcoin declined to $65,000, losing 2% in 24 hours as tech stocks experienced heavy selling pressure

- Software sector ETF dropped 3% Wednesday and is down 21% for the year as AI concerns mount

- Silver crashed 10.3% to $75.08 while gold fell 3.1% to $4,938 in sudden afternoon sell-off

- Stock futures for S&P 500, Nasdaq, and Dow all dropped 0.2% before Friday’s inflation report

- Apple fell 5% in its worst single-day performance since April 2025

Bitcoin has fallen back to $65,000 after losing most of its recent rally above $70,000. The cryptocurrency dropped 2% over the past 24 hours.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Ethereum and Solana posted similar declines during the same timeframe. The crypto market weakness coincided with broad selling across technology stocks.

The Nasdaq index fell 2% on Wednesday as investors dumped tech holdings. Software companies bore the brunt of the selling pressure.

The iShares Expanded Tech-Software Sector ETF declined 3% on Wednesday. The fund has now lost 21% of its value since the start of the year.

Investors are reassessing software company valuations as artificial intelligence coding tools improve rapidly. Questions about the sector’s high price multiples are driving the sell-off.

Macro strategist Jim Bianco highlighted the connection between software stocks and digital currencies. He pointed out that the software ETF has returned to last week’s low points.

Bianco described cryptocurrency as “programmable money” and noted both asset classes move together. The correlation between crypto and tech stocks reasserted itself this week.

Precious Metals Experience Sharp Losses

Gold and silver both posted gains earlier on Wednesday before reversing course. The precious metals saw rapid price declines in the afternoon trading session.

Silver ended the day down 10.3% at $75.08 per ounce. Gold closed 3.1% lower at $4,938 per ounce.

The afternoon plunge caught many market participants by surprise. The coordinated selling suggested broader market stress beyond just the tech sector.

Stock Market Futures Signal More Weakness

U.S. stock index futures fell on Friday morning ahead of key economic data. S&P 500, Nasdaq 100, and Dow Jones futures each declined approximately 0.2%.

E-Mini S&P 500 Mar 26 (ES=F)

E-Mini S&P 500 Mar 26 (ES=F)

Thursday’s trading session saw widespread losses across equity markets. Concerns about AI disruption have spread from technology into real estate and transportation sectors.

The seven largest technology companies all finished Thursday in negative territory. Apple recorded a 5% drop, marking its worst daily performance since April 2025.

The Magnificent Seven megacap stocks have been leading the broader market lower. These companies had previously driven much of the market’s gains.

Earnings Reports Show Mixed Results

Applied Materials shares surged more than 10% in premarket trading Friday. The chip equipment manufacturer exceeded earnings expectations and provided an optimistic forecast.

Rivian stock jumped 13% after reporting quarterly revenue of $1.286 billion. Analysts had predicted revenue of $1.26 billion for the electric vehicle maker.

Market participants are waiting for January’s consumer price index release. The inflation data will influence expectations for Federal Reserve monetary policy decisions.

The post Daily Market Update: Bitcoin Crashes to $65,000 as Tech Stocks Sell-Off appeared first on Blockonomi.

You May Also Like

PayToMe.co and Nixxy Inc. (NASDAQ: NIXX) Advance AI Financial Infrastructure Across Global Telecom Rails

Snowball Money and REI Network Integrate Web3 Identity