AM Best Comments on Credit Ratings of Cavello Bay Reinsurance Limited Following the Acquisition of AF Group by Enstar Group Limited

OLDWICK, N.J.–(BUSINESS WIRE)–AM Best has commented that the Credit Ratings (ratings) of Cavello Bay Reinsurance Limited (Cavello Bay) (Bermuda), a subsidiary of Enstar Group Limited (ENSTAR) (Bermuda), are unchanged following Enstar’s announcement that it has entered into a definitive stock purchase agreement to acquire 100% of the shares of Accident Fund Holdings, Inc. (AF Group) from Blue Cross Blue Shield of Michigan (headquartered in Lansing, MI).

Once the acquisition is completed, AF Group will become a wholly owned subsidiary of Enstar and operate largely as a standalone company, supported by Enstar. AF Group is expected to operate under its existing leadership team, while benefitting from the scale, network and expertise of Enstar and its investor group, including its partnership with Sixth Street. AM Best will monitor the acquisition progress through and after completion.

The transaction is expected to be completed in the second half of 2026 upon regulatory approvals and satisfaction of various other closing conditions.

Assuming that the acquisition is completed as contemplated, AM Best does not expect its execution to result in any immediate changes to Cavello Bay’s credit ratings. AM Best expects that Enstar’s financial leverage will remain within tolerance levels for its current ratings. If financial leverage is sustained at elevated levels for longer than contemplated, or if the terms of the financing differ materially from expectations, then AM Best could revisit the transaction’s impact on Enstar’s overall credit profile.

Although AF Group’s acquisition will significantly change Enstar’s business profile by adding underwriting activities to Enstar’s existing run-off business, AM Best does not anticipate a change in Enstar’s business profile assessment.

Enstar has extensive experience in actively managing workers’ compensation reserves, AF Group’s main line of business. While Enstar does not intend to change AF Group’s business strategy, Enstar can provide knowledge in reserves and claim payments areas, as Enstar’s has consistently outperformed the workers’ compensation industry, recording consistent prior year favorable reserve developments over time.

This press release relates to Credit Ratings that have been published on AM Best’s website. For all rating information relating to the release and pertinent disclosures, including details of the office responsible for issuing each of the individual ratings referenced in this release, please see AM Best’s Recent Rating Activity web page. For additional information regarding the use and limitations of Credit Rating opinions, please view Guide to Best’s Credit Ratings. For information on the proper use of Best’s Credit Ratings, Best’s Performance Assessments, Best’s Preliminary Credit Assessments and AM Best press releases, please view Guide to Proper Use of Best’s Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and data analytics provider specializing in the insurance industry. Headquartered in the United States, the company does business in over 100 countries with regional offices in London, Amsterdam, Dubai, Hong Kong, Singapore and Mexico City. For more information, visit www.ambest.com.

Copyright © 2026 by A.M. Best Rating Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

Contacts

Guilherme Monteiro Simoes, CFA

Senior Financial Analyst

+1 908 882 2317

guy.simoes@ambest.com

Steven M. Chirico, CPA

Director

+1 908 882 1694

steven.chirico@ambest.com

Christopher Sharkey

Associate Director, Public Relations

+1 908 882 2310

christopher.sharkey@ambest.com

Al Slavin

Senior Public Relations Specialist

+1 908 882 2318

al.slavin@ambest.com

You May Also Like

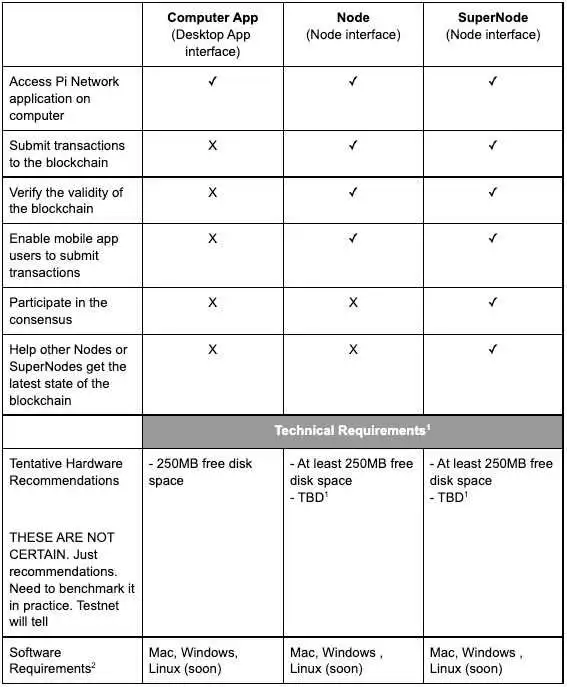

Pi Network Sets Feb 15 Deadline for Mainnet Node Upgrade

Pi Network Sets February 15 Deadline for Mandatory Mainnet Node Upgrade