Binance Fires Compliance Staff After Iran Sanctions Red Flags Spark Global Scrutiny

Binance Dismisses Compliance Staff After Internal Probe Into Iran Sanctions Violations

Global cryptocurrency exchange Binance has reportedly terminated members of its internal compliance team who uncovered potential sanctions violations related to Iran in late 2025, according to information first highlighted by the X account of Coinvo and independently reviewed by the HOKANEWS editorial team through industry sources and public records.

The reported dismissals have sparked renewed scrutiny over compliance oversight within major cryptocurrency platforms, particularly as regulators worldwide intensify enforcement of sanctions regimes and anti money laundering standards.

While Binance has not publicly released detailed statements outlining the circumstances surrounding the staff changes, the allegations raise important questions about internal governance, regulatory risk, and the evolving compliance landscape in the digital asset sector.

|

| Source: XPost |

Allegations and Internal Review

According to circulating reports, members of Binance’s compliance division identified transactions or account activity potentially linked to violations of international sanctions involving Iran during an internal review conducted in late 2025.

Sanctions frameworks administered by U.S. and international authorities restrict financial transactions involving certain jurisdictions, entities, and individuals.

Crypto exchanges operating globally are required to implement robust Know Your Customer and anti money laundering procedures to prevent sanctioned actors from accessing their platforms.

The reported dismissal of employees who flagged the issue has prompted concerns among observers regarding internal reporting processes and whistleblower protections.

HOKANEWS has verified that compliance staffing adjustments occurred, though detailed documentation surrounding specific individuals or investigative findings remains limited.

Sanctions Compliance in the Crypto Industry

Sanctions compliance has become a central focus for regulators overseeing cryptocurrency exchanges.

The U.S. Treasury’s Office of Foreign Assets Control and other international authorities have repeatedly emphasized that digital asset platforms must adhere to the same standards as traditional financial institutions.

Failure to comply with sanctions can result in significant fines, operational restrictions, or criminal investigations.

Several major exchanges have faced enforcement actions in recent years related to compliance lapses, underscoring the importance of internal monitoring systems.

The allegations involving Binance come at a time when regulatory expectations are intensifying globally.

Binance’s Regulatory History

Binance has previously navigated regulatory challenges across multiple jurisdictions.

The company has undertaken efforts to strengthen compliance infrastructure, including hiring experienced legal and regulatory professionals and enhancing transaction monitoring capabilities.

In recent years, Binance has publicly committed to improving transparency and cooperation with authorities.

The latest allegations, if substantiated, may test the effectiveness of those reforms.

The company’s global footprint means it must comply with diverse regulatory regimes simultaneously.

Whistleblower Protections and Corporate Governance

In large financial institutions, compliance teams play a critical role in identifying and mitigating regulatory risk.

Whistleblower protections are designed to ensure that employees can report concerns without fear of retaliation.

The reported termination of compliance personnel who identified potential sanctions violations raises broader questions about corporate governance and internal accountability mechanisms.

Corporate governance experts note that effective compliance programs require independence, transparency, and strong reporting channels to senior leadership and boards.

The long term impact of the reported staffing changes will depend on how Binance addresses internal oversight moving forward.

Market and Industry Reaction

News of the alleged dismissals circulated quickly across crypto focused media and social platforms.

Investors and industry participants are closely monitoring the situation, as regulatory developments often influence exchange reputation and user confidence.

Cryptocurrency markets tend to react sharply to compliance related headlines, particularly when they involve major global platforms.

While the immediate price impact on digital assets appears limited, the reputational dimension could have longer term implications.

Confidence in compliance standards remains critical for institutional participation.

Broader Geopolitical Context

Sanctions against Iran remain a sensitive geopolitical issue, particularly within U.S. foreign policy frameworks.

Financial institutions operating internationally must navigate complex sanctions laws that evolve in response to diplomatic developments.

Crypto platforms face additional challenges due to the borderless nature of blockchain transactions.

Advanced analytics tools are often deployed to detect sanctioned wallet addresses and suspicious patterns.

Regulators expect exchanges to maintain robust systems capable of identifying and blocking prohibited activity.

Potential Regulatory Consequences

If authorities determine that sanctions violations occurred or that internal compliance processes were insufficient, enforcement action could follow.

Consequences might include:

Financial penalties

Enhanced compliance monitoring

Operational restrictions

Settlement agreements

At this stage, no formal enforcement announcement has been issued in connection with the reported staffing changes.

Regulatory agencies typically conduct confidential investigations before publicizing findings.

The Importance of Transparency

Given the limited official detail available, transparency will be essential in restoring confidence.

Public clarification from Binance regarding the scope of the investigation and the rationale for staffing decisions could help address uncertainty.

In an increasingly regulated environment, exchanges are under pressure to demonstrate rigorous compliance frameworks.

Institutional investors and corporate partners often assess governance standards before engaging with crypto platforms.

The situation highlights the delicate balance between operational autonomy and regulatory accountability.

Conclusion

Binance’s reported dismissal of compliance team members who uncovered potential Iran related sanctions violations in late 2025 has drawn renewed scrutiny to governance and oversight practices within the cryptocurrency industry.

The information, first highlighted by Coinvo and independently reviewed by HOKANEWS, underscores the critical importance of sanctions compliance and internal reporting protections in global digital asset operations.

As authorities and market participants await further clarification, the episode serves as a reminder that regulatory risk remains a defining factor in the evolution of cryptocurrency exchanges.

HOKANEWS will continue monitoring official statements and regulatory developments related to this matter.

hokanews.com – Not Just Crypto News. It’s Crypto Culture.

Writer @Ethan

Ethan Collins is a passionate crypto journalist and blockchain enthusiast, always on the hunt for the latest trends shaking up the digital finance world. With a knack for turning complex blockchain developments into engaging, easy-to-understand stories, he keeps readers ahead of the curve in the fast-paced crypto universe. Whether it’s Bitcoin, Ethereum, or emerging altcoins, Ethan dives deep into the markets to uncover insights, rumors, and opportunities that matter to crypto fans everywhere.

Disclaimer:

The articles on HOKANEWS are here to keep you updated on the latest buzz in crypto, tech, and beyond—but they’re not financial advice. We’re sharing info, trends, and insights, not telling you to buy, sell, or invest. Always do your own homework before making any money moves.

HOKANEWS isn’t responsible for any losses, gains, or chaos that might happen if you act on what you read here. Investment decisions should come from your own research—and, ideally, guidance from a qualified financial advisor. Remember: crypto and tech move fast, info changes in a blink, and while we aim for accuracy, we can’t promise it’s 100% complete or up-to-date.

You May Also Like

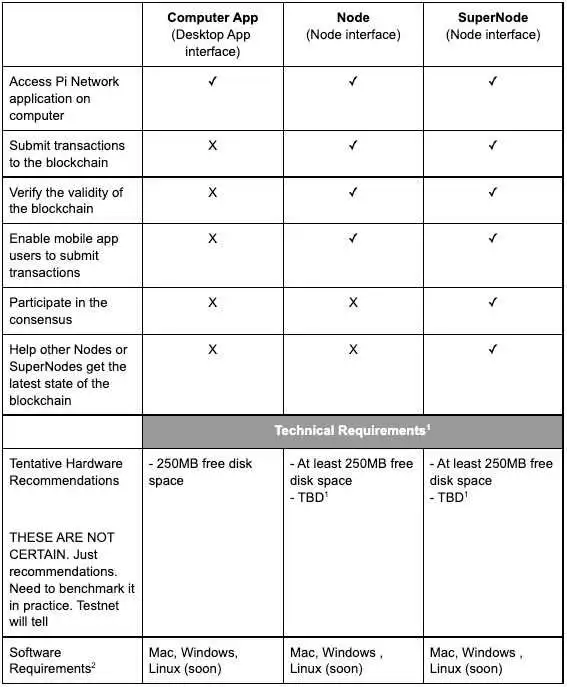

Pi Network Sets Feb 15 Deadline for Mainnet Node Upgrade

Pi Network Sets February 15 Deadline for Mandatory Mainnet Node Upgrade