Czech Republic Abolishes Bitcoin Capital Gains Tax in Bold Move to Become Europe’s Crypto Haven

Czech President Signs Law Eliminating Capital Gains Tax on Bitcoin in Landmark Crypto Reform

The Czech Republic has taken a significant step in reshaping its digital asset landscape after the country’s president signed legislation eliminating capital gains tax on Bitcoin, according to information first highlighted by the X account Crypto Rover and independently reviewed by the HOKANEWS editorial team through official parliamentary records and public statements.

The new law marks one of the most consequential crypto tax reforms in Europe, potentially positioning the Czech Republic as a more attractive destination for Bitcoin investors, entrepreneurs, and blockchain related businesses.

The legislation reflects a broader shift among certain jurisdictions seeking to modernize tax frameworks in response to the growing integration of digital assets into mainstream financial systems.

|

| Source: XPost |

What the Law Changes

Under the newly signed law, capital gains derived from Bitcoin transactions will no longer be subject to traditional capital gains tax treatment in the Czech Republic, provided that specific conditions outlined in the legislation are met.

Previously, individuals who realized profits from the sale or exchange of Bitcoin were required to report those gains and pay tax under capital income regulations.

The elimination of this tax obligation reduces the fiscal burden on crypto investors and may simplify reporting requirements.

While the law focuses specifically on Bitcoin, policymakers may evaluate its application to other digital assets as regulatory frameworks continue evolving.

A Strategic Move in European Crypto Policy

The Czech Republic has historically maintained a pragmatic approach toward cryptocurrency regulation, balancing innovation with compliance standards.

By removing capital gains tax on Bitcoin, the country signals an intention to foster a supportive environment for digital asset adoption.

Across Europe, regulatory discussions surrounding crypto taxation remain active, particularly as the European Union implements harmonized digital asset rules under broader financial legislation.

The Czech reform may intensify competitive dynamics among European jurisdictions seeking to attract blockchain investment.

Economic Implications

Tax policy can significantly influence investor behavior and capital allocation.

The removal of capital gains tax on Bitcoin may encourage:

Long term holding strategies

Increased retail participation

Relocation of crypto entrepreneurs

Growth of blockchain startups

Lower tax friction can enhance liquidity within domestic crypto markets and stimulate economic activity linked to digital assets.

However, fiscal analysts note that reduced tax revenue from capital gains must be balanced against potential increases in economic activity and investment inflows.

Investor Reaction

Market participants reacted swiftly to news of the reform.

Crypto advocates have described the move as a progressive step toward recognizing Bitcoin as a legitimate asset class.

Investors may view the Czech Republic as an increasingly favorable jurisdiction for digital asset operations.

Institutional players evaluating European expansion may also consider tax efficiency as part of broader strategic planning.

While Bitcoin markets are influenced by global factors, national policy shifts can shape localized adoption and capital flows.

Broader Regulatory Landscape

The global crypto regulatory environment remains diverse.

Some countries have implemented strict reporting requirements and taxation regimes, while others have introduced exemptions or reduced rates.

The Czech decision to eliminate capital gains tax on Bitcoin stands out within the European context.

It reflects growing recognition that digital assets have become integrated into mainstream financial portfolios.

At the same time, authorities are likely to maintain anti money laundering compliance and consumer protection measures.

Tax reform does not eliminate regulatory oversight.

Implications for Businesses and Startups

Blockchain startups and crypto focused companies often evaluate regulatory clarity and tax policy when selecting operational bases.

By easing capital gains obligations, the Czech Republic may strengthen its appeal to entrepreneurs seeking predictable and favorable frameworks.

Potential outcomes include:

Expansion of crypto related financial services

Increased venture capital inflows

Development of blockchain research initiatives

Strengthened fintech ecosystems

Local universities and research institutions may also benefit from increased private sector collaboration.

Fiscal Considerations

Eliminating capital gains tax on Bitcoin raises questions about fiscal impact.

While immediate tax revenue from Bitcoin gains may decline, policymakers may anticipate offsetting economic growth through increased investment and entrepreneurial activity.

Proponents argue that fostering a competitive digital asset environment can broaden the overall tax base in other areas, including corporate and income taxes.

Critics caution that volatility in crypto markets complicates revenue forecasting.

As with many policy changes, long term outcomes will depend on investor response and economic conditions.

International Perspective

The Czech reform may influence policy debates beyond Europe.

Governments worldwide continue assessing how to treat cryptocurrency gains within tax systems.

Some jurisdictions have adopted holding period exemptions, while others impose standard capital gains rates.

The Czech model may serve as a case study in balancing innovation with fiscal responsibility.

Investors operating internationally must remain attentive to cross border tax implications.

What Happens Next

Implementation details, including reporting thresholds and compliance guidelines, are expected to be clarified through regulatory guidance.

Authorities may monitor the impact of the reform on investment flows and economic activity.

Financial institutions operating in the Czech Republic will likely update advisory materials and compliance processes.

Market participants will also observe whether similar reforms emerge in neighboring countries.

Conclusion

The Czech president’s signing of legislation eliminating capital gains tax on Bitcoin represents a landmark development in European crypto policy.

Highlighted by Crypto Rover and independently reviewed by HOKANEWS, the reform underscores the evolving relationship between digital assets and national tax systems.

As global competition for blockchain innovation intensifies, the Czech Republic’s decision may position it as a leading jurisdiction in the digital asset economy.

HOKANEWS will continue tracking regulatory developments and their implications for global cryptocurrency markets.

hokanews.com – Not Just Crypto News. It’s Crypto Culture.

Writer @Ethan

Ethan Collins is a passionate crypto journalist and blockchain enthusiast, always on the hunt for the latest trends shaking up the digital finance world. With a knack for turning complex blockchain developments into engaging, easy-to-understand stories, he keeps readers ahead of the curve in the fast-paced crypto universe. Whether it’s Bitcoin, Ethereum, or emerging altcoins, Ethan dives deep into the markets to uncover insights, rumors, and opportunities that matter to crypto fans everywhere.

Disclaimer:

The articles on HOKANEWS are here to keep you updated on the latest buzz in crypto, tech, and beyond—but they’re not financial advice. We’re sharing info, trends, and insights, not telling you to buy, sell, or invest. Always do your own homework before making any money moves.

HOKANEWS isn’t responsible for any losses, gains, or chaos that might happen if you act on what you read here. Investment decisions should come from your own research—and, ideally, guidance from a qualified financial advisor. Remember: crypto and tech move fast, info changes in a blink, and while we aim for accuracy, we can’t promise it’s 100% complete or up-to-date.

You May Also Like

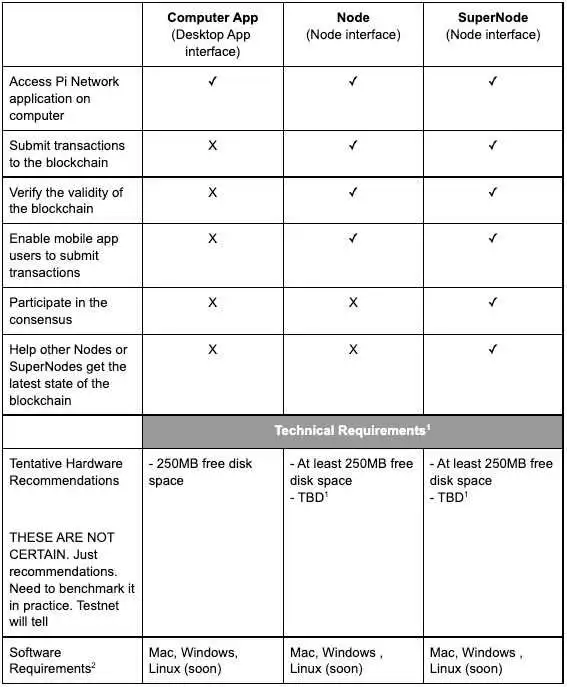

Pi Network Sets Feb 15 Deadline for Mainnet Node Upgrade

Pi Network Sets February 15 Deadline for Mandatory Mainnet Node Upgrade