Digital Gold Tokens Cross $6B as Investors Seek Safe-Haven Exposure

Key Takeaways

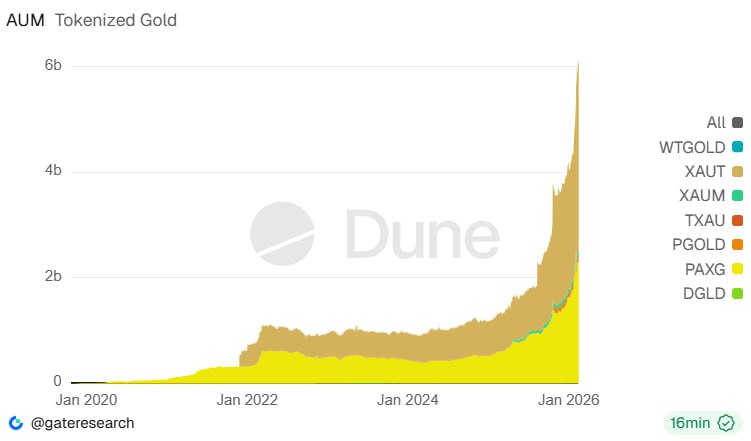

- Tokenized gold market capitalization has exceeded $6 billion, up more than $2 billion year-to-date.

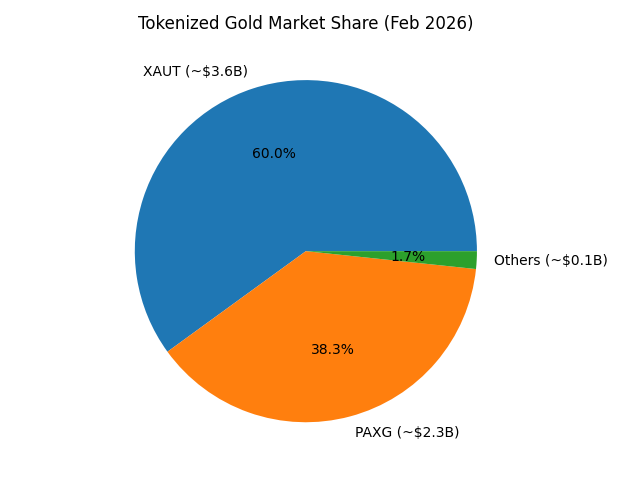

- Tether Gold (XAUT) and Paxos Gold (PAXG) control approximately 97% of the sector.

- Over 1.2 million ounces of physical gold back on-chain tokens, connecting blockchain transferability to vaulted reserves.

The segment has expanded by more than $2 billion since the start of 2026 and has grown roughly fivefold over the past two years, reflecting sustained capital inflows rather than short-term trading momentum.

From Niche Product to a $6B Tokenized Commodity Segment

Tokenized gold remains the primary driver of tokenized commodities, accounting for the majority of category value and much of the recent expansion. The market’s growth in early 2026 has been notably concentrated in gold-backed tokens, as investors used on-chain instruments to access safe-haven exposure with shorter settlement cycles and fewer operational frictions than physical custody.

While tokenized gold remains small relative to the broader global gold market, its liquidity footprint has been expanding. In 2025, tokenized gold trading activity reached roughly $178 billion, placing it behind only the largest traditional gold ETF products in turnover. That volume profile suggests the market is increasingly functioning as a transferable settlement layer rather than a passive store of value.

While tokenized gold remains small relative to the broader global gold market, its liquidity footprint has been expanding. In 2025, tokenized gold trading activity reached roughly $178 billion, placing it behind only the largest traditional gold ETF products in turnover. That volume profile suggests the market is increasingly functioning as a transferable settlement layer rather than a passive store of value.

Gold’s Price Surge Meets Digital Market Liquidity

The sector’s growth has coincided with a sharp rally in bullion prices, with gold recently trading around $4,900–$5,000 per ounce after hitting highs near $5,600 in January 2026. Elevated inflation sensitivity, geopolitical risk, and reserve diversification trends have supported demand for defensive assets across regions. Within digital markets, tokenized gold has benefited from its ability to lower access barriers through fractional ownership and continuous trading availability.

Tokenization also changes the mechanics of holding gold exposure. Instead of managing storage logistics or ETF brokerage rails, investors can acquire gold-backed tokens and move them across networks, wallets, and venues. Inflows into leading tokens during early 2026 indicate that capital seeking reduced volatility and non-sovereign store-of-value exposure is increasingly using tokenized wrappers as a liquidity-efficient channel.

Across the wider RWA universe, tokenized assets are estimated at roughly $328 billion, with commodities representing a small but fast-growing share. Tokenized gold has been the most established use case within that subset, largely due to existing custody standards and global price benchmarks.

XAUT and PAXG Concentration Shapes Market Structure

The tokenized gold market is highly concentrated, with Tether Gold (XAUT) and Paxos Gold (PAXG) together accounting for approximately 96%–97% of total sector value. XAUT, at an estimated $3.6 billion market cap, is structured for broad distribution across multiple blockchain networks and is backed by allocated gold held in Swiss vaults. Its market share has been supported by deep exchange availability and wider on-chain utility.

PAXG, with an estimated $2.3 billion market cap, emphasizes U.S.-aligned compliance and regular reporting practices, operating under oversight frameworks associated with regulated issuers. Both instruments represent direct claims on vaulted bullion and are designed to track spot gold, subject to operational terms that include redemption thresholds and fees.

PAXG, with an estimated $2.3 billion market cap, emphasizes U.S.-aligned compliance and regular reporting practices, operating under oversight frameworks associated with regulated issuers. Both instruments represent direct claims on vaulted bullion and are designed to track spot gold, subject to operational terms that include redemption thresholds and fees.

This duopoly introduces concentration risk, liquidity and trust are disproportionately tied to two issuers and their custody/audit frameworks. At the same time, the market share concentration reflects scalability: issuers with established vaulting relationships and distribution channels have been able to absorb demand more efficiently than smaller competitors.

How Tokenized Gold Functions

| Gold Backing | 1,200,000 oz |

| Gold Price | $5,000/oz |

| Total Value | ~$6B |

Tokenized gold is issued as blockchain-based tokens backed 1:1 by allocated physical bullion held in professional vault custody. Issuers acquire and allocate gold, then mint corresponding tokens that can be transferred, traded, or used as collateral across digital platforms.

READ MORE:

Bitcoin and Ethereum ETFs Bleed Over $520 Million in Single-Day Outflows

Eligible holders may redeem tokens for physical gold, subject to minimum thresholds and operational requirements. The structure combines traditional custody with on-chain settlement, enabling continuous transferability and fractional exposure without altering the underlying asset.

Some platforms allow tokenized gold to be lent for yield, though returns reflect counterparty and platform risk rather than gold’s price performance.

Key Risks: Concentration, Custody Dependence, and Redemption Frictions

Despite its growth, tokenized gold introduces risks that differ from both physical bullion and gold ETFs. Issuer concentration remains the central structural factor, while custody arrangements and audit transparency are critical to maintaining confidence in the 1:1 backing model. Investors also monitor the potential for premiums or discounts to emerge relative to spot gold, particularly during periods of market stress or liquidity fragmentation.

Redemption thresholds and operational requirements can limit the practical ability of smaller holders to access physical delivery, increasing reliance on secondary market liquidity for exits. Regulatory scrutiny is also a persistent variable, particularly as authorities globally refine frameworks for commodity-linked tokens and related consumer protection standards.

Tokenized Gold’s Role in 2026: A New Liquidity Rail for a Traditional Safe Haven

The $6 billion milestone underscores that tokenized gold is shifting from a niche product into an infrastructure segment that connects traditional safe-haven exposure to digital settlement rails. Rather than replacing physical bullion or established gold ETFs, gold-backed tokens are expanding access points, improving transferability, and enabling new collateral pathways within digital markets.

Further growth will likely depend on liquidity depth, confidence in issuer custody practices, and the extent to which tokenized gold becomes embedded in institutional workflows. For investors, the category increasingly resembles a market structure story, where access, settlement, and trusted backing determine adoption – more than a speculative narrative tied to short-term trading cycles.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Digital Gold Tokens Cross $6B as Investors Seek Safe-Haven Exposure appeared first on Coindoo.

You May Also Like

BFX Presale Raises $7.5M as Solana Holds $243 and Avalanche Eyes $1B Treasury — Best Cryptos to Buy in 2025

Interest rate cuts are coming – investors can expect a 200% increase in returns through Goldenmining