Trump Media Files Bitcoin and Ethereum ETF Again

Trump Media refiles Bitcoin, Ethereum, and Cronos ETFs with staking rewards, aiming to attract retail and institutional investors pending SEC approval.

Trump Media and Technology Group Corp. has refiled to launch Bitcoin and Ethereum ETFs. The funds have included staking rewards and are aimed at attracting retail and institutional investors. Pending approval from the SEC, the ETFs will offer regulated access to digital assets and integrate DeFi-style income strategies for shareholders and traders.

Truth Social ETFs Focus On BTC, ETH, Cronos Token

The filings are the Truth Social Bitcoin and Ether ETF and Truth Social Cronos Yield Maximizer ETF. The Bitcoin and Ether ETF follows both BTC and ETH, and includes Ether Staking Yields. The Cronos fund is based on the CRO token of Crypto.com, which aims to offer network staking rewards to investors.

Crypto.com will serve as custodian, liquidity provider and staking services provider. Yorkville America Equities will act as registered investment adviser and sponsor with an annual management fee of 0.95%. Pending SEC approval, both ETFs are set to list on NYSE Arca, which is expected to provide a regulated platform for trading digital assets.

It was in June 2025 when the Trump Media first announced filings for crypto ETFs. Previous applications included Crypto Blue Chip ETF that is holding five major digital assets. The company also confirmed a record date for its Digital Token Initiative on February 2, 2026, distributing tokens to DJT shareholders, showing it is still working on digital assets with its shareholders.

Market Implications and Strategic Partnerships Highlight Growth

Analysts point out that the strategy of pairing staking rewards with ETFs may appeal to investors who are looking for more yield than just the price gains. By incorporating staking as a direct integration, the ETFs provide additional returns over conventional passive cryptocurrency ETFs.

Moreover, the involvement of Crypto.com guarantees custody and liquidity support, minimizing risks for the operation of the funds for participants.

TMTG’s renewed filings show increasing interest in both retail and institutional investors in regulated crypto ETFs. Digital gold, BTC and ETH, and CRO exposure with staking makes for a differentiated investment product. Investors benefit from structured access without having to manage wallets or private keys, which will increase opportunities for market participation worldwide.

If approved, the ETFs could be a significant milestone in the adoption of digital assets. They are a combination of structured regulated investment frameworks, DeFi-led incentive rewards and strategic partnerships. Analysts suggest that the confidence of the market and trading volumes can rise once the SEC approval is granted and provides a transparent and accessible point of entry for cryptocurrency exposure.

Trump Media’s filings show that there is continued innovation in tokenized finance. The combination of exposure to BTC, ETH, and CRO, together with the stakeholders mechanisms, makes these ETFs competitive products.

Overall, with support from Crypto.com and Yorkville America Equities, these ETFs are poised to boost investor confidence. They may also accelerate broader adoption of regulated digital assets globally.

The post Trump Media Files Bitcoin and Ethereum ETF Again appeared first on Live Bitcoin News.

You May Also Like

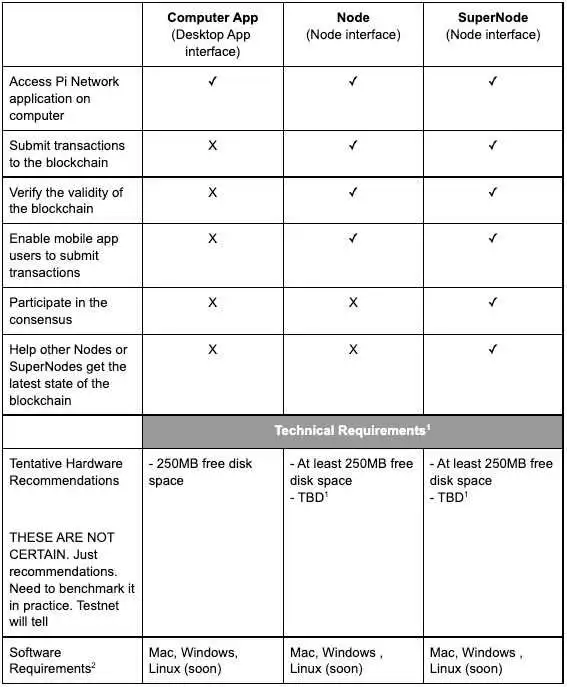

Pi Network Sets Feb 15 Deadline for Mainnet Node Upgrade

Pi Network Sets February 15 Deadline for Mandatory Mainnet Node Upgrade