Dogecoin (DOGE) Price: Surges 11% as X Announces Crypto Trading Feature

TLDR

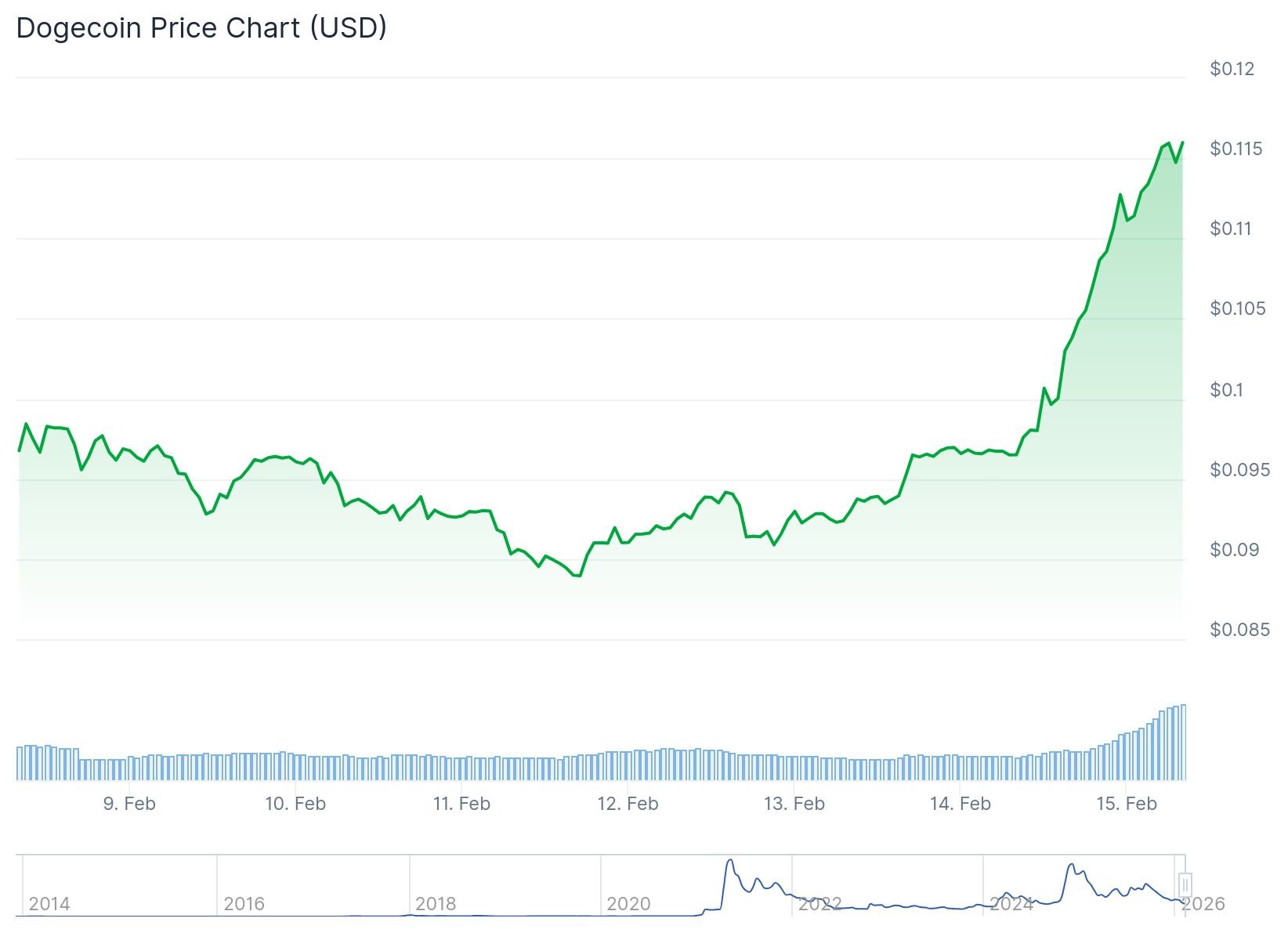

- Dogecoin traded 11% higher over 24 hours, reaching nearly $0.11 per coin, making it the biggest gainer among large cap cryptocurrencies.

- X (formerly Twitter) announced plans to enable direct stock and crypto trading from the timeline in coming weeks, likely driving Dogecoin’s price increase.

- Bitcoin briefly rose to $70,434 before dropping to $69,798, remaining flat for the week after $360 million in net outflows from US Bitcoin ETFs.

- Ethereum spiked to nearly $2,100 before falling to $2,080, up 1% over the day, with $161 million in outflows from US Ethereum ETFs during the week.

- Standard Chartered forecasted Bitcoin could drop to $50,000, while CryptoQuant suggested $55,000 as a realistic bottom following recent market liquidations.

Dogecoin climbed 11% over a 24-hour period on Saturday. The memecoin reached nearly $0.11 per coin at 2pm New York time.

Dogecoin (DOGE) Price

Dogecoin (DOGE) Price

The price jump came after X announced new trading features. The platform’s head of product said users will soon be able to trade stocks and crypto directly from their timeline.

X owner Elon Musk has promoted Dogecoin for years. He has called it his favorite cryptocurrency in interviews and posts on X.

Bitcoin showed less impressive movement on Saturday. The largest cryptocurrency rose to $70,434 before dropping back down.

Bitcoin traded at $69,798 after the dip. The coin remained flat for the week overall.

Bitcoin ETF Outflows Continue

US Bitcoin exchange-traded funds saw $360 million in net outflows during the week. The funds are managed by BlackRock, Fidelity, and Grayscale.

Small inflows during some days were offset by larger withdrawals mid-week. The pattern suggests investor uncertainty about Bitcoin’s direction.

Ethereum followed a similar path to Bitcoin on Saturday. The second-largest cryptocurrency briefly touched $2,100.

Ethereum then fell to $2,080. This represented a 1% gain over the previous day.

US Ethereum ETFs recorded $161 million in outflows for the week. The selling pressure affected both major cryptocurrencies.

Price Predictions Point Lower

Bitcoin crashed to nearly $60,000 last week. The drop came after $19 billion in crypto bets were liquidated in October.

More liquidations occurred last week when investors pulled back. The selling followed President Trump’s nomination of Kevin Warsh for Federal Reserve chair.

Warsh has been an inflation hawk in the past. This could mean slower interest rate cuts.

Standard Chartered Bank predicts Bitcoin could fall to $50,000. Blockchain analysts CryptoQuant see $55,000 as a realistic bottom.

Dogecoin remains 87% below its May 2021 peak. The coin has gained over 34,000% in the past 10 years despite recent losses.

The memecoin competes directly with Bitcoin as a payment network. It has less functionality than cryptocurrencies built on Ethereum.

X has explored crypto integration before. Previous payment-related news from the platform has boosted Dogecoin’s price.

The post Dogecoin (DOGE) Price: Surges 11% as X Announces Crypto Trading Feature appeared first on CoinCentral.

You May Also Like

a16z Crypto Founder Discusses Stablecoins: The "WhatsApp Moment" in the Crypto World Has Arrived

XRPL’s token escrow targets regulatory-friendly blockchain use