The Bitcoin Treasury Movement Rolls On — Here’s What’s New

Bitcoin has emerged as one of the go-to cryptocurrency assets for treasury strategies by different companies in the past few years.

This trend has intensified recently, and here are some of the latest additions.

Slowly Climbing Up

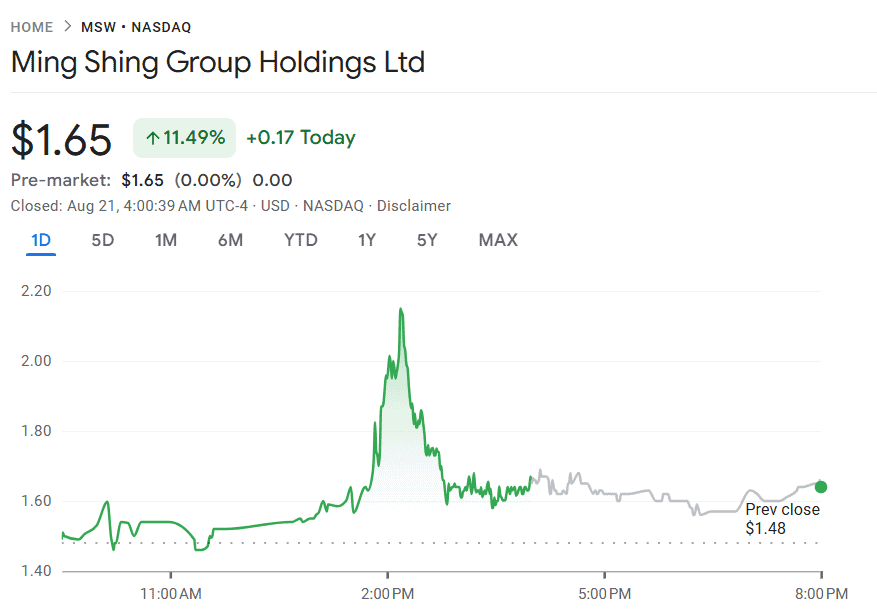

One of the more recent procurements comes from Ming Shing Group, a publicly traded Hong Kong-based company listed on the NASDAQ (MSW), specializing in wet trades, such as plastering, tiling, and bricklaying, among others.

The purchase agreement is for 4,250 bitcoins, worth approximately $482 million, with an average price of $113,638 per unit. It is currently ranked 45th on the BitcoinTreasuries leaderboard, with 833 BTC, having started accumulating in early January, trailing the Nordic healthcare company H100 Group’s stash of 911 BTC.

Its stock has reacted positively to the announcement, rising over 11% daily earlier tshi week, according to the most recent data from Google Finance.

Source: Google Finance

Source: Google Finance

A Known Face

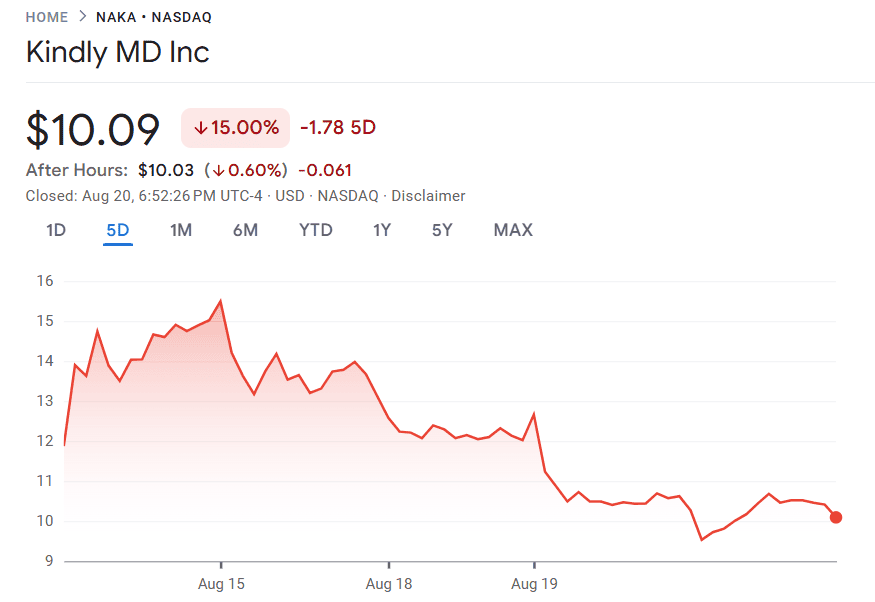

Earlier in the week, KindlyMD increased its holdings by a notable 5,744 BTC, with an estimated cost of $679 million, at an average cost per bitcoin of $118,204. It’s an American healthcare and healthcare data company, also trading on the NASDAQ (NAKA), having merged with its Bitcoin-native holding company, Nakamoto Holdings Inc., at the start of May.

The firm joined the race later in the same month, with the mission of accumulating a million of the leading crypto asset. They’re much further ahead in the rankings, holding 5,765 BTC and currently sitting in 16th place, with a notable lead over Semler Scientific, which owns 5,021 BTC at print time.

The company’s stock, however, did not react so well to the news and has been declining since the start of the week, as indicated by data from Google Finance at the time of writing.

Source: Google Finance

Source: Google Finance

The post The Bitcoin Treasury Movement Rolls On — Here’s What’s New appeared first on CryptoPotato.

You May Also Like

Polymarket Prices 86% Odds Of Sub-$80 – Will $83 Break?

Markets await Fed’s first 2025 cut, experts bet “this bull market is not even close to over”