Bitcoin Tests Historic Cycle Structure as Market Awaits Regime Shift Confirmation

Bitcoin is once again approaching a structural inflection zone, with price behavior mirroring patterns seen in prior cycles.

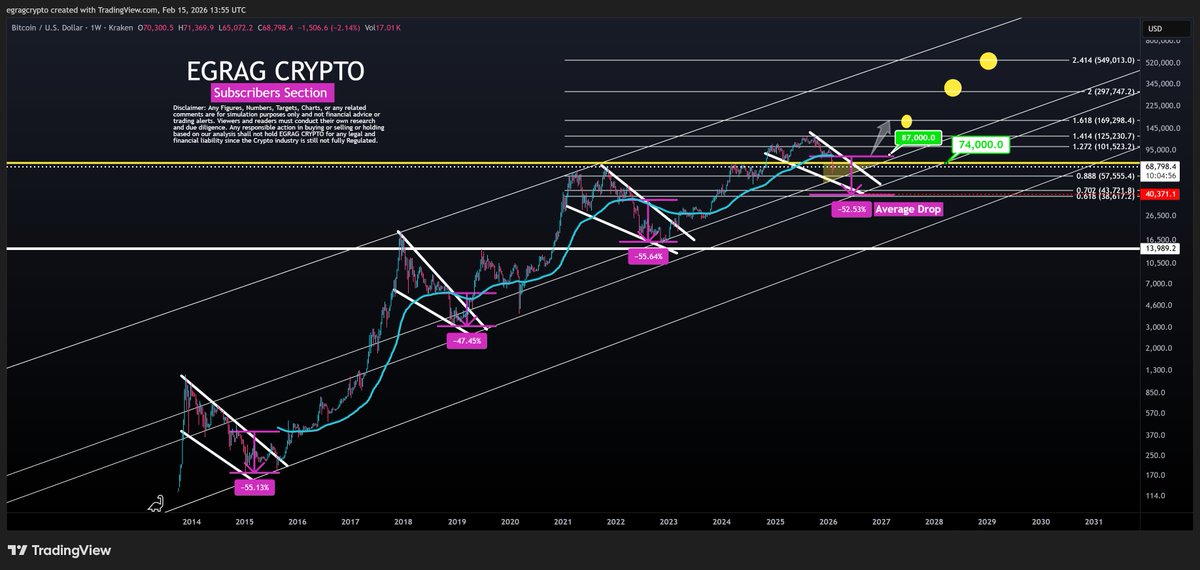

According to analysis shared by EGRAG CRYPTO, the broader macro setup has remained consistent since Bitcoin’s inception, and a clear technical threshold now defines whether this cycle deviates from history.

The core question is whether the current structure will resolve differently, or repeat its established pattern.

Source: https://x.com/egragcrypto/status/2023034996030631978

Source: https://x.com/egragcrypto/status/2023034996030631978

The Conditions That Would Change the Pattern

EGRAG outlines three key technical requirements for declaring a structural break from prior cycle behavior:

- A decisive close above $74,000

- Sustained holding above the February 6, 2026 low (~$60,000)

- Final confirmation with a close above the 100 EMA near $87,000

Only if these conditions are met, sequentially and with confirmation, would the current cycle be considered structurally different from previous macro patterns.

The $74K level functions as the immediate breakout trigger. The ~$60K level represents the structural floor. The 100 EMA near $87K acts as the long-term regime confirmation line.

If Those Levels Are Not Reclaimed

Absent a decisive move through those thresholds, the macro structure remains unchanged. In that case, the current cycle would continue to follow the same broad setup that has historically defined Bitcoin’s market phases.

This implies that:

- Failure below $74K keeps breakout attempts unconfirmed

- Loss of the ~$60K region would weaken structure materially

- Rejection below the 100 EMA (~$87K) maintains historical cycle alignment

Under this framework, nothing has structurally shifted, only timing within the broader pattern.

Structural Takeaway

Bitcoin’s cycle question is not philosophical but technical. A close above $74K initiates the deviation scenario, sustained holding above $60K protects structure, and confirmation above the 100 EMA near $87K would formally signal a break from historical behavior.

Until those conditions are met, the macro setup remains consistent with prior cycles, and confirmation, not anticipation, determines whether this time is truly different.

The post Bitcoin Tests Historic Cycle Structure as Market Awaits Regime Shift Confirmation appeared first on ETHNews.

You May Also Like

Cronos (CRO) Flatlines Despite Altcoin Season, Analyst Explains Why

Stripe-Backed Bridge Secures U.S. National Trust Banking License