Toyota Explores Blockchain to Digitize Vehicle Ownership

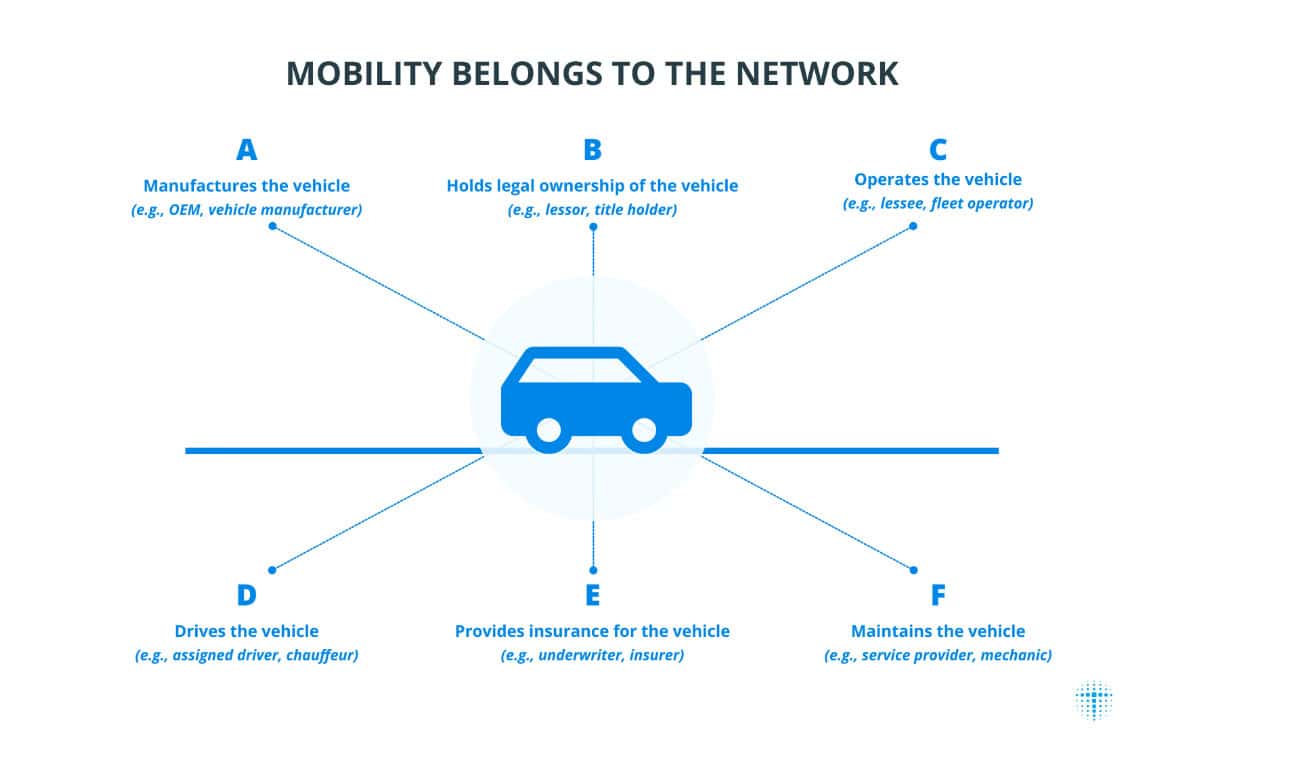

The blockchain has gained popularity as it introduced cross-border transactions and the creation of borderless networks, which have become increasingly prominent in the real-world assets (RWAs) space. However, in this asset class, specifically mobility, it cannot be simplified and removed from boundaries created by commercial practices, regulations, and institutional frameworks.

Toyota’s Blockchain Lab, the R&D arm of the carmaker, has been busy exploring the blockchain and its potential applications in its vehicles, potentially overcoming traditional hurdles such as registration, insurance, and maintenance, among others, by creating a verifiable “Trust Chain” that represents multi-party relationships on-chain.

Current-Day Obstacles

They proposed a concept called the Mobility-Oriented Account (MOA) last year, to understand this framework from the perspective of the connection between the user and mobility. The initiative aimed to describe mobility as an “abstract account,” but it also exposed that the notion could not completely capture the complex relationships involved in it.

Their most recent paper is a continuation of the research from a different point of view. MOA attempted to outline mobility from an individual entity, whereas the current goal is to describe it with the network in mind. We can already grasp mobility as part of a network, given the complex relationships that encapsulate it.

Source: Toyota Blockchain Lab

Source: Toyota Blockchain Lab

Mobility is currently being reimagined, no longer just a means of transport, but rather a valuable asset that generates value. The rise of electric and autonomous vehicles is peaking global interest in the value of mobility, and how it can be uncoupled from its traditional roots. Three structural gaps prevent any attempts at making this possible.

One is organizational, where vehicle registration records and operational information are kept by governments and corporations, which restricts initial valuation and assessment. Then there is the industrial sector, where no open and interoperable network exists between entities within the ecosystem—finally, the national gap, where registration, tax, and insurance records are not unified under a single certificate.

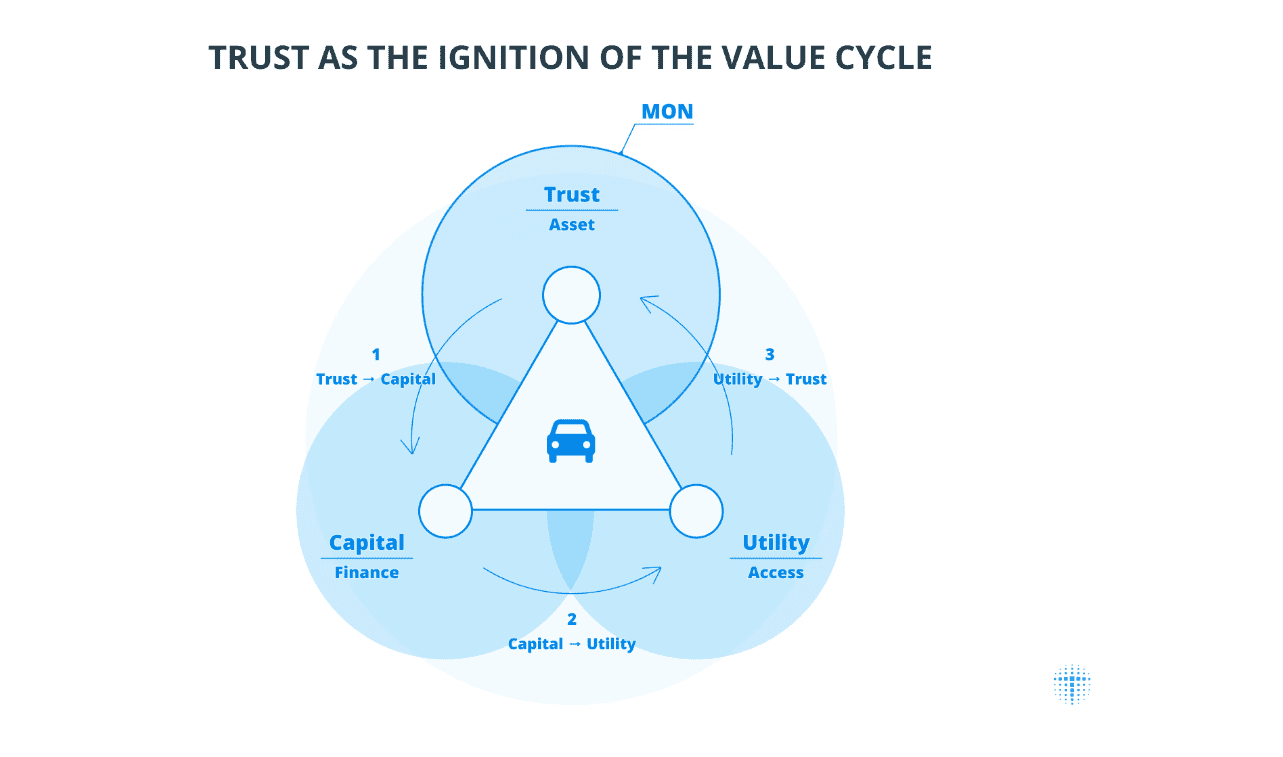

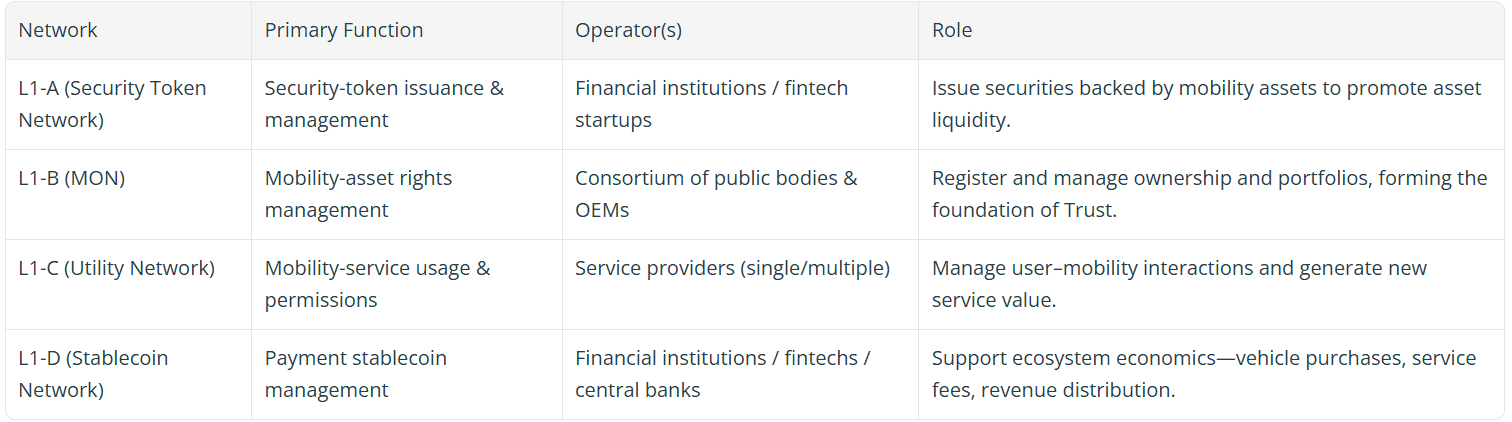

The Mobility Orchestration Network (MON)

This new concept is a protocol-layer blockchain architecture designed to orchestrate trust and unlock the value of mobility assets across organizational, industrial, and national boundaries. It combines three on-chain verified proofs, or Trust Chains, as a single one cannot fully outline mobility asset value.

-

Institutional Proof: Vehicle title/registration, insurance compliance, to establish legality

-

Technical Proof: VIN, manufacturing data, sensor integrity, to ensure it’s fit for purpose

-

Economic Proof: Usage metrics, maintenance, and revenue history, to attest to economic value

This is how the MON concept addresses the organizational gap. The introduction of Trust across sectors is addressing the industrial gap, connecting them seamlessly, which, in itself, reinforces the value of mobility. We can think of it as a catalyst, with its primary role being to orchestrate the many networks that work together.

Source: Toyota Blockchain Lab

Source: Toyota Blockchain Lab

The goal for the final, national gap is to enable global circulation of value without making any changes to the already existing local ecosystems. A key point here is that MON is designed as a protocol rather than a single platform, allowing different systems to be integrated seamlessly across borders.

Real-World Implementation

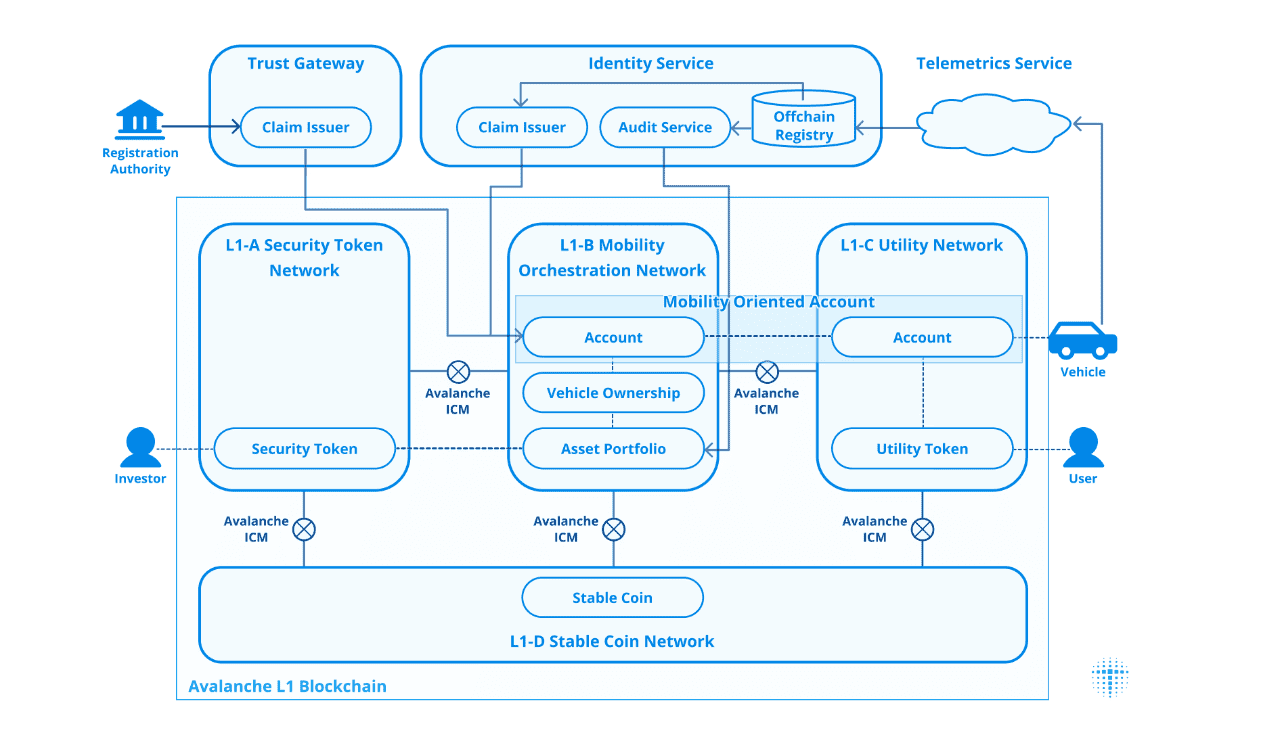

So far, it has been outlined how Trust Chains can help define the on-chain identity of a mobility asset. MOA functions as a container for it, holding the proofs it carries, but to grasp different types of information, it’s split into two distinct accounts.

-

T‑MOA (Trust-side): Holds finalized institutional and economic proofs

-

U‑MOA (Utility-side): Manages real-time operational verifications (e.g., driver credentials, vehicle status)

Additionally, a tokenization framework must be present, enabling a gradual transition from non-fungible mobility ownership (via NFTs) to fungible financial assets. This reflects its evolving nature—from ownership to liquidity.

How It Looks As A Prototype

MON employs a multi-chain approach, utilizing Avalanche as its foundational layer, and deploys separate chains for Trust (MON), Capital (tokenized assets), Utility (mobility operations), and Stablecoin networks—all interconnected via Avalanche’s Interchain Messaging (ICM) system.

Source: Toyota Blockchain Lab

Source: Toyota Blockchain Lab

The ICM is the infrastructure that ensures complete and secure communication across different blockchain networks. Some prominent protocols are integrated into the intricate network, including IBC from Cosmos and CCIP from Chainlink.

A separate structure called the Trust Gateway acts as the off-chain bridge to on-chain trust. Several mechanisms are involved, including Verifiable Credentials, Decentralized Oracles, Trusted Intermediaries, and others.

Source: Toyota Blockchain Lab

Source: Toyota Blockchain Lab

The post Toyota Explores Blockchain to Digitize Vehicle Ownership appeared first on CryptoPotato.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Stronger capital, bigger loans: Africa’s banking outlook for 2026