Ethereum Whale Offloads $543M in ETH: Red Alert For The Market?

Despite BTC $69 364 24h volatility: 1.2% Market cap: $1.39 T Vol. 24h: $39.12 B and the crypto market timid yet steady recovery over the past few days, a prominent Ethereum whale and early investor transferred approximately $543M worth of Ether ETH $1 995 24h volatility: 3.2% Market cap: $240.68 B Vol. 24h: $25.02 B to Binance this week, signalling potential sell-side pressure as the asset struggles to maintain key technical support levels.

The transaction saw over 261,000 ETH transferred to the exchange. This move is raising concerns about liquidity absorption in a market already under strain.

DISCOVER: Best Solana Meme Coins By Market Cap 2026

On-Chain Data Reveals Selling Pressure: Ethereum Whale “Garrett Jin” Unloading $543M

The funds originated from wallets labelled “Garrett Jin,” a known early crypto investor active since the 2011 Bitcoin era. The entity deposited a total of 261,024 ETH into Binance across three large tranches on February 14 and 15.

Large transfers to centralized exchanges are typically viewed as a precursor to selling, as investors move assets to liquid venues to exit positions. This is not the only major whale exiting their ETH portfolio recently. Notably, Vitalik Buterin also sold ETH during the significant sell-off in early February, which only further weakened already low market sentiment.

While Jin reportedly retains over 800,000 ETH, the sudden liquidity shift has spooked traders: especially as ETH trades again below $2,000.

EXPLORE: What is the Next Crypto to Explode in 2026?

Bearish Signals Mount as Price Tests $2,000

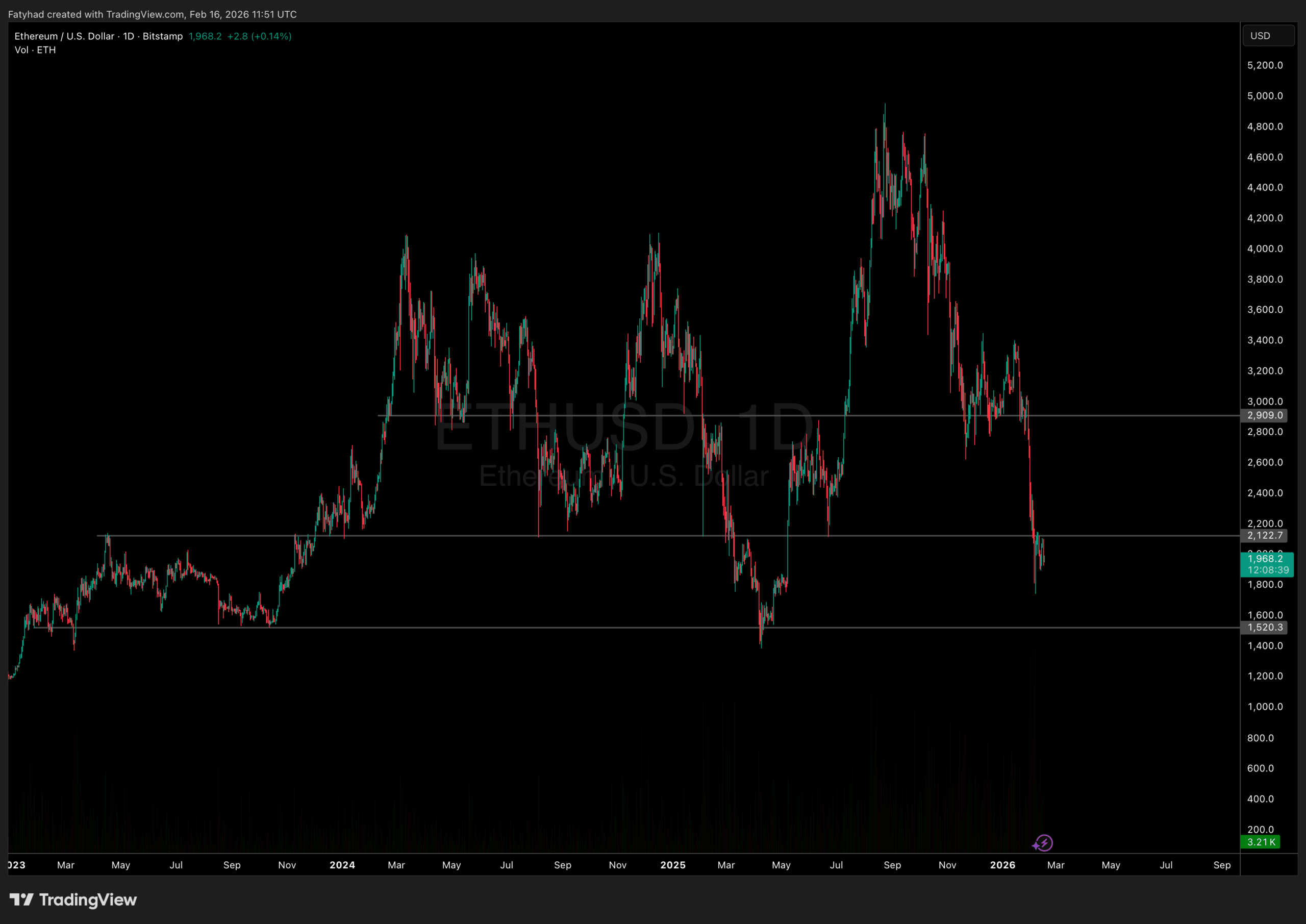

Ethereum Price Analysis Source: TradingView

Ethereum has faced significant selling pressure in February, dropping from highs above $2,800 to drop several times below the $2,000 mark. Now the price is currently forming a “bear pennant” on daily charts, a technical pattern that often precedes further downside.

This movement aligns with a broader trend of institutional reallocation. Similar market behaviour was observed when Ether slid 9% as long-term holders bought the dip in previous corrections, though current data suggests whales may now be de-risking rather than accumulating.

The infusion of over half a billion dollars in potential sell pressure comes at a critical moment for Ethereum. Technical analysis points to $1,950 as short-term support; a breach here could trigger a measured move toward $1,550, representing a potential 20% drop.

Open Interest (OI) in ETH derivatives has also declined, suggesting traders are closing longs rather than betting on a rebound. While some analysts argue this transfer could be a strategic OTC swap or a reallocation of staking, the immediate market reaction remains cautious.

DISCOVER: 10 New Upcoming Binance Listings to Watch in February 2026

nextThe post Ethereum Whale Offloads $543M in ETH: Red Alert For The Market? appeared first on Coinspeaker.

You May Also Like

Yedi Yıl Sonunda Bitcoin’lerini Satan ve Bu Altcoine Geçen Dev Balina, Büyük Satış Yaptı! “5 Milyar Dolar Zararı Var!”

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon