Food lobby begs Trump for tariff carveouts on cucumbers and fis

Food industry leaders in the U.S. are flooding Trump’s trade team with one message: don’t slap tariffs on products we can’t grow.

That plea, coming from grocers, seafood firms, restaurants, and fresh produce lobbies, follows the White House decision this month to hit dozens of countries with a wave of new duties.

According to the Financial Times, Trump’s latest tariffs have pushed America’s overall trade tax rate to the highest it’s been in decades, and food lobbyists are now working overtime to get their most vulnerable products exempted.

Their pitch is blunt: some items just aren’t grown in this country at scale, and tariffs on them are going to wreck prices across the food chain. Instead of launching an all-out war on Trump’s policy, the lobbyists are going in one-by-one, trying to carve out exceptions for cucumbers, fish, shrimp, pineapples, coffee; anything that could make a grocery bill worse.

Seafood industry defends imports as essential

Gavin Gibbons, the chief strategy officer at the National Fisheries Institute, argued that the seafood trade should be treated differently. “There are so many voices, so many products that say, ‘Well, we just need an exemption, because we’re unlike others’,” he said, and added, “We would like an exemption for all [seafood].”

Gavin said that 85 percent of seafood consumed in the U.S. is imported, and American fisheries are already capped at their legal harvest limits. Expanding domestic fish farms isn’t feasible either, thanks to tight federal rules.

Government data shows the U.S. had a $24 billion seafood trade deficit in 2022, and Gavin warned that without tariff relief, that number would only grow. Shrimp is especially dependent on imports. He said 90 percent of shrimp eaten in the U.S. is brought in from abroad, and over a third of that comes from India, which Trump is now punishing with a 50 percent tariff in response to its oil deals with Russia.

Restaurants are also caught in the crossfire. The National Restaurant Association sent a letter last month to trade representative Jamieson Greer warning that food prices on menus could climb fast if fresh ingredients, many of which are only available seasonally, get hit with high duties.

Produce groups push back on rising food costs

On the produce front, the industry is just as alarmed. The U.S. imports $36 billion worth of fresh fruits and vegetables, with Mexico leading the pack, followed by Peru for fruits and Canada for vegetables.

Andy Harig, a vice-president at the Food Industry Association, which represents major grocers like Walmart and Albertsons, explained what’s at stake if exemptions aren’t granted. “Tariffs are designed to raise prices.

Some of these are significant enough that they will raise prices by a very noticeable amount,” he said. Andy’s team recently analyzed the case of cucumbers, a product that’s become almost entirely import-reliant.

In 1990, just 35 percent of cucumbers came from outside the U.S. That number is now close to 90 percent. If the U.S. tried to grow them year-round, it would need massive greenhouse operations — a costly undertaking that would hit shoppers hard.

Andy added that his group isn’t calling for a return to old trade models. “There is still a desire to be able to ask for exemptions, and try to turn these tariffs into a more targeted and focused kind of approach to addressing both reshoring production in the U.S. and supporting U.S. jobs,” he said.

There are a few trade deals on the table that might offer partial relief. A new agreement with Indonesia includes language about natural resources that aren’t available domestically, which might open a door for exemptions on things like tropical fruits. A similar line appears in the U.S.–EU trade deal, but that document doesn’t say which products might qualify.

Brazil, which just got slapped with a 50 percent tariff, managed to get some foods excluded — like orange juice and Brazil nuts — while coffee was left out, despite not being produced in the U.S. Commerce Secretary Howard Lutnick hinted last month that items like coffee, mangoes, and pineapples could eventually be spared, but again, nothing’s guaranteed.

The smartest crypto minds already read our newsletter. Want in? Join them.

You May Also Like

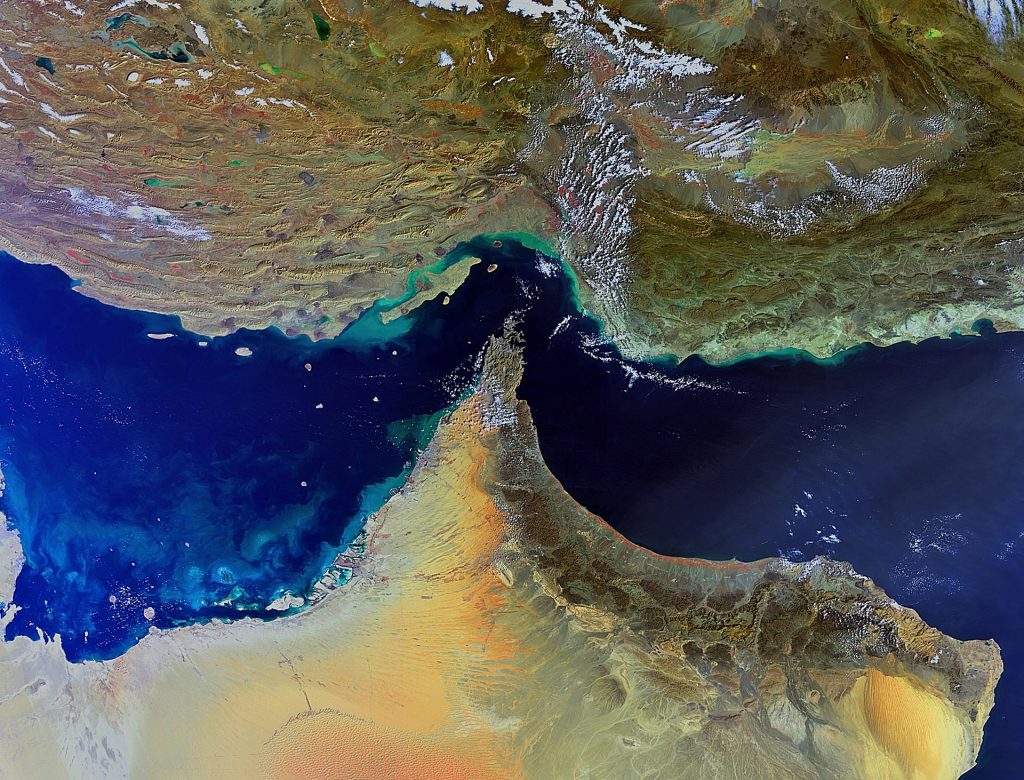

İran Hürmüz Boğazı’nı Kapatırsa Ne Olur? Verilerin Gösterdiği Tek Bir Şey Var!

TON Station Daily Combo 01 March 2026: Maximize Your $TONS Rewards Today