Binance Denies Iran Sanctions Breach Claims, Says No Investigators Were Fired

Binance has rejected the allegations that it enabled a transaction tied to Iran and fired the staff who raised concerns regarding the transfer.

The crypto exchange issued a formal response on X following a report by Fortune that claimed internal investigators uncovered over $1 billion in suspicious transfers. Binance said the report is not true and contains many inaccuracies.

According to Fortune, the transactions moved through the platform between March 2024 and August 2025, which was over a year; during the operation, all the funds came in from Iranian entities. The report stated that the transfers involved USDT on the Tron network and cited many unnamed sources familiar with the case.

The media outlet also reported that at least five internal investigators, some with law enforcement backgrounds, were sacked after documenting the activity. It also claimed that additional senior compliance staff had left the company a few months ago.

Also Read: Binance Fires Investigators as Sanctions Risk Resurfaces

Contrary to the report, Binance released a letter signed by ‘Binance Communications’ denying the allegations. According to the exchange platform, no investigators were dismissed for raising compliance concerns, and any suggestion that the company was retaliating was “categorically false.”

The company also added that there were no sanctions violations linked to the activities that were referenced in the article. According to the exchange, a proper internal review with the support of external legal counsel has been done, and the review found no evidence that it violated applicable sanctions laws in connection with the transactions mentioned.

Binance Compliance and Commitment Claims

Binance said it continues to cooperate with regulators and fulfill all its monitoring and oversight commitments. The exchange noted that since its 2023 resolution with U.S. authorities, it has strengthened its compliance framework and invested heavily in proper sanction screening in order to monitor all the systems and follow anti-money laundering rules.

The company also pointed out that it is regulated in multiple jurisdictions, including the Abu Dhabi Global Market, in addition to other local regulators. It said its compliance program is among the most robust in the digital asset industry.

Also Read: Bitcoin-Linked Services: Nexo Relaunches Crypto Platform in the United States

You May Also Like

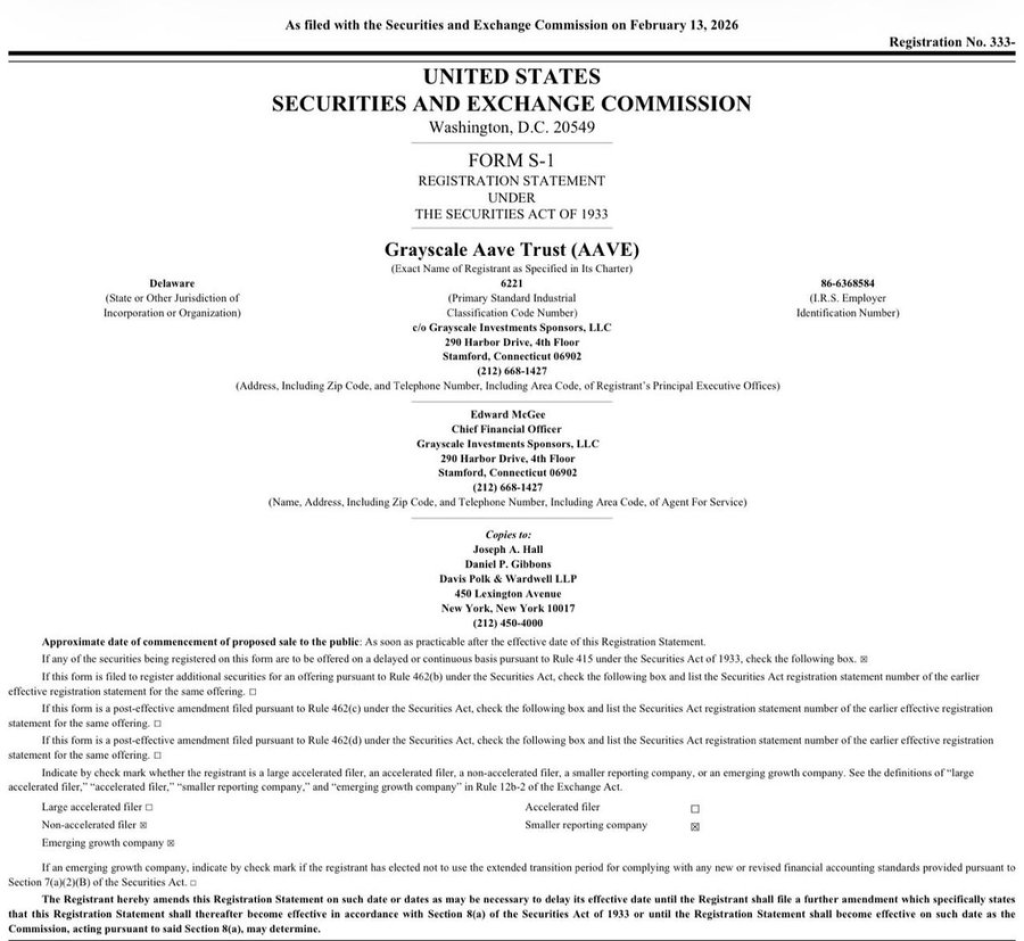

Will SEC Approve the First DeFi ETF? AAVE Filing Sparks Big Question

Wall Street Giants Lead Crypto Hiring Surge: JPMorgan, Citi & More