Top UK Bank Cuts 2026 Bitcoin and XRP Price Targets, Sees Tougher Path Ahead

Ripple (XRP) and Bitcoin prices have started to struggle in 2026. The bearish pattern that dominated 2025 has continued into 2026, and conditions could worsen further in the near term.

A post from BankXRP (@BankXRP) notes a fresh downgrade from Standard Chartered that directly affects the Bitcoin and XRP price outlook for 2026. The bank’s digital asset lead, Geoffrey Kendrick, now points to what he describes as a possible final capitulation phase before recovery can begin.

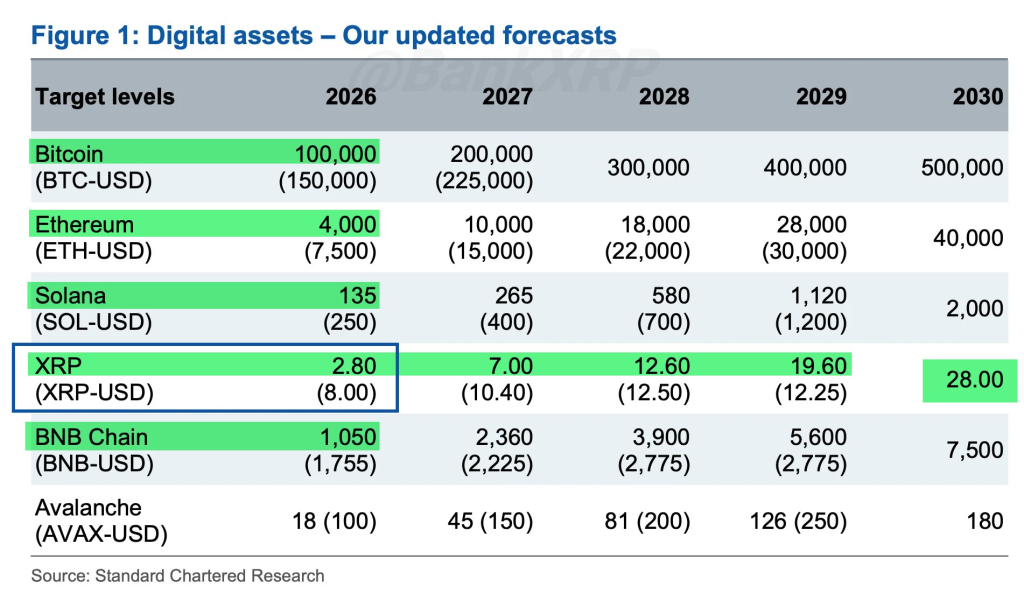

Standard Chartered reduced its 2026 expectations across major cryptocurrencies. Bitcoin now carries a revised target near $100,000 instead of the earlier $150,000 projection. XRP shows an even sharper adjustment, with the 2026 estimate lowered to about $2.80 from the previous $8 outlook. Ethereum also moved down to roughly $4,000 from $7,500.

The attached forecast chart places these weaker short term expectations beside stronger long range projections through 2030. Bitcoin rises toward $200,000 in 2027 and continues higher in later years. XRP follows a similar path, climbing from the reduced 2026 level toward double digit territory by the end of the decade. This structure suggests near term pressure exists, yet the broader cycle still points upward over time.

ETF Behaviour And Macro Conditions Create Pressure On BTC Price And XRP Price

Geoffrey Kendrick links the softer outlook to exchange-traded fund flows. Bitcoin ETF holdings have declined since late 2025, and many buyers entered near an average level close to $90,000.

Positions that sit below entry price can increase the chance of additional selling instead of dip buying. Kendrick estimates ETF balances dropped by almost 100,000 BTC from their peak, which weakens demand support in the short run.

@BankXRP / X

@BankXRP / X

Macro conditions add further strain. Recent United States economic data presents a mixed picture at a moment when interest rate cuts remain uncertain. Expectations for policy easing appear delayed until later leadership changes at the Federal Reserve. Limited liquidity expansion can reduce fresh inflows into risk assets, which includes both BTC price and XRP price performance.

Long Term Recovery Path Remains Visible Despite Short Term Capitulation Risk

Kendrick still views the current downturn as less severe than earlier crypto bear phases. Previous cycles faced major platform failures that damaged confidence across the industry. Present conditions lack similar structural collapses, which may indicate stronger resilience as institutional participation expands.

Read Also: Silver Price to $1,000? These Two Historic Ratios Say It’s Not as Crazy as It Sounds

Standard Chartered therefore expects recovery once market lows form during 2026. Other digital assets could follow the same direction as Bitcoin and XRP after stabilization appears. The forecast chart supports this narrative through rising targets in the years after 2026, even though the immediate path looks challenging.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Top UK Bank Cuts 2026 Bitcoin and XRP Price Targets, Sees Tougher Path Ahead appeared first on CaptainAltcoin.

You May Also Like

The DDC Group and MindMap Digital Announce Strategic Partnership

Bitcoin 8% Gains Already Make September 2025 Its Second Best