Bitcoin Whales Flood Binance As Correction Deepens: On-Chain Data Shows

Bitcoin’s ongoing correction is pulling large holders back onto centralized venues, with CryptoQuant data showing a sharp jump in whale-dominated inflows to Binance. At the same time, derivatives positioning continues to unwind, reinforcing the picture of a market de-risking across both spot and futures.

Bitcoin Whale Share Of Inflows Spikes On Binance

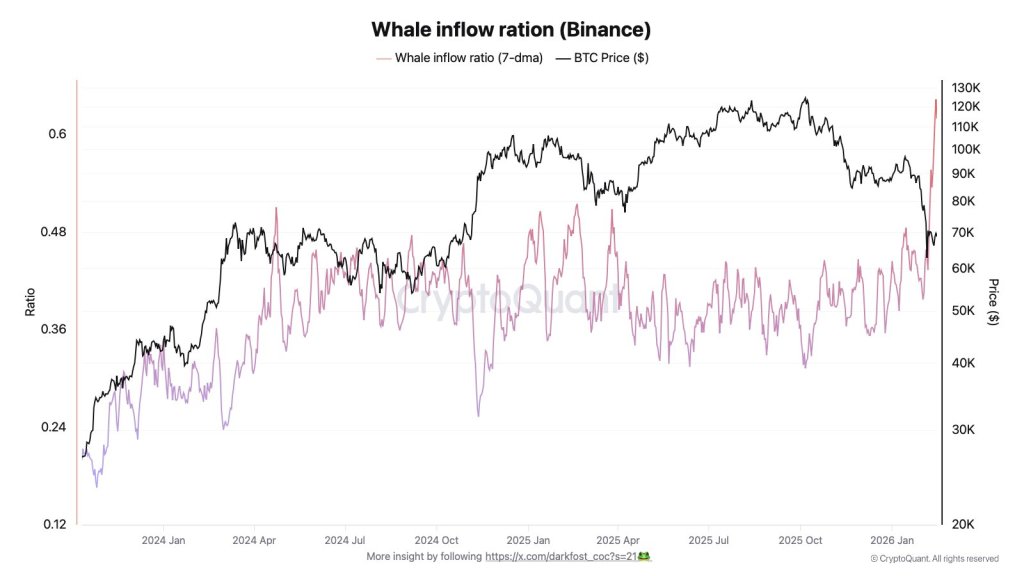

CryptoQuant contributor Darkfost (@Darkfost_Coc) said Binance is seeing a notable rise in whale activity as the drawdown pressures participants “from retail participants to whales and even institutions.” His focus was the “whale inflow ratio,” a metric that compares BTC inflows from the 10 largest transactions against total exchange inflows, smoothed using a weekly average to reduce the impact of one-off transfers.

“According to the whale inflow ratio, we are seeing a clear surge in whale activity on Binance, reflecting a specific dynamic in the market,” Darkfost wrote. “This ratio is calculated by comparing BTC inflows from the 10 largest transactions to total inflows. Using a weekly average helps reveal a clearer trend, filtering out noise from isolated, exceptional transactions.”

Between Feb. 2 and Feb. 15, Darkfost said the ratio rose from 0.4 to 0.62, implying that a larger share of inbound BTC to Binance is now coming from a small set of large transfers. While the metric doesn’t prove intent, a higher concentration of whale inflows is often read as an increase in potential sell-side supply sitting on exchange order books, particularly during risk-off stretches.

“It is important to note, however, that this reflects an increase in their share of inflows, which can be interpreted as rising sell-side pressure in the market,” he added.

Darkfost also flagged that some of the activity may be linked to a specific entity. “Part of these inflows can be attributed to a well-known whale, believed to be Garrett Jin. Nicknamed 19D5 or ‘the Hyperunit whale,’ this whale has been particularly active on Binance recently, moving close to 10,000 BTC onto the platform.”

He framed the broader context as a liquidity and venue-choice story rather than a single wallet-driven anomaly, arguing that multiple whales have been sending “significant amounts of BTC” to Binance, aided by its depth while uncertainty pushes investors to reassess exposure.

Derivatives Unwind Adds To Pressure

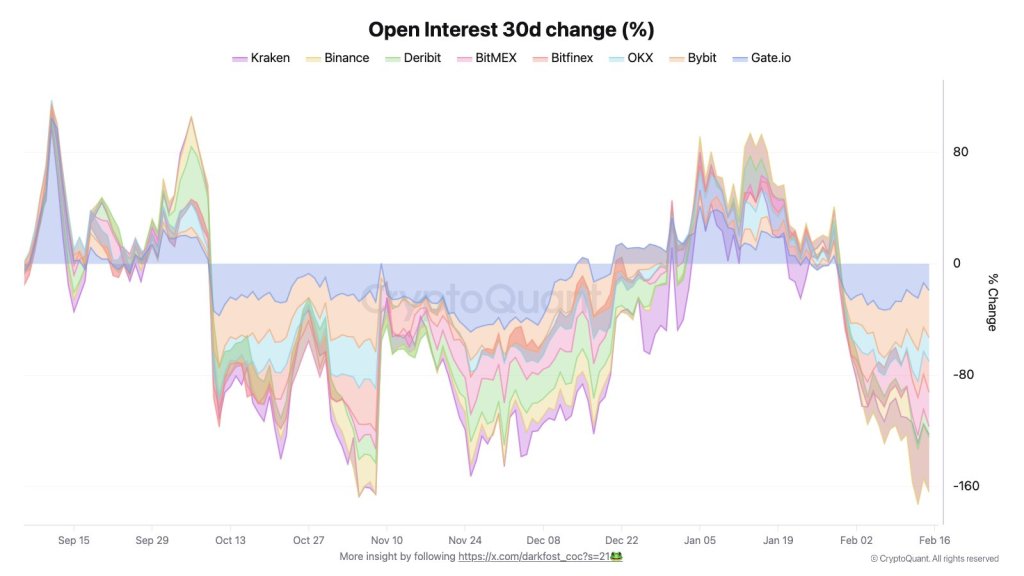

In a separate post, Darkfost argued the derivatives market contraction that followed the cycle’s top remains a central feature of the current tape. “Analyzing Bitcoin open interest across exchanges highlights how severely the derivatives market has contracted since the last all time high and the October 10 sell off,” he wrote, adding that speculation “reached unprecedented levels.”

He pointed to prior peaks in BTC-denominated open interest on Binance: 94,300 BTC after the November 2021 peak versus 120,000 BTC at the October 2025 market top and said aggregate open interest across all exchanges rose from 221,000 BTC in April 2024 to 381,000 BTC at the cycle peak.

Since that top, he said open interest has fallen in almost every month, including a sharp Oct. 6–Oct. 11 drawdown when Binance open interest dropped 20.8%, while Bybit and Gate.io each posted 37% declines. The contraction has continued, with Binance down another 39.3%, Bybit down 33%, and BitMEX down 24%, according to Darkfost.

His takeaway is that the market is still in a risk-reduction phase, whether voluntary or forced by liquidations amid volatility. “Overall, this environment indicates that investors are actively reducing exposure, cutting risk, or being forced out through liquidations driven by ongoing volatility,” he wrote. “Under these conditions, it is difficult to envision Bitcoin stabilizing sustainably and reigniting a bullish trend in the short term.”

At press time, BTC traded at $67,823.

You May Also Like

Will Crypto Market Rally or Face Fed Shock?

CME Group to Launch Solana and XRP Futures Options