Litecoin Price Prediction: Will LTC Hit $300 by 2030?

Key Takeaways

- Litecoin is likely to trade in the $95–$120 range in 2026 under base-case conditions.

- A strong 2027–2028 crypto cycle could push LTC toward $150–$200.

- Long-term upside toward $250–$300 by 2030 depends heavily on Bitcoin-led expansion.

As one of the oldest actively traded cryptocurrencies, it continues to function as a liquidity bridge and transactional asset, but its price performance has lagged behind newer narratives in the market.

2026: Stabilization Above $100?

Assuming broader crypto markets maintain structural recovery into 2026, Litecoin has a reasonable probability of stabilizing between $95 and $120. This range reflects moderate capital inflows without assuming speculative excess.

A conservative framework would place LTC closer to $80–$100 if macro conditions remain tight or altcoin liquidity underperforms. Conversely, sustained Bitcoin strength and improving sentiment could help Litecoin establish a base above $100, a psychologically and technically important threshold.

At this stage, 2026 appears more consistent with consolidation and gradual appreciation rather than breakout acceleration.

2027: Cycle Acceleration Phase

If historical cycle patterns repeat, Litecoin tends to lag Bitcoin early in expansions and then participate more aggressively once capital rotates into mid-cap assets. In a strong cycle environment, price levels between $150 and $200 become plausible.

However, this outcome is conditional. Litecoin’s upside depends less on internal innovation and more on macro liquidity and Bitcoin dominance dynamics. Without renewed speculative appetite, price expansion may remain capped.

2030: Structural Growth or Utility Plateau?

By 2030, Litecoin’s trajectory will likely reflect one of two scenarios:

- Utility-Driven Growth: Gradual appreciation into the $180–$220 range as adoption expands steadily.

- Cycle-Driven Expansion: A return toward $250–$300 if a major bull market lifts legacy altcoins alongside Bitcoin.

While projections toward $300+ are possible, they assume a broad expansion phase rather than asset-specific catalysts. Litecoin historically mirrors macro cycles rather than creating them.

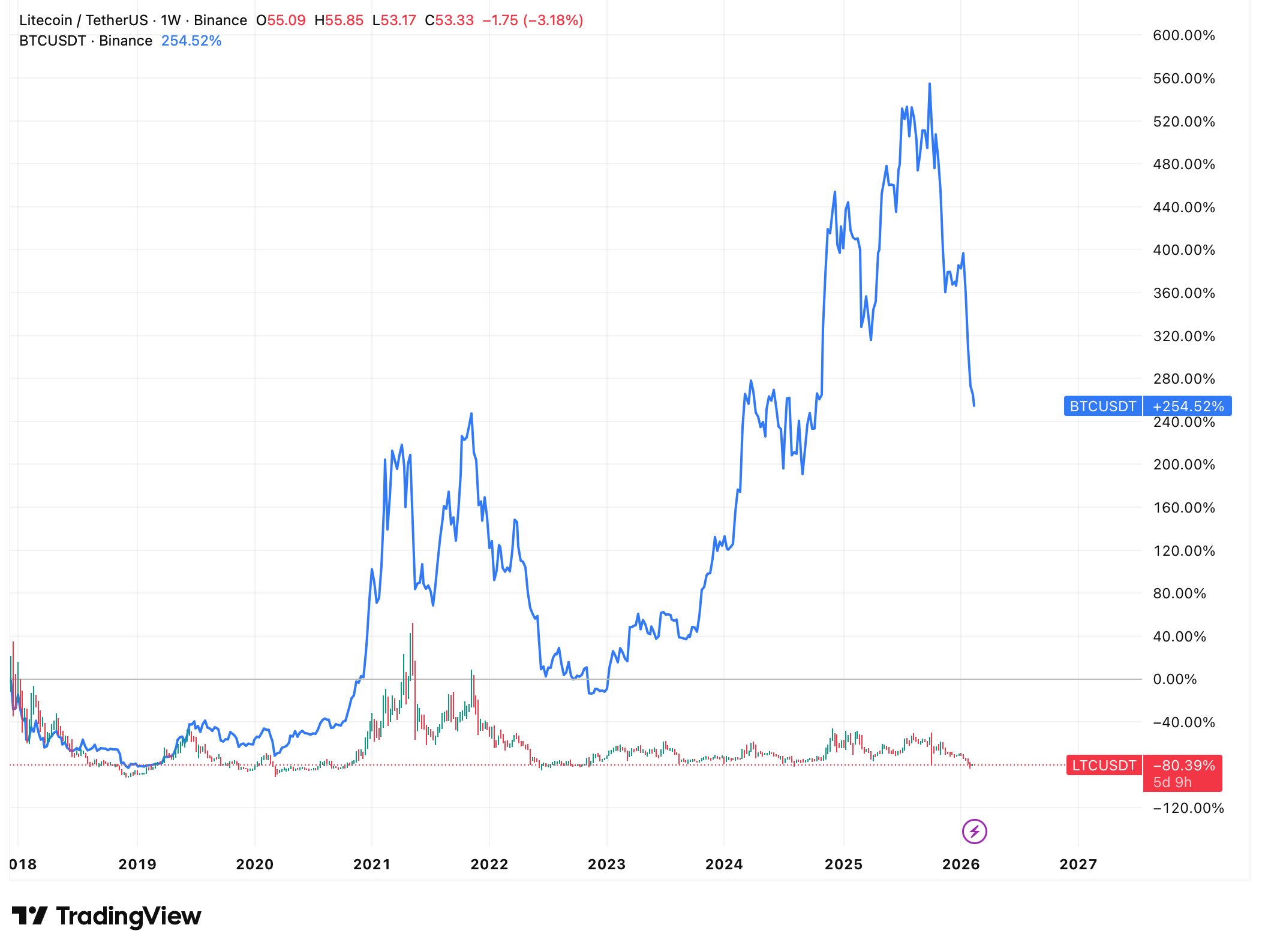

Technical Structure and Cycle Behavior

Technically, Litecoin continues to respect long-term macro structure similar to prior cycles. Analysts such as Michaël van de Poppe have previously highlighted the importance of multi-year support zones and altcoin cycle rotations in assessing LTC’s potential to revisit $150–$250 ranges during bullish phases.

Technically, Litecoin continues to respect long-term macro structure similar to prior cycles. Analysts such as Michaël van de Poppe have previously highlighted the importance of multi-year support zones and altcoin cycle rotations in assessing LTC’s potential to revisit $150–$250 ranges during bullish phases.

READ MORE:

Binance Records Third Straight Month of Stablecoin Outflows

What remains consistent across cycles is Litecoin’s high correlation with Bitcoin. It rarely leads, but it often participates once momentum broadens.

Risk Factors

Several structural risks remain:

- Persistent underperformance versus newer layer-1 networks.

- Declining retail speculation in older assets.

- Liquidity concentration around Bitcoin and Ethereum.

- Regulatory developments impacting exchange listings or derivatives access.

Additionally, Litecoin’s lack of a dominant narrative in emerging sectors such as DeFi, RWA, or AI-linked tokens may limit speculative upside compared with trend-driven assets.

Final Assessment

Litecoin’s long-term outlook remains constructive but is dependant on various factors. The asset benefits from longevity, exchange integration, and established liquidity, yet it does not currently command a disruptive narrative.

In a strong market cycle, LTC can reasonably target the $150–$200 region, with $250–$300 possible in peak speculative phases. In a slower-growth environment, price appreciation may remain confined below $200 through 2030.

Ultimately, Litecoin’s path is less about innovation-driven revaluation and more about its position within broader crypto liquidity cycles. Investors should frame expectations accordingly.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Litecoin Price Prediction: Will LTC Hit $300 by 2030? appeared first on Coindoo.

You May Also Like

We should be prepared for “short-term disruptions” in the labor market from AI

ZKP’s Presale Stage 2 Countdown Begins: Smart Buyers Rush Before Supply Cuts While Monero & Cardano Face Market Shifts