Arthur Hayes Warns Bitcoin Drop Signals Hidden Credit Stress

Highlights:

- Hayes says Bitcoin’s decline may signal tightening credit and weaker dollar liquidity.

- He warns that AI job losses could increase defaults and create heavy losses for banks.

- He argues that stock markets may not yet reflect the full scale of this credit risk.

Bitcoin (BTC) has been falling since its October high near $126,198, while the Nasdaq 100 Index has mostly stayed steady. Arthur Hayes, co-founder of BitMEX and managing partner at Maelstrom, says this gap could be a warning sign. He believes credit conditions may be tightening. In his view, Bitcoin is already reflecting that pressure, while the broader stock market has not fully reacted yet.

Factors Behind the Bitcoin and Nasdaq Split

Hayes argues that Bitcoin has become a highly sensitive indicator of fiat credit supply and dollar liquidity. In a recent Substack post titled “This Is Fine,” he calls Bitcoin a “fiat liquidity fire alarm.” It means BTC tends to react faster than traditional assets like stocks when liquidity starts drying up.

Analysts have pointed out that a number of variables could affect this split. Some analysts have argued that the decline in dollar liquidity and the Fed’s choice to maintain high interest rates could be squeezing credit and causing risk assets such as Bitcoin to weaken. Others have cited the cycle effects of Bitcoin, profit-taking following the record high, and ETF flows as other factors.

AI Job Losses and Banking Stress

A big part of Hayes’ warning centers on the impact of artificial intelligence on jobs. He argues that rapid AI adoption could displace a large share of “knowledge workers” in the U.S. If many people lose income, they may struggle to pay loans, which leads to rising defaults and credit losses for banks.

Hayes uses statistics from the US and states that the total number of knowledge workers in the US is about 72 million. He also models a scenario in which 20% of these knowledge workers end up losing their jobs due to AI automation. In this case, he estimates that banks could incur consumer credit losses of about $330 billion and mortgage losses of about $227 billion, totaling $557 billion in potential write-downs.

These are quite high numbers, and they might put smaller banks with less robust financial situations under pressure, even if the bigger banks are able to deal with the situation. Defaults could rise, and this might cause banks to make their lending criteria stricter, depriving the economy of credit.

Hayes believes that if credit stress rises, the Fed might eventually intervene to support markets. In the past, during recessions, central banks have increased liquidity by lowering interest rates or buying assets to calm markets. Hayes stated that when liquidity expansion resumes, Bitcoin might eventually rise.

However, not all experts agree on the timing or severity. Some believe the divergence between Bitcoin and traditional markets is worth watching, but not yet a confirmed signal of crisis. They note that Bitcoin’s relationship with equities is not always stable and can vary depending on market context.

What It Means for Investors

For now, Bitcoin traders and investors are paying attention to a few things. They are seeing if credit becomes less available, if dollar liquidity changes, and if stock markets start to feel the squeeze as well. If Hayes is correct, the recent fall of Bitcoin could be an early indicator. This could be a sign of financial trouble that will show up later in traditional markets.

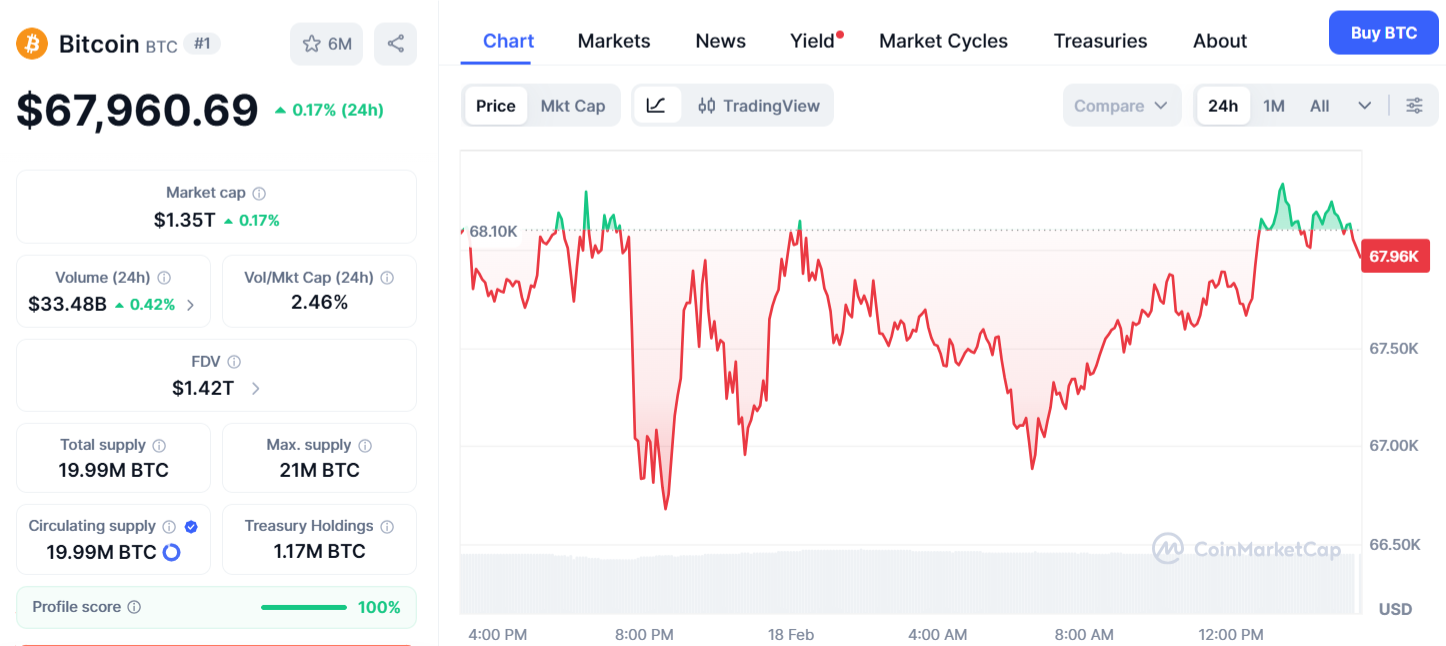

At the time of writing, BTC was trading at $67,960, up 0.17% over the past 24 hours. However, it remains 46.02% below its all-time high.

BTC Price Chart: CoinMarketCap

BTC Price Chart: CoinMarketCap

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Trump adviser demands Fed economists be 'disciplined' for arguing with presidential tactic

CME Group to launch options on XRP and SOL futures