Sequans Launches $200M Stock Sale for Bitcoin Strategy

Highlights:

- Semiconductor company, Sequans launches $200M stock sale to expand its growing BTC portfolio.

- The French company will gradually sell shares to raise capital by capitalising on favourable market conditions.

- Sequans will conduct the sales program according to its shelf registration statement on Form F-3.

French semiconductor and cellular IoT chip solutions company, Sequans, has announced a new plan to raise $200 million through an at-the-market (ATM) equity program for its Bitcoin treasury strategy. The initiative aligns with the company’s long-term goal of acquiring 100,000 BTC by 2030.

Sequans filed the fundraising program with the United States Securities and Exchange Commission (SEC), which allows it to sell up to $200 million worth of shares, capitalising on favourable market conditions. Unlike a one-off fundraising, the French firm plans to issue its shares gradually over time.

The company stated:

Sequans CEO Sheds More Light on the Company’s Move

Dr. Georges Karam, Sequans Chief Executive Officer (CEO), emphasised that the fundraiser is strictly for the company’s Bitcoin treasury strategy. Hence, all proceeds from the program will be used to purchase more BTC, increasing Sequans’ BTC holdings per share and creating long-term value for its investors.

The CEO stated:

Sequans Joins Growing Number of Bitcoin Investment Firms

On June 23, 2025, Sequans announced a $384 million fundraiser for its Bitcoin treasury. This move positioned it among a growing trend of public companies with BTC as a core asset. On the Bitcoin Treasury Net platform, the semiconductor company ranks twenty-fourth and owns 3,170 BTC worth $349 million with a $137 million market cap.

Germany’s Bitcoin Group SE is Europe’s largest corporate holder of BTC with 12,387 tokens. Sequans follows closely in the second spot and could overtake the German firm if it remains consistent in its Bitcoin investments. Meanwhile, the number of companies that own Bitcoin as a core treasury asset has risen from just over 100 in January 2025 to 174. This shows that many firms now recognise Bitcoin as a sustainable asset class with good reward potential.

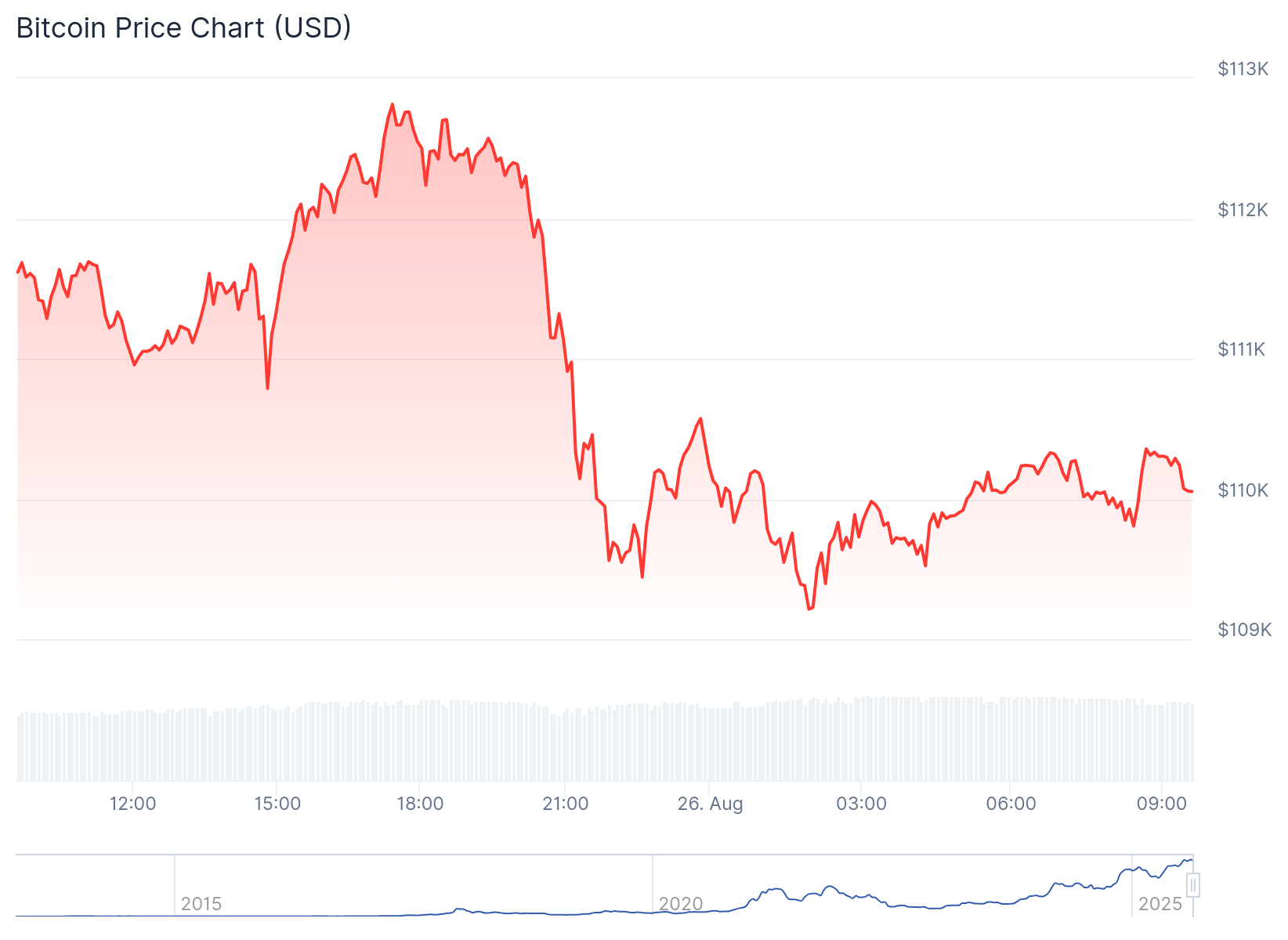

BTC Dips Below $110K as Sequans Launches $200M Stock Sale for its Strategy

At the time of writing, CoinGecko data revealed that Bitcoin is down 1.8% in the past 24 hours, trading at $109,900, with price extremes fluctuating between $109,214 and $112,815.

Source: CoinGecko

Source: CoinGecko

Despite BTC’s concerning price dip, companies and whale investors’ interests in the token remain strong. In one of its most recent tweets, on-chain crypto transactions tracker, Lookonchain reported that a whale bought 455 BTC for $50.75 million. Since July 18, this investor has accumulated 2,419 BTC for $280.87 million at an average of $116,104 per BTC. Following BTC’s current price struggle, the whale investor now sits on a $16 million unrealised loss.

On August 25, Metaplanet and Strategy expanded their BTC portfolio with fresh acquisitions. Both companies secured a combined 3,184 BTC worth $368.6 million. Strategy bought 3,081 tokens, increasing its holdings to 632,457 BTC, valued at approximately $46.5 billion. Metaplanet purchased 103 tokens and now owns 18,991 BTC worth $1.95 billion.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

The Federal Reserve cut interest rates by 25 basis points, and Powell said this was a risk management cut

Zero Knowledge Proof Kicks Off 2026 With Presale Auction Plus $5M Reward – Could This Spark Major Movement?