Arthur Hayes Warns Bitcoin and Nasdaq Divergence Signals Dollar Liquidity Stress

BitMEX co-founder Arthur Hayes has issued a measured warning about the Bitcoin-Nasdaq divergence suggesting imminent stress in dollar liquidity. Hayes argues this divergence, exacerbated by declining institutional flows since the asset’s October 2025 highs, serves as a leading indicator for a broader credit crunch driven by AI-related economic shifts.

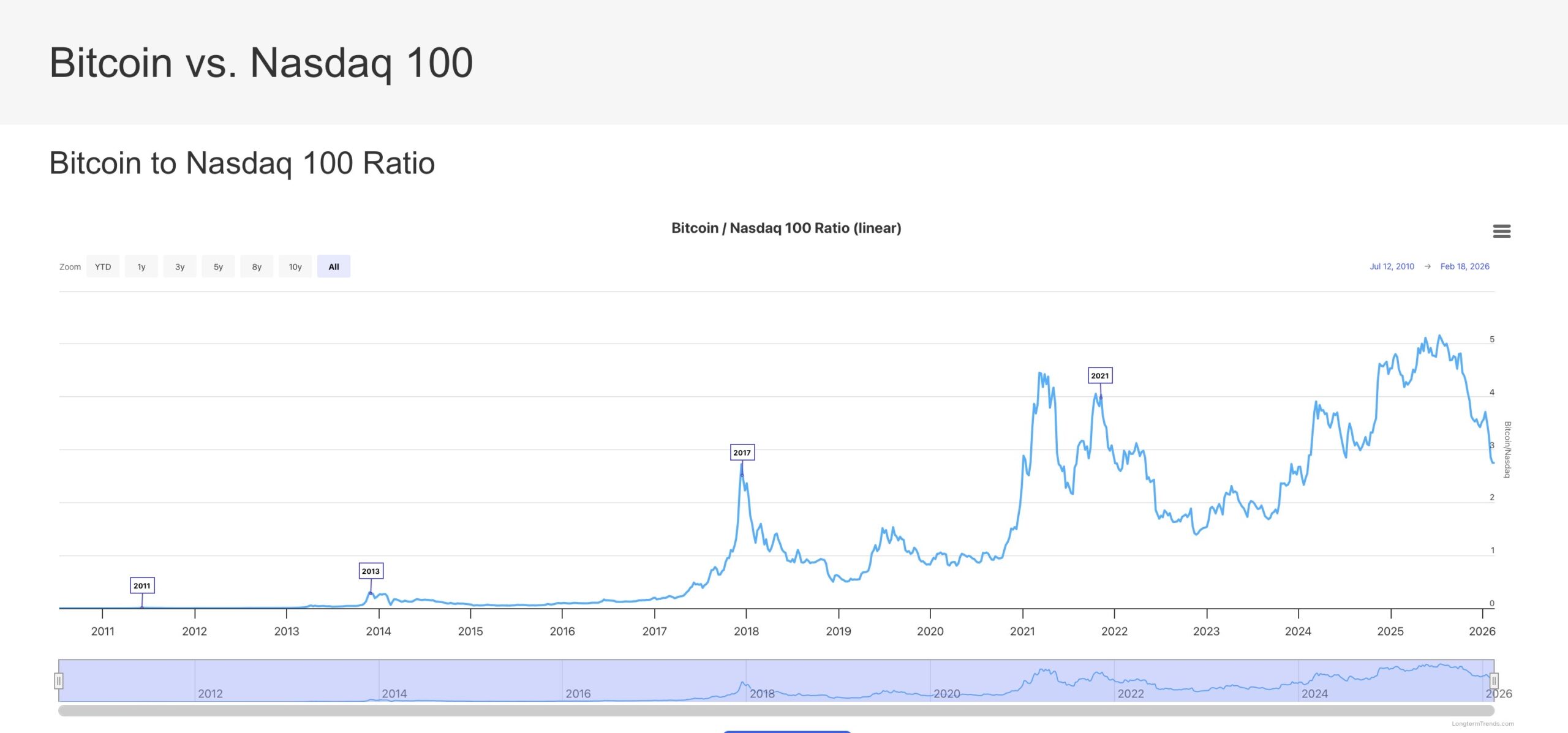

Bitcoin Vs Nasdaq 100 Source: Longtermtrends

The chart above shows the ratio of Bitcoin’s price to the Nasdaq 100 index value. A rising ratio indicates Bitcoin is outperforming the Nasdaq 100 while a falling ratio suggests the opposite.

He describes Bitcoin as the “global fiat liquidity fire alarm,” meaning it tends to react more quickly and sensitively to shifts in fiat credit conditions than traditional equities do.

The current split, he argues, points to tightening dollar liquidity and an impending deflationary credit event.

EXPLORE: What is the Next Crypto to Explode in 2026?

Bitcoin-Nasdaq Divergence: The Correlation Breakdown

For much of the post-2020 era, Bitcoin has traded in lockstep with technology equities, serving as a proxy for risk propensity. However, the current separation, where the Nasdaq remains buoyant while Bitcoin trends downward, signals a potential fracture in underlying market mechanics. Hayes posited in his latest essay ironically titled “This Is Fine” that crypto often reacts first to changes in fiat credit conditions.

While equities effectively price in forward earnings, crypto is more sensitive to net dollar liquidity, referring to the availability of cash in the banking system versus assets drained by facilities like the Federal Reserve’s reverse repo program. This divergence suggests that while the stock market has not yet priced in credit tightening, the crypto market is already reacting to the removal of monetary cushions.

strong>DISCOVER: Best Solana Meme Coins By Market Cap 2026

What Arthur Hayes’ Liquidity Warning Signals for Bitcoin Institutional Flows

The Bitcoin and Nasdaq divergence is stark: Bitcoin has struggled to regain momentum, while big tech remains resilient. Hayes attributes this to early tremors of an AI-driven credit contraction affecting job stability and loan defaults.

Recent flow data appears to substantiate the liquidity thesis. While tech stocks hold value, Bitcoin price drops have tracked with weakening institutional interest, reflecting a risk-off shift among traders. Furthermore, crypto products recorded a net outflow of $1.7 billion recently, validating the narrative that capital is exiting the sector as liquidity tightens.

Despite the short-term negative price action, not all cohorts are capitulating. Analysis indicates that Bitcoin ETF holders have suffered a 44% crash yet maintained “diamond hands”, refusing to sell into the dip. This bifurcation between short-term liquidity flows and long-term holder conviction complicates the bearish signal.

EXPLORE: 10 New Upcoming Binance Listings to Watch in February 2026

Bitcoin Price Outlook: Key Levels to Watch

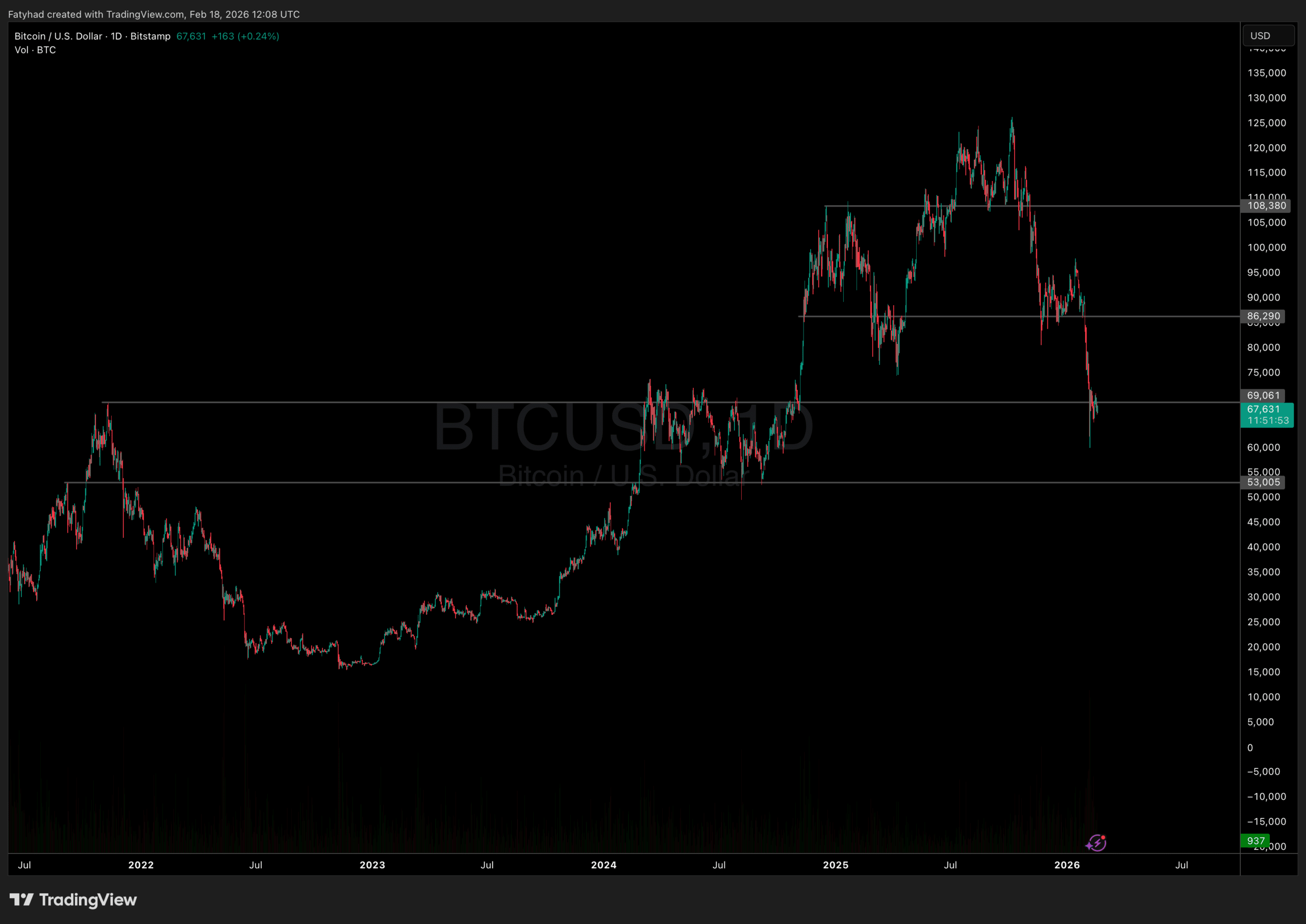

Bitcoin Price Analysis Source: TradingView

Traders are now eyeing critical technical zones to gauge the validity of Hayes’ bearish liquidity outlook. If the disconnect persists, Bitcoin could face further downside pressure testing the $60,000 support level. A breach below this psychological floor could open the path toward summer lows around $50,000.

Conversely, supply dynamics offer a mixed picture. While Bitcoin exchange reserves have surged in certain venues indicating potential sell-side pressure, the persistent calmness of long-term holders suggests a floor may be near. The outcome likely depends on whether the “AI-driven” credit stress Hayes anticipates materializes in broader banking metrics.

Until correlation allows for a clearer directional bias, a break below current consolidation levels would act as confirmation of the liquidity stress scenario.

nextThe post Arthur Hayes Warns Bitcoin and Nasdaq Divergence Signals Dollar Liquidity Stress appeared first on Coinspeaker.

You May Also Like

Coinbase CEO advocates for crypto legislation reform in Washington DC

Pope Leo laments a world ‘in flames’ at Ash Wednesday service