SOL USD Reclaims $80 as Network Transaction Activity Hits Record High

SOL $82.22 24h volatility: 2.5% Market cap: $46.75 B Vol. 24h: $3.45 B successfully claimed the critical $80 support level on Tuesday, trading now around $82 as network fundamentals surged to unprecedented levels. The SOL USD price recovery coincides with a historic spike in on-chain engagement, where daily non-vote transactions recently peaked at a record 148 million. A non-vote transaction involves transferring Solana to the network and collecting it into blocks.

The parallel rise suggests that genuine network utility, rather than just speculative trading, may be establishing a solid floor for the asset.

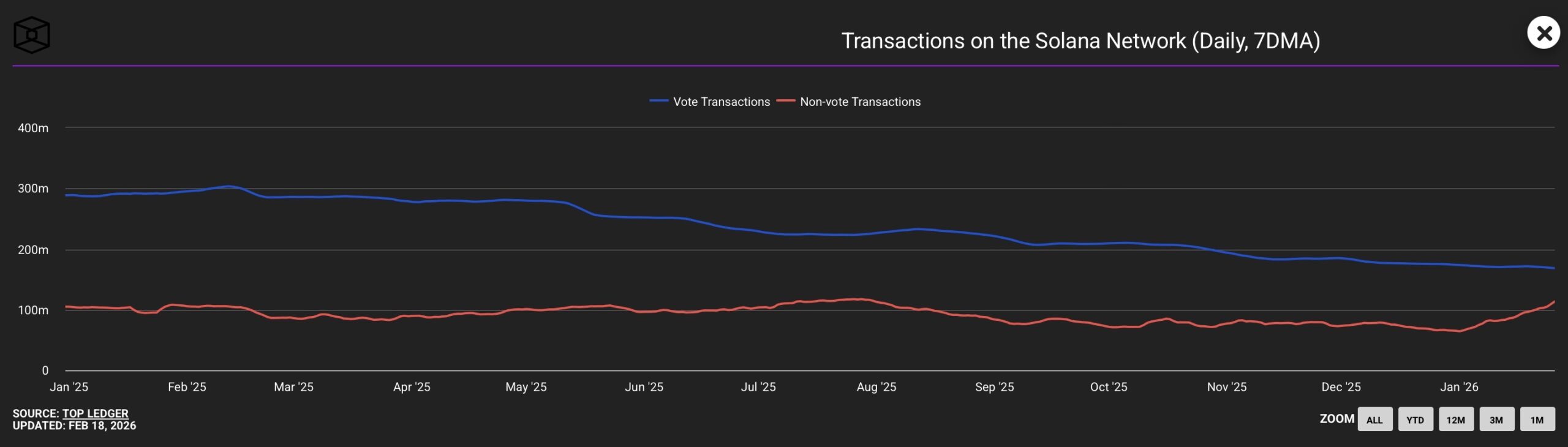

Transactions on the Solana Network (Daily, 7DMA) Source: The Block

EXPLORE: What is the Next Crypto to Explode in 2026?

What’s Driving the Transaction Surge?

Data indicates that Solana’s network is undergoing a massive stress test, validating its high-throughput design. The network exceeded 116 billion total transactions over the last year, with daily non-vote transactions hitting 148 million in late January. This volume represents a significant divergence from previous cycles.

What is fueling this intense volume? While memecoins continue to contribute to network traffic, there is a distinct shift toward sustainable finance. As Solana moves beyond its meme coin phase, decentralized exchange (DEX) volumes have rivaled Ethereum’s, driven by sub-cent fees and faster finality. Furthermore, the rise in real-world asset (RWA) tokenization hitting record values suggests that institutional adoption and stablecoin settlements are playing a larger role in these on-chain metrics than in previous years.

Solana Metrics Source: RWAs

EXPLORE: 10 New Upcoming Binance Listings to Watch in February 2026

SOL USD Price Analysis: Technical Levels to Watch

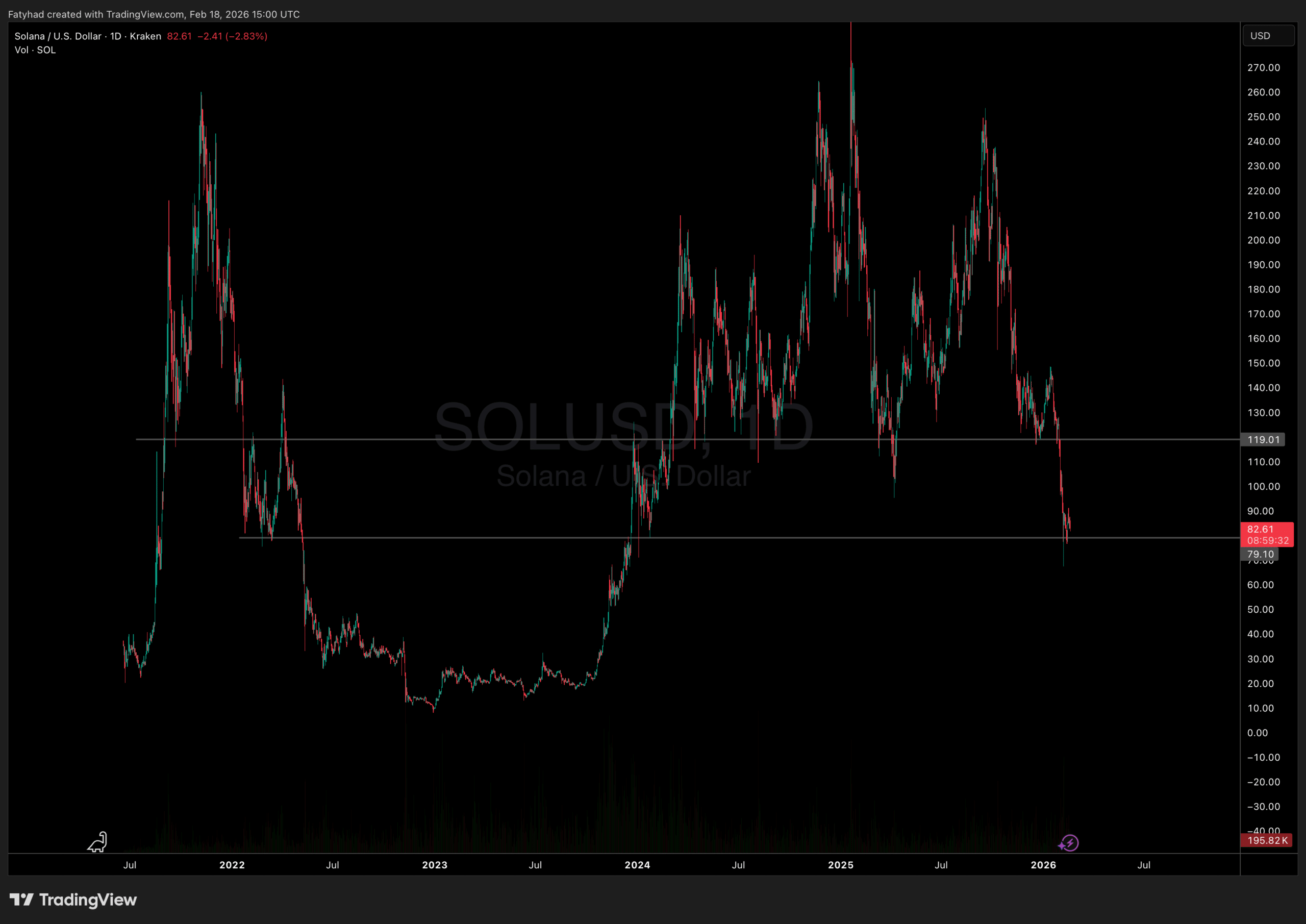

SOL USD Price Analysis Source: TradingView

Solana is currently changing hands at $87.16, marking a 1.65% increase over the last 24 hours. The primary focus for traders has been defending the $80 mark, a level that previously served as a strong demand zone. Market analysts note that holding this region is vital for preventing a slide toward lower liquidity zones. While the asset has formed a logical base here, it still faces resistance overhead.

Some price predictions suggest the dip below $100 may have been a final capitulation event, but bulls must reclaim the psychological three-digit barrier to confirm a definitive trend reversal. Conversely, a failure to hold $80 could expose the asset to deeper downside, as broader crypto market sentiment remains fragile.

DISCOVER: Best Solana Meme Coins By Market Cap 2026

Can Network Growth Sustain SOL’s Recovery?

The divergence between high network usage and suppressed price action often precedes a valuation realignment. Institutional confidence appears to be returning alongside retail activity; for instance, key ecosystem player Jupiter recently announced a major investment deal to further settle in JupUSD, highlighting the capital flowing into Solana’s infrastructure despite price volatility.

However, risks remain. On-chain analytics from Nansen suggest that while user adoption is real, evidenced by active addresses doubling recently, maintaining this momentum requires the fee market to stabilize against potential congestion. Can the fundamentals finally force a decoupling from broader market corrections? The coming weeks will likely determine if record-breaking usage can translate into sustained price appreciation.

nextThe post SOL USD Reclaims $80 as Network Transaction Activity Hits Record High appeared first on Coinspeaker.

You May Also Like

Structural job strain caps rand gains – Commerzbank

Trump gushes over Nicki Minaj's skin to mark Black History Month: 'So beautiful'