77% of Crypto Users Want Stablecoins Inside Their Bank Apps, Survey Shows

A new global survey suggests stablecoins are moving firmly into the financial mainstream. The Stablecoin Utility Report 2026, commissioned by Coinbase and BVNK and conducted by YouGov, surveyed 4,658 crypto-active individuals and found a strong preference for integrating stablecoins directly into traditional banking platforms.

Rather than emphasizing ideological decentralization, respondents prioritized convenience, efficiency, and trust, signaling a shift from early crypto narratives toward practical financial use.

Banking Integration Takes Center Stage

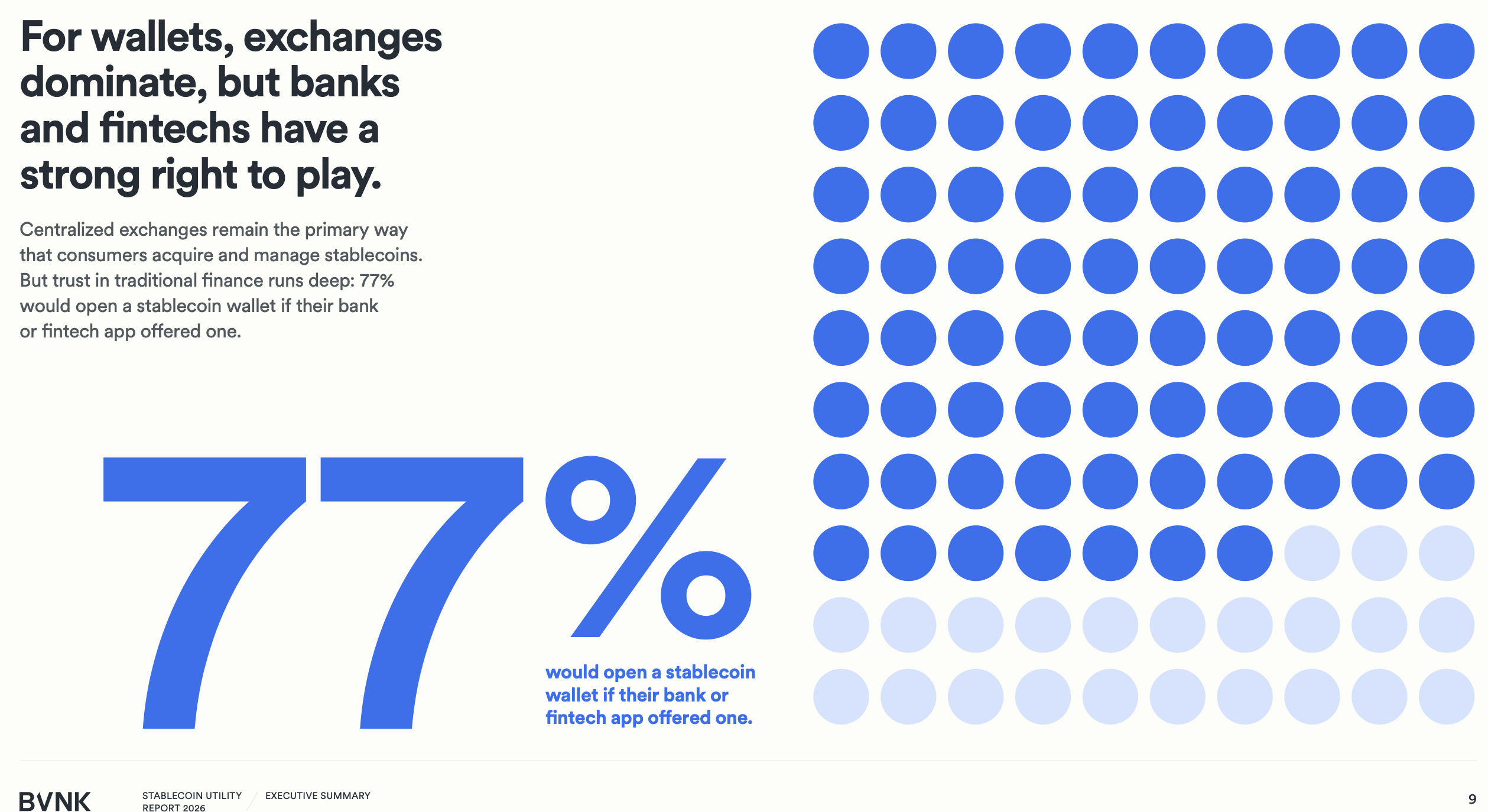

One of the most striking findings is that 77% of respondents said they would open a stablecoin or crypto wallet directly within their existing bank or fintech app if given the option.

Source: https://info.bvnk.com/utility

Source: https://info.bvnk.com/utility

Spending interest is also high. About 71% indicated they would use a stablecoin-linked debit card to spend their tokens for everyday transactions.

Stablecoins are no longer just a trading tool. Among respondents, 39% already receive part of their income in stablecoins, and for that group, stablecoins account for roughly 35% of their annual earnings. This suggests a growing reliance on digital dollars not only for payments but also for salary distribution.

Freelancers and contractors are particularly active users. Around 73% said stablecoins have improved their ability to work with international clients by reducing friction and delays in cross-border payments.

Adoption Patterns Across Regions

The data shows a sharp contrast between emerging and high-income markets.

In lower- and middle-income economies, adoption rates are significantly higher. In Africa, ownership reaches 79%, and 95% of Nigerian respondents said they prefer stablecoin payments over the local naira, citing inflation and inefficient banking rails.

In wealthier economies, ownership sits closer to 45%, but average balances are much larger. Users in high-income regions hold around $1,000 on average, compared to just $85 in emerging markets.

Demographically, ownership skews younger and entrepreneurial. Globally, men are more likely to hold stablecoins (60%), although in Africa ownership is evenly split between men and women.

Why Users Choose Stablecoins

The primary motivations are practical rather than ideological. Lower fees (30%), improved security (28%), and global accessibility (27%) were cited as the main reasons for using stablecoins.

However, barriers remain. Around 30% of respondents identified the irreversible nature of transactions as a major concern, while many pointed to complexity in user experience as an obstacle to wider adoption.

There is also a noticeable spending gap. While 42% say they want to use stablecoins for larger purchases, only 28% currently do, reflecting limited merchant acceptance.

Overall, the findings suggest stablecoins are transitioning from a niche crypto instrument to a mainstream financial tool, provided banks and fintech platforms are willing to integrate them directly into everyday financial services.

The post 77% of Crypto Users Want Stablecoins Inside Their Bank Apps, Survey Shows appeared first on ETHNews.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

Will XRP Price Increase In September 2025?