Why Is Bitcoin Down Today? What’s Next for the Market?

The post Why Is Bitcoin Down Today? What’s Next for the Market? appeared first on Coinpedia Fintech News

Bitcoin (BTC) price has dropped 1.4% in the past 24 hours to trade at $66,414 on Thursday February 19, 2026. Massive liquidations persist, wiping out $201 million in the last 24 hours, with Bitcoin liquidations accounting for $58.98. The flagship coin has also revisted levels last seen in April 2025, just before it hit a new all-time high of $126,000 in October.

Additionally, Bitcoin’s open interest has declined from about $75,000 to about $45,000 between October and press time. Meanwhile, BTC’s 24hour open interest has risen 1.84%, but this indicates a bearish momentum when coupled with the coin’s declining value.

Retailers flee crypto market following heightened economic uncertainty

According to CryptoQuant’s on-chain analyst, there is a massive exodus of retailers from the crypto market. This has been fueled by raised economic uncertainty due to fluctuating trade policies, and the geopolitical tensions between the US and Europe over Greenland. The State’s Treasury has also allocated liquidity in favor of its Treasury General Account (TGA) over more speculative assets like Bitcoin.

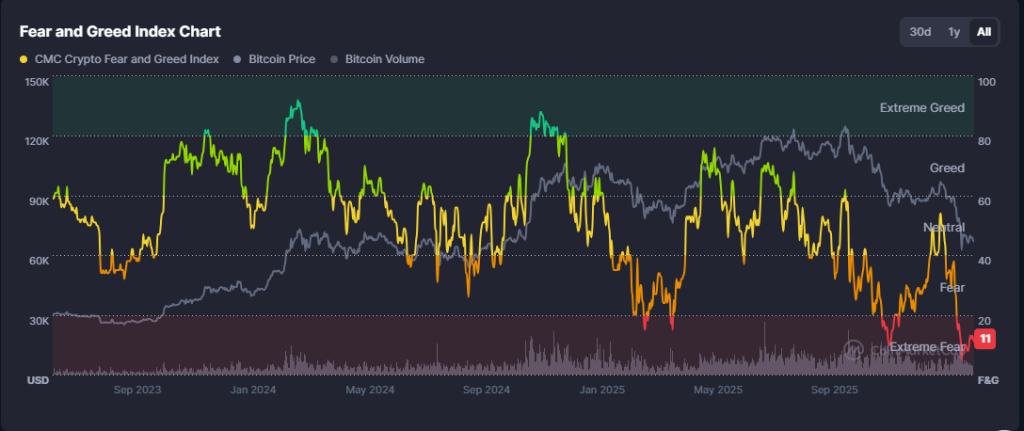

As such, the market has witnessed massive whale liquidations and ETF outflows, with BlackRock recording over $350 million in outflows last month. The crypto fear-and-greed index now reads extreme fear at 11/100. Additionally, the Relative Strength Index (RSI) reads 40.5, indicating crypto’s navigation deeper into the oversold territory.

Source: CoinMarketCap

The panic-driven market has brought Google searches for “Bitcoin going to zero” to new highs of 100. This surpasses the previous high score of 72 recorded during the 2022 bear season.

Key Opinion Leaders Read Bullish Signs

Despite the crypto blood bath, several crypto influencers think Bitcoin’s current position could catapult it to higher levels.

“Retail capitulation at this scale has historically marked late-stage corrections. But it doesn’t mean immediate reversal,” CryptoQuant wrote in a post, adding, “The arrows in the chart illustrate this clearly: each prior extreme negative reading was followed by violent recoveries to new highs.”

Also bullish are Coinbase CEO Brian Armstrong and Eric Trump. The two expressed bullish crypto predictions at yesterday’s World Liberty Forum (WLF) held in Palm Beach.

Former BitMEX CEO and co-founder Arthur Hayes and MicroStrategy CEO Michael Saylor have conveyed similar views. The latter company even purchased 2,486 Bitcoin two days ago, bringing its holdings to 717,131 BTC. Meanwhile, JPMorgan Chase has expanded its pro-crypto services, citing institutional client pressure. In matters legal, the Securities and Exchange Commission (SEC) is keen on being accommodating when developing regulations for the crypto industry.

You May Also Like

Strategy CEO to discuss Bitcoin with Morgan Stanley’s digital asset head next week

Stablecoin Yield ‘Effectively Off The Table’: White House Narrows Rewards Debate In Latest Meeting