Ethereum Funding Rate Flip Signals Structural Shift in Market Sentiment

According to a report shared by CryptoQuant, Ethereum’s current derivatives positioning reveals a structural divergence that many traders may be overlooking.

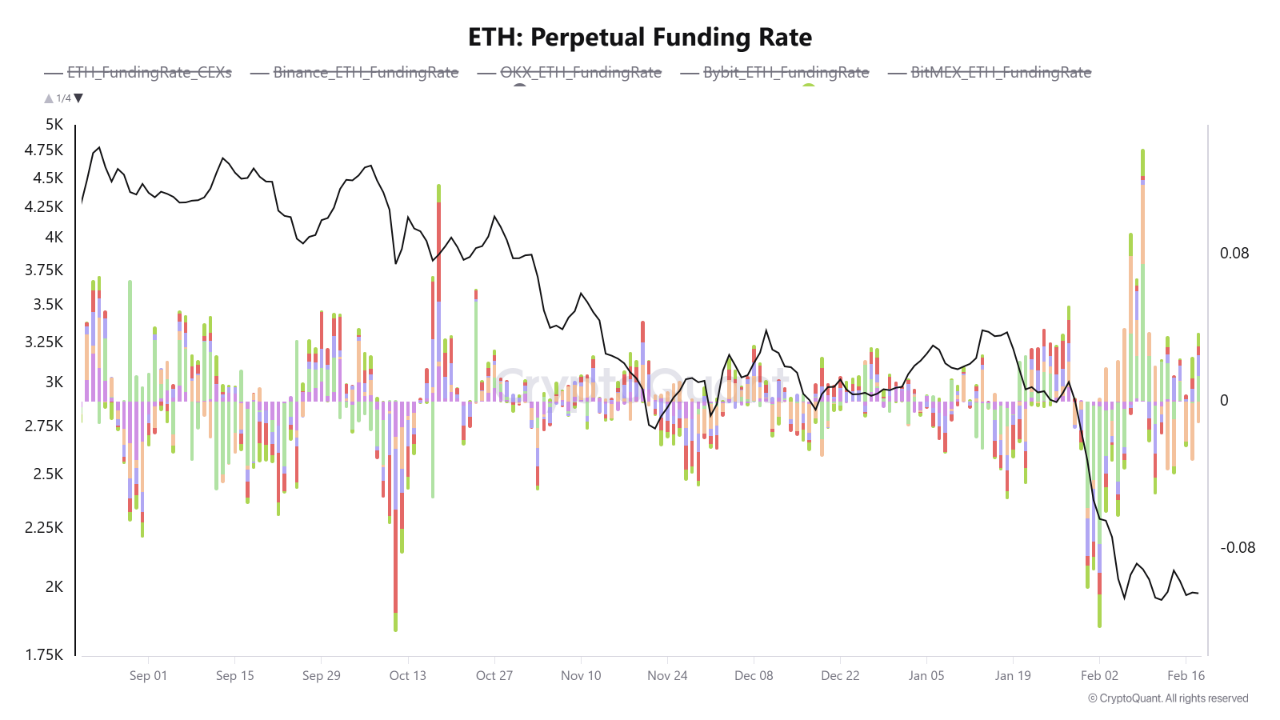

Ethereum is trading near levels similar to those seen in October 2024. At that time, ETH moved within the $2,400–$2,600 range, and aggregate funding rates across major centralized exchanges were elevated, running between 0.055% and 0.097%.

Binance, OKX, and Bybit were aligned with positive funding, reflecting strong long positioning and broad risk appetite.

Today, ETH is trading near $1,960, but the derivatives structure looks fundamentally different.

Funding Rates Tell a Different Story

The aggregate funding rate has compressed to approximately +0.030%, and Binance has shifted into negative territory at -0.0034%. This means shorts are paying longs, a reversal from the prior cycle phase.

Other exchanges are showing neutral conditions. OKX is near +0.00076%, Bybit around +0.00104%, and Deribit slightly negative. The market is no longer uniformly long-biased. Instead, positioning has flattened or tilted cautiously bearish.

The significance lies in the contrast. When price revisits similar levels but derivatives sentiment has flipped, it suggests that traders have been reshaped by intervening volatility. The rally toward $3,300 followed by a 40% decline in under six weeks altered risk appetite materially.

The significance lies in the contrast. When price revisits similar levels but derivatives sentiment has flipped, it suggests that traders have been reshaped by intervening volatility. The rally toward $3,300 followed by a 40% decline in under six weeks altered risk appetite materially.

Binance Leading the Shift

The divergence becomes more pronounced when isolating Binance. The exchange has maintained negative funding for nearly two weeks, reaching as low as -0.012% in certain sessions, while other platforms hover near neutral.

Historically, when the largest derivatives venue sustains negative funding while peers lag, it reflects gradual repricing of risk rather than a short-lived panic event. Extreme fear often produces sharp funding spikes that reverse quickly. Persistent negative funding tends to signal structural caution.

At present, the cycle signal remains bearish under this framework. The indicator would begin to normalize only if Binance funding converges back toward neutral levels. That realignment has not yet occurred.

A Sentiment Reset at the Same Price Zone

The key takeaway is not simply that funding has turned negative. It is that Ethereum has revisited similar price territory with an entirely different derivatives posture.

In October 2024, longs dominated. Today, positioning is defensive. That shift suggests that trader psychology has changed more than price itself.

Until funding structure stabilizes across major exchanges, particularly Binance, the derivatives landscape continues to reflect cautious sentiment rather than renewed expansion.

The post Ethereum Funding Rate Flip Signals Structural Shift in Market Sentiment appeared first on ETHNews.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Buterin pushes Layer 2 interoperability as cornerstone of Ethereum’s future

‘Great Progress’: Cardano Founder Shares Update After CLARITY Act Roundtable

Read the full article at coingape.com.