Schiff Warns Bitcoin Could Drop to $20K if $50K Support Fails

Highlights:

- Schiff warns that a break below $50,000 could trigger a deeper crash.

- He says Bitcoin volatility proves structural weakness, not strength.

- Bitcoin ETFs see $403.9 million weekly outflows amid record weak start.

Peter Schiff has once again raised alarms over Bitcoin’s future. In a post shared on Thursday on X, he said if the world’s largest cryptocurrency breaks decisively below $50,000, selling pressure could intensify. He warned that such a move might eventually drag the price down to $20,000. According to CoinMarketCap, Bitcoin is trading near $67,033. A fall to $50,000 would mean about a 25% drop from current levels. From its October peak above $126,000, such a move would also leave the asset down roughly 84% from its all time high.

Schiff Defends Bearish View, Points to Bitcoin’s Long History of Volatility

On his post, a market participant questioned the basis of Schiff’s bearish outlook on X. Engelbrecht challenged him to provide technical analysis supporting the claim and expressed confidence that Bitcoin would not fall below $40,000.

In response, Schiff did not cite charts or indicators. Instead, he pointed to Bitcoin’s long history of dramatic price swings. He argued that each time the asset reaches a new high, supporters claim extreme volatility is over, yet sharp corrections continue to follow. Reiterating his long-held stance, Schiff maintained that such instability is inherent to Bitcoin, describing volatility as “a feature, not a bug.”

Schiff’s latest comments follow a pattern he has maintained for more than a decade. The gold advocate has consistently questioned Bitcoin’s intrinsic value and long-term sustainability. Data tracked by the website Bitcoin Deaths shows that he is among the most frequent high-profile critics, with at least 22 public predictions of Bitcoin’s collapse recorded since 2010.

Geoff Kendrick, head of digital asset research at the bank, said crypto demand is softening as economic pressure rises. He cited slowing U.S. growth, reduced expectations for Federal Reserve rate cuts, and falling ETF holdings as key risks to Bitcoin. As a result, Standard Chartered cut its 2026 Bitcoin target from $150,000 to $100,000 and warned the price could still drop toward $50,000 if conditions deteriorate.

ETF Withdrawals Add Pressure on Bitcoin Price

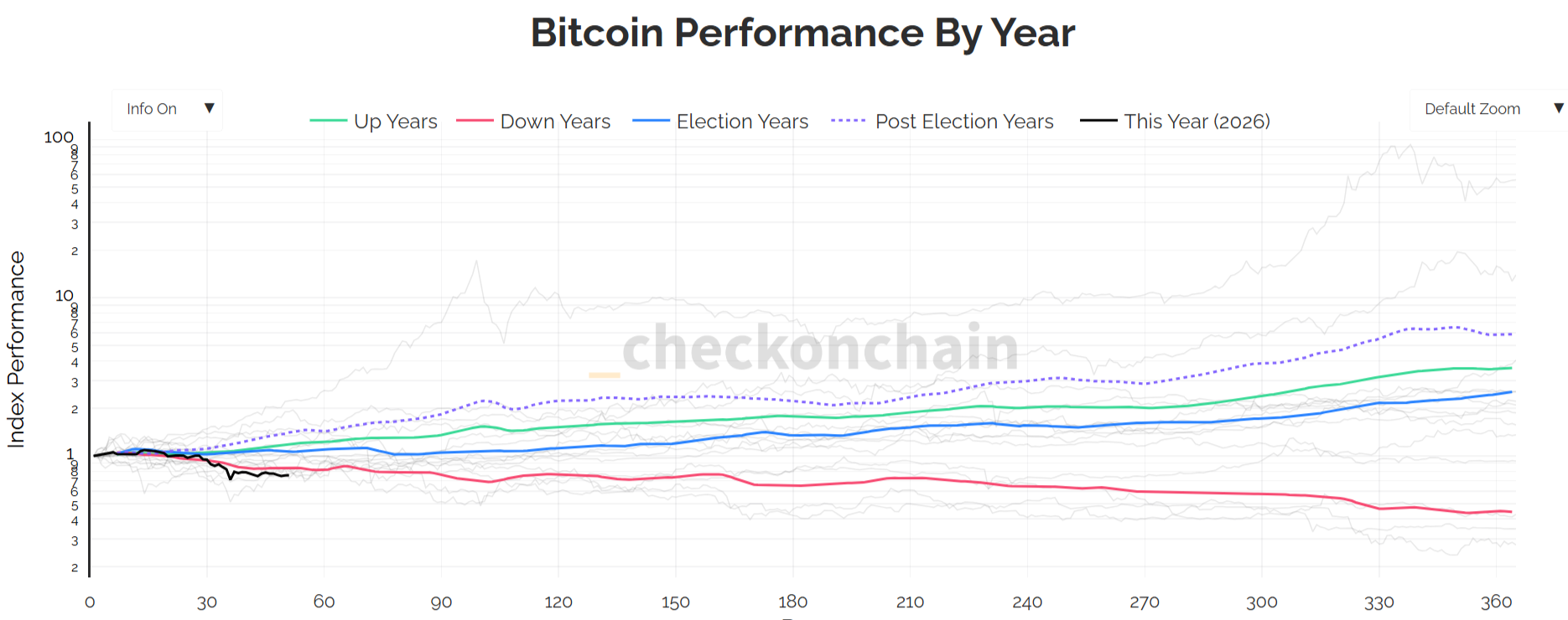

Recent Bitcoin ETF outflows are adding fresh pressure as the market struggles to regain strength. According to SoSoValue, spot Bitcoin ETFs recorded $165.8 million in net outflows on Thursday alone. That pushed total weekly withdrawals to $403.9 million. The steady withdrawals align with weaker sentiment and price stagnation. Also, data from Checkonchain indicates that Bitcoin is off to its worst yearly start on record, 50 days into 2026, even weaker than early 2018.

Bitcoin Performance Yearly Data: Checkonchain

Bitcoin Performance Yearly Data: Checkonchain

Major Banks Maintain $150,000 Bitcoin Target Despite Consolidation

At the same time, several major financial institutions remain firmly optimistic. Research teams at Bernstein have reiterated their $150,000 year end price target for Bitcoin. Analysts pointed to steady institutional adoption, expanding spot market liquidity, and growing interest from wealth managers as key drivers behind their outlook.

According to Crypto2community analysis, if Bitcoin breaks below the $65,970 support level, the price could slide toward $59,871 or even lower in the short term. However, the more probable scenario remains a move higher toward $96,962.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

Here’s How Much $100, $500, and $1,000 in Little Pepe (LILPEPE) Will Be Worth if the Price Hits $3 in 2026

Trump 'ashamed' of 'unpatriotic and disloyal' Supreme Court after tariff decision