The Next Few Days Will Decide Whether Bitcoin Price Explodes to $80K or Crashes to $40K

Bitcoin is sitting at one of those moments where the market feels tense. Not collapsing. Not moving higher. Just hovering at a level that really matters.

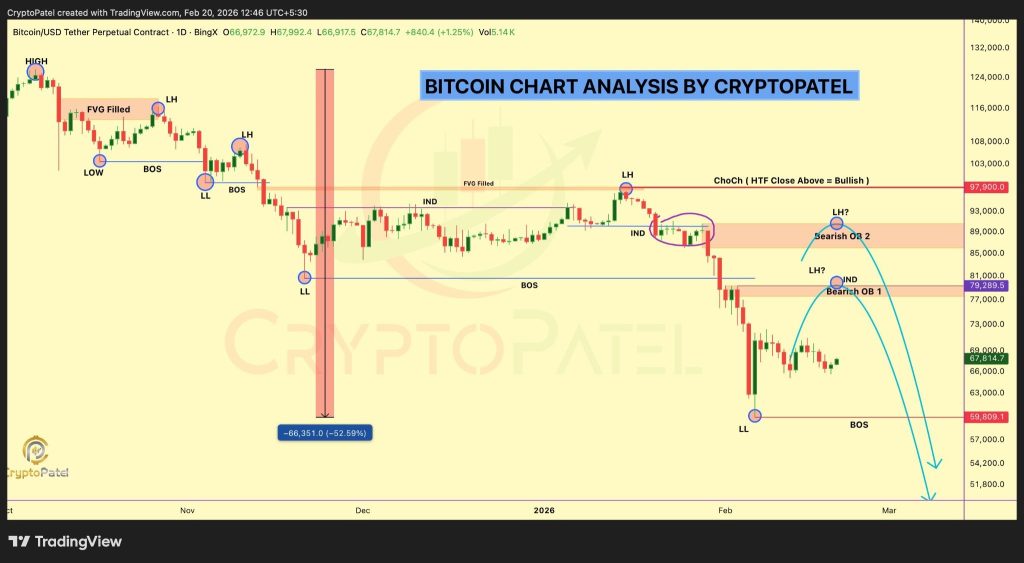

Crypto Patel explained it clearly: “Bitcoin is currently at a crossroads. Bitcoin might climb back to the $80,000 mark or even above. Alternatively, it might go past that point and drop even lower, potentially to the $40,000 mark.

As of now, Bitcoin is trading sideways in the upper $60,000s after its sharp decline. The daily chart has a clear lower low at $59,800. That level is the line that separates recovery from real trouble. Everything revolves around that zone.

Source: X/@CryptoPatel

Source: X/@CryptoPatel

The Bullish Case for BTC: Hold $60K, Reclaim $79K

If the BTC price continues holding above the recent low near $60,000, bulls still have a shot. Above current levels, there’s heavy resistance around $79,000. That area of the price chart has been identified as a bearish order block, which indicates a high volume of selling previously.

If the price were to go back to that area and close strongly above it, the market sentiment can change very fast. A strong move through the $80,000 mark could take the price all the way to the $88,000 to $90,000 region.

In simple terms, holding $60k keeps the structure alive. Reclaiming $79k flips momentum back to the upside. That’s the path where the recent selloff looks like a shakeout instead of the start of a deeper trend shift.

The Bearish Case for BTC: Lose $60K and It Gets Heavy

Now flip the script. If the BTC price drops below $60,000 before reclaiming $80,000, the structure confirms weakness. The daily chart already shows lower highs forming. Breaking that major swing low would add fuel to the downside.

The first target would likely sit in the low $50,000s. Below that, the chart projection points toward the $40,000 region. That area lines up with prior consolidation from the last big expansion phase, and markets tend to revisit those zones.

It wouldn’t mean the end of Bitcoin. But it would mean a much deeper correction than many traders are expecting right now.

Read Also: The Clarity Act Could Unleash Trillions Into Bitcoin: The Math Is Brutal

Why Order Blocks Matter Here

The zones around $79K and $89K aren’t random numbers. They’re areas where large sellers previously defended aggressively. The BTC price needs to break through those levels with strength to shift control back to buyers.

At the same time, $60,000 is more than just a round number. It’s the structural pivot. It’s the floor that keeps the higher timeframe intact. As long as Bitcoin stays above it, bulls can argue for recovery. Once that level gives way, the narrative changes quickly.

The Market Hasn’t Chosen Yet

What makes this setup so interesting is that the BTC price hasn’t committed in either direction. It’s compressing between support and resistance. That usually doesn’t last long.

The next few daily closes will likely decide whether Bitcoin rotates higher toward $80K or rolls over toward the $40K zone. For now, it’s a waiting game. The levels are clear. The structure is defined. The only missing piece is the move. And when it comes, it probably won’t be subtle.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post The Next Few Days Will Decide Whether Bitcoin Price Explodes to $80K or Crashes to $40K appeared first on CaptainAltcoin.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

Metaplanet CEO Denies Hiding Details