Solana Just Lost the RWA Crown to XRP Ledger as RLUSD Explodes Past $1B

Asheesh Birla, CEO at Evernorth and a long-time executive within the XRP ecosystem, pointed out a change in the Real-World Asset (RWA) leaderboard: the XRP Ledger (XRPL) has overtaken Solana in total tokenized RWA value. His observation highlights what he sees as accelerating institutional adoption on XRPL, particularly in segments that bridge traditional finance and blockchain infrastructure.

RWAs represent tokenized versions of traditional financial instruments; such as treasuries, funds, credit products, and stable-value assets. When RWA issuance grows on a particular chain, it often indicates that institutions are choosing that network for compliance-friendly deployment. Birla’s argument is that XRPL’s design, with built-in features and guardrails that mirror aspects of existing financial market infrastructure, is increasingly attractive to institutional participants seeking clarity and structure.

RLUSD Growth and Expanding Liquidity

A key part of Birla’s thesis centers on RLUSD. The stablecoin scaled from zero to over $1 billion in issuance within months last year, and distribution has continued expanding. Its recent full integration on Binance is another step in broadening access and deepening liquidity. Stablecoin growth typically acts as a foundational liquidity layer for tokenized assets and on-chain markets, and rising issuance often precedes higher transactional activity.

The combination of RWA growth and stablecoin liquidity suggests a maturing ecosystem rather than a short-term spike. If capital is flowing into tokenized treasuries or credit instruments on XRPL, deeper liquidity pools become essential. RLUSD’s expansion may therefore be reinforcing broader adoption trends.

DEX Activity Hits 13-Month High

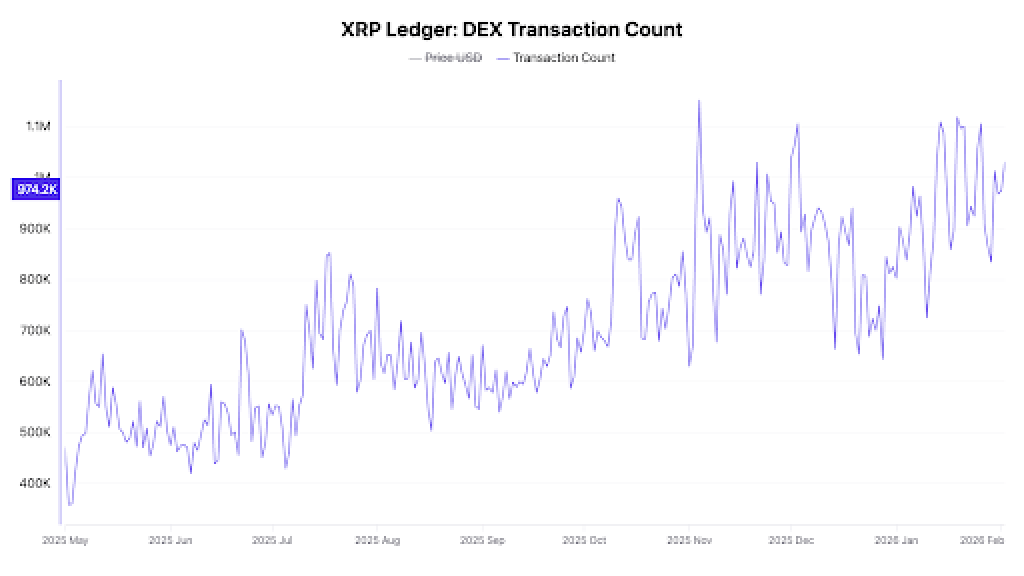

The chart provided shows XRP Ledger decentralized exchange (DEX) transaction counts reaching a 13-month high at the start of 2026. After fluctuating between roughly 400,000 and 800,000 daily transactions throughout 2025, activity has pushed toward the upper end of that range, nearing one million transactions per day.

Source: X/@ashgoblue

Source: X/@ashgoblue

Rising DEX transaction counts typically indicate growing on-chain participation. More transactions can translate into tighter spreads, improved liquidity, and greater capital efficiency across trading pairs. The upward trend in activity aligns with the broader narrative of expanding RWA and stablecoin use cases on XRPL.

Even though short-term pumps in transaction volume can occur during periods of volatility, the broader pattern here appears to show sustained growth rather than a one-off event. That is important when assessing whether adoption is structural.

Read also: Here’s the XRP Price If Clarity Act Passes and Ripple Achieves Integration with US Banks

Infrastructure Expansion: XLS-66 and New Capabilities

Birla also referenced ongoing validation of XLS-66, an amendment that introduces additional capabilities to the network. Each new primitive expands what developers and institutions can build on XRPL, from more advanced financial instruments to improved liquidity coordination and institutional-grade tooling.

As with any blockchain ecosystem, technological upgrades and institutional participation tend to reinforce one another. If the infrastructure continues to evolve while capital inflows increase, the competitive landscape among Layer 1 networks in the RWA sector could shift further.

For now, the data points (RWA leadership, RLUSD growth, and rising DEX activity) indicate that XRPL is getting measurable traction in areas traditionally associated with institutional finance.

Read also: XRP + JASMY: Two Undervalued Crypto Projects Flying Under the Radar

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Solana Just Lost the RWA Crown to XRP Ledger as RLUSD Explodes Past $1B appeared first on CaptainAltcoin.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

Metaplanet CEO Denies Hiding Details