What a U.S.-Iran War Could Mean for Bitcoin and Crypto Prices in 2026

TLDR

- Polymarket bettors put the odds of a U.S. strike on Iran this month at 61%

- Bitcoin is trading around $67,400 with key support at $65,000–$65,729 at risk

- Short Term Holder SOPR has dropped below 1.0, meaning recent buyers are selling at a loss

- Analysts warn Bitcoin could fall to $53,000 if a strike triggers further sell-offs

- Gold and treasuries are expected to benefit while crypto faces more downside pressure

Bitcoin is trading around $67,400 as fears of a U.S. military strike on Iran push investors toward safer assets.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Prediction market Polymarket now shows a 61% chance of U.S. military action against Iran this month. That spike in odds has rattled both crypto and stock markets.

Bitcoin and the broader crypto market have lost roughly half their total value since October. That sell-off began with a $19 billion liquidation event and has continued unwinding since.

Bitcoin was trading above $100,000 during last year’s Israel-Iran strikes. It now sits around $67,400, nearly 33% lower.

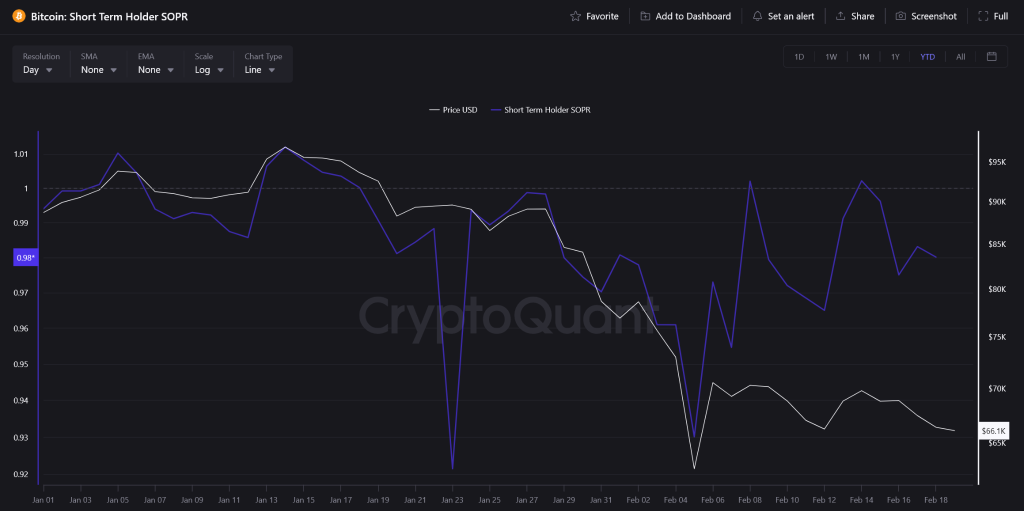

On-chain data from CryptoQuant shows the Short Term Holder SOPR has dropped below 1.0. That means recent buyers are now selling at a loss just to exit their positions.

Source: CryptoQuant

Source: CryptoQuant

The short-term Sharpe ratio has also turned negative, pointing to poor risk-adjusted returns. Around $80 million in long positions have been wiped out since Bitcoin fell from $70,000.

Key Support Levels to Watch

Bitcoin is currently leaning on a support zone between $65,729 and $66,000. A daily close below that level could open the door to $60,000.

Sebastian Serrano, CEO of crypto exchange Ripio, warned Bitcoin could drop as low as $53,000 if bearish momentum following a potential strike continues.

Julio Moreno, head of research at CryptoQuant, told DL News that geopolitical headwinds would push Bitcoin and Ethereum prices lower in the current bear market environment.

What History Shows

Bitcoin has long been pitched as a hedge against geopolitical risk. But past conflicts have shown it does not always behave that way.

During Israel’s “Operation Midnight Hammer” strike in June 2025, Bitcoin’s price fell sharply. It dipped again when the U.S. joined the conflict later that month.

Prices recovered after President Trump signalled a pause in attacks, showing how sensitive crypto is to political signals.

This time, analysts say conditions are weaker going into any potential conflict. The market is already in a bear trend with fragile sentiment.

Some believe whales may use the dip as a buying opportunity. Analyst Arthur Hayes pointed to Treasury liquidity dynamics that could support crypto once tensions ease.

Diplomatic talks are scheduled in Oman on Friday, which could shift the tone. If those talks reduce tension, a short-covering rally remains possible.

The post What a U.S.-Iran War Could Mean for Bitcoin and Crypto Prices in 2026 appeared first on CoinCentral.

You May Also Like

PENGU Token Gains 0.81% as Pudgy Penguins Cultural Momentum Drives Market Interest

Hong Kong Monetary Authority and Fed Cut Interest Rates by 25 Bps