Bitcoin Price News as ETFs Shed $2.7B, USDT Hits FTX-Era Lows, Avalanche Bounces to $9, and the DeepSnitch AI Presale Bounds Toward 1000x Launch in 2026

Tether’s USDT is headed for its steepest monthly supply decline since the FTX collapse in late 2022, with roughly $1.5 billion erased from circulation in February alone. And that’s as spot Bitcoin ETFs have shed above $2.7 billion year-to-date, which is to say BTC is now on course for its worst annual start on record.

But things aren’t all doom and gloom if you consider how contraction in one corner usually means capital is rotating into another, and while macro-driven price action squeezes the majors, the latest Bitcoin price news also has traders with eyes out for AI crypto projects with working infrastructure, perfect for the 2026 market.

If you’re among them, DeepSnitch AI is where to go. Its launch is days away now, and now is the time to get in on the presale, not least because there’s much buzz about a possible moonshot launch when the platform goes live.

On that platform will be five autonomous agents that are due to change what DYOR looks like in a way that could completely shake the way retail traders manage their money. It’s already raised above $1.67 million, but the token is still at only $0.04064.

Liquidity contracts: USDT supply shrinks as Bitcoin ETFs approach a five-week outflow streak

USDT’s circulating supply dropped roughly $1.5 billion in February after a $1.2 billion dip in January, per Artemis Analytics data reported by Bloomberg. And whale wallets sold above $69 million USDT across 22 wallets in a single week, which amounts to a 1.6x acceleration in selling velocity.

Since USDT accounts for about 71% of the total stablecoin market cap at $183 billion, this contraction is a mark of weakening on-ramp demand.

Meanwhile, as far as ETFs are concerned, spot Bitcoin funds posted above $165 million in outflows on February 20, with BlackRock’s IBIT accounting for above $368 million in weekly losses. Analysts at DropsTab noted BTC is near its April 2024 halving level, which is something that’s truly unprecedented this far into any cycle.

There’s pressure on established assets, no doubt about it. But this is what funnels capital toward earlier-stage opportunities, and BTC volatility analysis right now suggests projects priced before discovery are likely to do well, especially where there’s utility to power it along.

Full Bitcoin market updates and alternative investment details

1. DeepSnitch AI’s anticipated moonshot launch

If the biggest stablecoin is contracting and ETFs are bleeding, the question now is where smart money would go. And if 2026 market updates so far are anything to go on, where AI and utility are the go-to nexus, the answer is AI utility tokens with products people can already use.

It’s tough to find a presale that’s proving that utility beyond a shadow of a doubt, but DeepSnitch AI is ar are token in that sense, which is why its anticipated 1000x run seems entirely plausible.

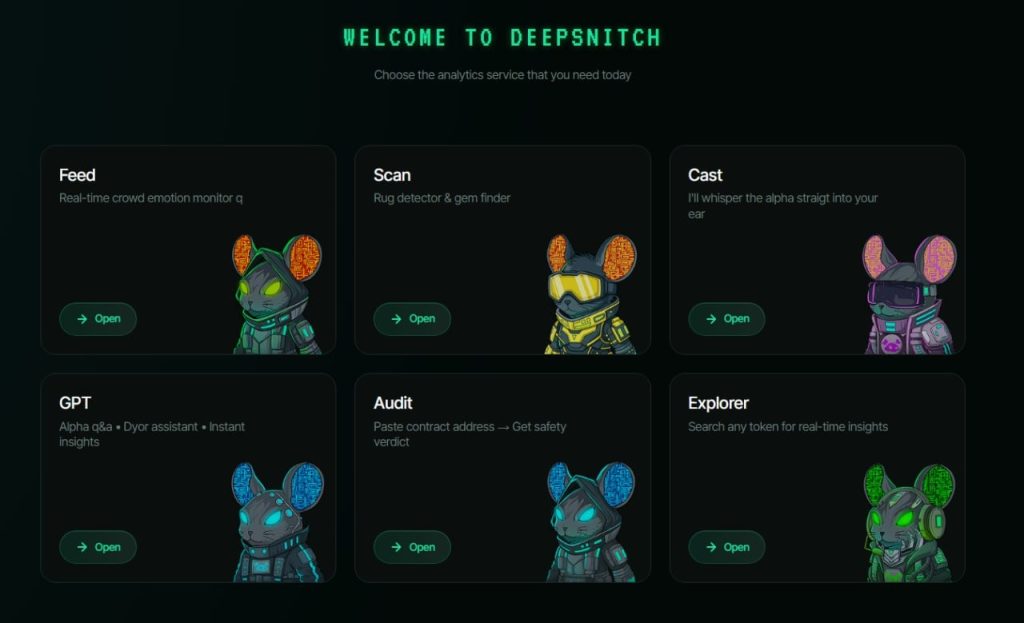

Developed by expert on-chain analysts, it’s turning DYOR from a vague crypto mantra into something tidy, easy-to-do, easy-to-read, with a unified dashboard that shows you everything you need to know in one clear view:

You click into Token Explorer and see risk scoring, liquidity metrics, and holder concentration in one view. Run AuditSnitch on the contract address, and you get a verdict: CLEAN, CAUTION, or SKETCHY. Then decide, with SnitchGPT available, if you want a plain-language summary instead of interpreting charts yourself.

Because this process becomes a simple pre-buy habit, the adoption potential is enormous here. And higher adoption means buying pressure, which at a micro-cap valuation means the token price builds fast.

Whether you’re the type to gun after the next adrenaline rush or, instead, are a more cautious investor, DeepSnitch AI has utility that’s truly uncommon, and that’s where its value is so clear. Staking runs uncapped and dynamic, so APR rises as more users join, and the team is days away now from launching a platform that insiders believe could cue a 1000x run. But for now, it’s still priced at $0.04064, and it’s a live system that has proven its utility with working, internally-shipped tools. There’s almost no reason to doubt it.

2. Bitcoin price news

Despite some rather grim Bitcoin price news recently, the token’s bull case hasn’t disappeared just yet. BTC was at around $67,780 on February 20, with algorithmic forecasts pointing toward roughly $77,000 within a month and as high as $93,000 by year-end.

Analyst Jelle pointed out that most major bottoms formed between the 200-week SMA and EMA, which is right where BTC is sitting now. And Wells Fargo even flagged a potential “YOLO trade” wave from tax refunds.

That said, if you’re hoping to see incredibly high returns, Bitcoin isn’t where to look for them this year. At a $1.36 trillion market cap, even a 38% annual gain gets you to $93,000. That’s not anything to sniff at, of course, and it’s Bitcoin, so it has its roots firmly in the soil.

But DeepSnitch AI is where modest inflows can create dramatic repricing, so while Bitcoin price news isn’t looking as optimistic as it usually does, this is where you can turn instead for far higher near-term returns.

3. Avalanche price prediction

Under Avalanche’s hood, with the token having bounced 3.79% to above $9 on February 20, outpacing Bitcoin, there’s no hollow momentum to be found. Rather, above 1,600 AI agents are reportedly running on the network, which gives the rebound a utility backstory most relief rallies lack.

MACD has spun around to positive, and RSI at 36 has room before hitting overbought territory.

If AVAX holds the $8.77 Fibonacci support, the next test is $10.19 resistance. A break below $8.77 could drag it back toward $7.70, though.

BTC volatility analysis right now favors high-beta alts catching a bid once fear eases, but if you want outsized returns, earlier-stage tokens like DeepSnitch AI are where small inflows deliver dramatic results.

Final verdict

With USDT shrinking, ETFs bleeding, and Bitcoin treading water near cycle lows, you can look at that and feel uneasy, rightfully so. But alternatively, you can consider how fear-stage pricing is where the most asymmetric entries live.

BTC’s macro case is intact, as Bitcoin price news makes clear, AVAX has utility bubbling underneath, and most excitingly, DeepSnitch AI has an extraordinary shipped product, a micro-cap price, and a launch that could compress months of upside into weeks.

On top of that, it has bonus codes available right now to give you significantly more DSNT at the same cost. Pair that with the uncapped dynamic staking APR, and the compounding effect on a potential 1000x run at launch is hard to turn away from.

If you don’t want to turn away, head over to the DeepSnitch AI official site to check out the codes and the presale. You can also join the community on X and Telegram for launch alerts and key updates from the team.

FAQs

Based on February Bitcoin price news, will Bitcoin go back up in 2026?

Bitcoin market updates make a recovery toward $77,000-$93,000 plausible for the token by year-end. But at a $1.36T market cap, BTC’s multiplier ceiling is limited, so if you want far higher returns, DeepSnitch AI’s presale has the moonshot asymmetry that Bitcoin price news won’t be able to factor in.

Why is USDT supply declining?

Whale wallets and smart-money traders are redeeming USDT at an accelerating pace. The $1.5 billion February decline signals capital rotating out of stable holdings, potentially into higher-risk, higher-reward opportunities. DeepSnitch AI’s presale is one of the most compelling destinations for that rotation.

What are the best tokens to watch during this BTC volatility analysis?

BTC remains the macro bellwether, based on Bitcoin price news this year so far, and AVAX is flashing utility growth, but for macro-driven price action with moonshot potential, DeepSnitch AI’s presale at $0.04064 offers the sharpest asymmetry—with launch now imminent.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post Bitcoin Price News as ETFs Shed $2.7B, USDT Hits FTX-Era Lows, Avalanche Bounces to $9, and the DeepSnitch AI Presale Bounds Toward 1000x Launch in 2026 appeared first on CaptainAltcoin.

You May Also Like

And the Big Day Has Arrived: The Anticipated News for XRP and Dogecoin Tomorrow

Rising Altcoin Inflows Signal Potential Market Sell-Off: CryptoQuant

Highlights: Inflows of altcoins in exchanges have surged by 22% in early 2026. An increase in deposits indicates a growing sell-side pressure. The