Expert Explains How XRP Will Power the World

Global finance faces a long-standing challenge: trillions of dollars remain idle in pre-funded accounts, tied up in slow and costly cross-border payment systems. Businesses and financial institutions seek faster, cheaper, and more efficient ways to move money internationally, creating an opportunity for innovative solutions to reshape the global financial infrastructure.

Blockchain analyst Wilberforce Theophilus recently highlighted on X how XRP could serve as the bridge that unlocks this trapped capital. According to Wilberforce, XRP’s design allows it to streamline payments, reduce settlement times, and create real economic value by acting as a bridge currency for fiat transactions worldwide.

Unlocking Dormant Global Liquidity

Wilberforce explains that trillions of dollars sit dormant in nostro and vostro accounts, pre-funded solely to facilitate international payments. XRP’s On-Demand Liquidity (ODL) solves this inefficiency by instantly converting local fiat into XRP, sending it across borders, and reconverting it into the destination currency.

This mechanism allows banks to free up previously locked capital, which can then be deployed for lending, investment, and other productive economic activities. Contrary to claims that XRP’s supply is too large, Wilberforce argues that as global adoption grows, demand will surge, making the available supply increasingly valuable as a bridge asset.

Fast, Low-Cost Cross-Border Payments

Theophilus highlights XRP Ledger’s speed and efficiency. Transactions settle in just three to five seconds with minimal fees, a dramatic improvement over traditional systems like SWIFT, which often take days to complete a transfer. XRP’s instant currency conversion minimizes friction and mitigates currency risk, benefiting remittance providers, fintechs, and banks using RippleNet and ODL daily.

By functioning as a bridge asset, XRP simplifies global payments and accelerates settlement. Real-world adoption already demonstrates its value, as institutions rely on XRP for live cross-border transactions and liquidity management.

Transforming Global Financial Infrastructure

Wilberforce emphasizes that XRP’s potential extends beyond incremental efficiency gains. As adoption grows, it could become a foundational tool for global payments, supporting trillions of dollars in daily international transactions. Its scalability, speed, and low cost make it uniquely positioned to integrate legacy banking systems with next-generation digital finance.

By unlocking trapped liquidity, enabling instant settlements, and providing a practical bridge for fiat, XRP is positioned not just as a cryptocurrency but as a transformative financial instrument. Wilberforce’s analysis underscores that XRP’s operational and technical advantages may allow it to power global finance, bridging the gap between traditional and digital monetary systems.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers should conduct in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News

The post Expert Explains How XRP Will Power the World appeared first on Times Tabloid.

You May Also Like

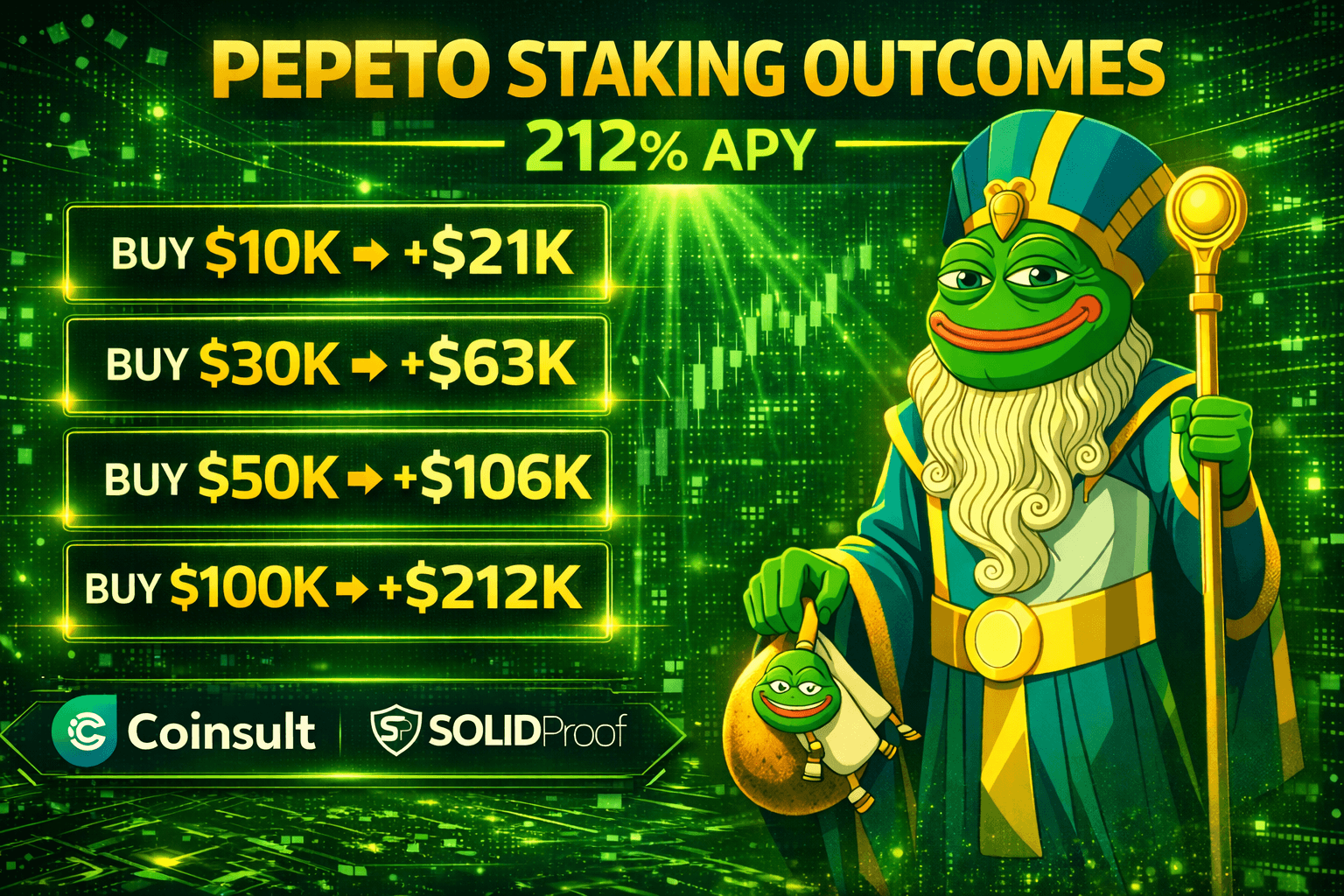

Top 100x Coin to Buy: Pepeto, XRP, Dogecoin, and Solana Lead the Market Pulse This February

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.