Avenir Group: Institutional investors urgently need to open up funding channels between traditional and crypto markets

PANews reported on August 29 that according to official news, at the BTC Asia roundtable forum "Asian Institutions Lead the Beginning of a New Era of Bitcoin", Avenir Group CEO Jason Lan pointed out that as products such as Bitcoin ETFs and Digital Asset Treasuries (DATs) drive traditional institutions to enter the market at an accelerated pace, institutional investors are facing new core challenges: the separation of funding channels between traditional finance and the crypto market has seriously restricted capital efficiency.

Jason emphasized that cross-market capital flows currently face widespread challenges, including long transit times, high friction costs, and a lack of unified purchasing power. Even for investors who already hold assets, efficient allocation and reallocation between markets remains difficult, resulting in significant amounts of capital remaining inefficiently idle. "The key to the future lies in enabling institutional investors to connect all assets within a single system, achieving unified capital pathways and purchasing power." This implies unified management and cross-market trading of traditional and digital assets, promoting efficient capital flows across different markets. He believes that as regulatory frameworks in major global markets become clearer, a policy-friendly and capital-efficient environment is rapidly emerging. "Whoever can first address capital efficiency will lead the next phase of the financial landscape."

You May Also Like

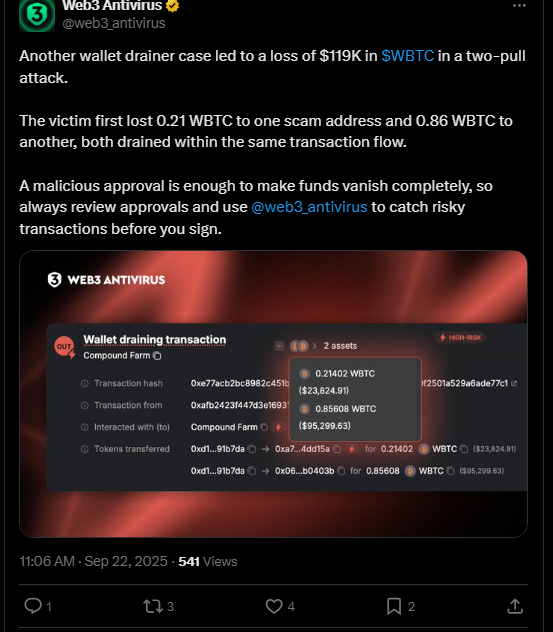

$119K WBTC Drained in Wallet Scam Amid Fake Airdrop Surge

SwayHorizonAi Reviews — Are Their Market Insights Legit? A Quick Overview