GENIUS Act: The US Dollar's Smoking Gun in the De-Dollarization War?

What started out as a cryptocurrency enthusiast's hedge against crypto-asset volatility has evolved into a powerful tool that is reshaping the global monetary landscape, redefining how money flows across borders, and challenging the very mechanics of monetary policy. The protagonist in this evolving epic is not a traditional or central bank, but the stablecoin.

For the uninitiated, stablecoins are a form of programmable digital currency designed to maintain a stable value relative to a reference asset, such as the US dollar. It achieves this peg by maintaining a liquid reserve of the reference asset in a mixture of cash and/or cash equivalents.

Digital Dollarization

As blockchain-based assets, stablecoins are globally transferable at any time, by anyone and settle near instantly, making them an attractive proposition in emerging markets, where they have unsurprisingly gained traction. Chronic inflation and volatile local currencies have created a natural demand for an asset that is both an efficient medium of exchange and stable store of value in such markets. To this end, the mutually beneficial relationship is clear - stablecoin issuers benefit from the interest accrued on their US Treasury holdings, while users – both individuals and corporations – gain access, at a very low cost, to a more stable and efficient way to transact globally and hedge against currency debasement.

Where financial infrastructure is weak or capital controls exist, stablecoins offer near-instant cross-border transactions, bypassing the delays and high fees characteristic of correspondent banking networks. With just a smartphone, anyone, at anytime and from anywhere can transact in USD-denominated stablecoins. These features also mean that stablecoins can promote financial inclusion by providing accessible digital alternatives to the traditional banking system.

The realities of daily life at the local level can often be at odds with state-led efforts to reduce reliance on the the U.S. dollar. For the common man, the priorities are clear. It is about the ability to save and remit daily via an asset that preserves their purchasing power - the unintended effect of which increases the global demand for dollars and further sidelines local currencies in favour of a globally traded currency that preserves the user's store of value.

Moving Away From the Dollar

The U.S. dollar’s dominance in global trade and reserves has long been a pillar of U.S. economic influence, even as its share of the global economy declines. The trust in the ability to redeem T-bills at face value is what underpins the significant geopolitical influence the U.S. has been able to wield. This influence has allowed the U.S. to impose unilateral sanctions on any economy, and more recently imposing tariffs,; destabilising the global economic order.

The BRICS (Brazil, Russia, India, China, and South Africa) nations have long been promoting the use of local currencies in international trade. Brazil and Russia, for example, conduct varying levels of bilateral trade with China denominated in Chinese yuan (CNY). The New Development Bank (NDB), established by the BRICS nations, supports these efforts by offering financing in local currencies.

Over the last 10 years, the share of the US Treasuries owned by foreigners has fallen sharply, from 50 percent in 2014 to around a third today. Similarly, USD share of disclosed foreign reserves fell from 65.2% in 2014 to 57.8% in 2024. By any measure, this is still a fairly large percentage.

A Stroke of GENIUS

The GENIUS Act, signed into legislation about a month ago, sets the regulatory foundation for stablecoins. The framework mandates issuers to maintain a reserve fully backed 1:1 by cash or short-term US Treasury securities with monthly public disclosures of their reserves. Only US Treasury bills (T-bills) with maturities of 93 days or less qualify under these rules, explicitly excluding commercial paper and corporate bonds.

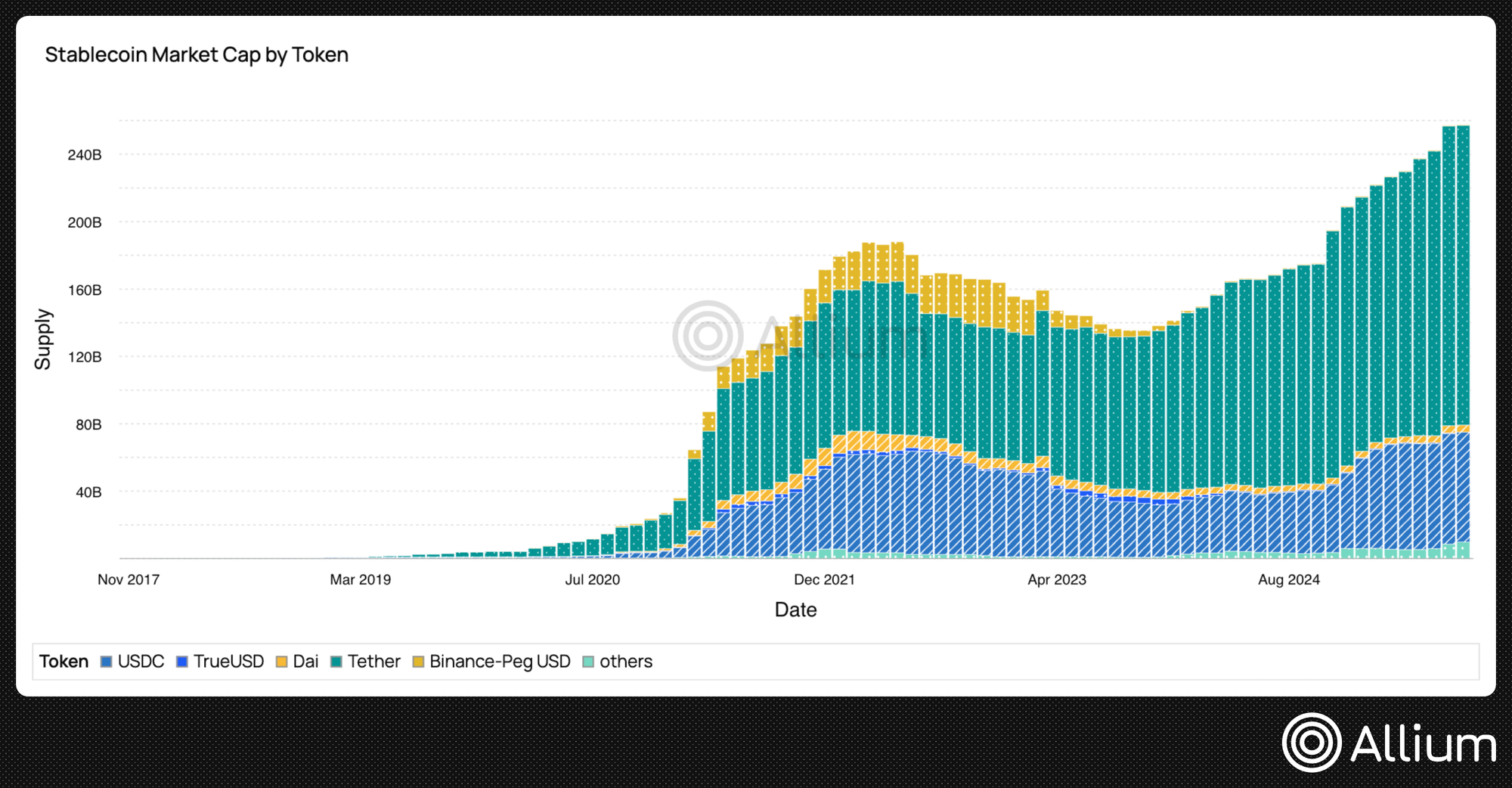

With almost $164.5 billion USDT (issued by Tether) and $64.6 billion USDC (issued by Circle) currently in circulation, Tether and Circle are the two largest issuers of USD-pegged stablecoins and dominate that market today. Collectively, the two hold close to $180 billion in US Treasuries—surpassing the foreign reserves of many nation states such as Saudi Arabia and South Korea.

Source: Allium - Crosschain Stablecoin Supply

Source: Allium - Crosschain Stablecoin Supply

This comparatively vast appetite for T-bills by stablecoin issuers is creating a new, powerful source of demand that influences treasury yields and liquidity dynamics in markets traditionally dominated by financial institutions and foreign governments. This piece of legislation may yet herald a new era in entrenching the dollar's global dominance by creating a cheap way for the U.S. to originate debt and offloading the responsibility of making the dollar accessible worldwide to stablecoin issuers.

Reactions Meet Expectations

Predictably, banks are concerned about the possibility of significant deposit outflows into stablecoin issuers, potentially eroding the banks’ role as monetary intermediaries and destabilizing the banking system. The European Central Bank (ECB) echoed these concerns, worried specifically about interest-bearing stablecoins siphoning deposits from traditional banks and disrupting the transmission of monetary policy.

The MiCA framework in the European Union (EU), among other things, imposes a cap on the circulation of non-Euro stablecoins within the region, addressing some concerns around such stablecoins weakening central bank control over money supply and financial stability. Hong Kong's recent stablecoin regulatory regime outlines strict requirements for issuers, but is applicable to any single-currency Fiat-Referenced Stablecoin (FRS), and could be part of a nuanced strategy in tandem with People's Bank of China's e-CNY.

Payments behemoths Visa and Mastercard have launched various capabilities that integrate stablecoin rails into their payment networks. This move is an acknowledgment that stablecoins will reshape payment rails, especially for costly cross-border transactions. For them, offering immediate, mass market distribution for stablecoins will ensure they can maintain a central role in payments.

Taking the lead with the GENIUS Act has given the U.S. its best chance at once again securing a formidable seat in the global financial order. Keep in mind that although stablecoins appear to be digitally wrapped versions of the US dollar, they are privately issued assets and not fiat money. So, while stablecoins like USDT and USDC offer emerging markets some much-needed stability, they can't really fix the inherent macroeconomic challenges of the dollar.

You May Also Like

WLD Price Prediction: Targets $0.73 by February as Bullish Momentum Builds

Top Solana Treasury Firm Forward Industries Unveils $4 Billion Capital Raise To Buy More SOL ⋆ ZyCrypto