Bitcoin (BTC) Price: Why September Could Spell More Trouble for Bulls

TLDR

- Bitcoin hovers around $110,000 as gold surges to record $3,508 per ounce

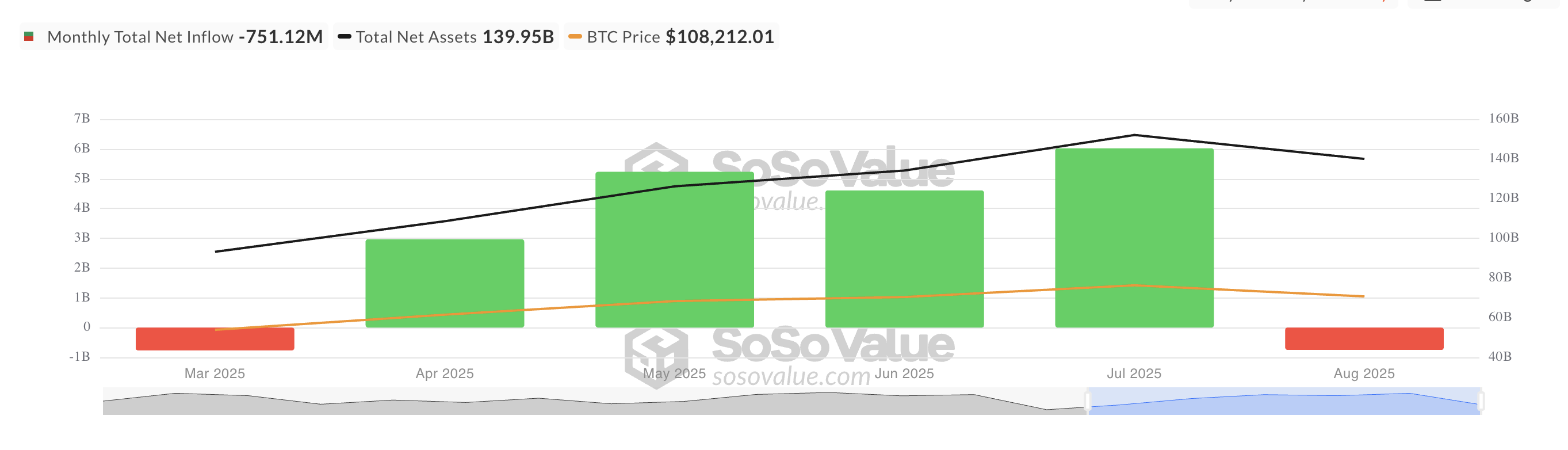

- ETF outflows totaled $751 million in August, ending four months of steady inflows

- September historically weak month for Bitcoin with multiple negative returns

- Ethereum shows fatigue with 28% drop in active addresses since July

- Friday’s jobs report could determine if Fed cuts rates in September

Bitcoin trades near $110,000 as traders monitor the Federal Reserve’s next moves. The cryptocurrency has struggled since reaching its all-time high of $123,731 on August 14.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The leading digital asset has lost nearly 10% since that peak. Gold presents a stark contrast, jumping to $3,508 per ounce on Tuesday and breaking previous records.

Source: TradingView

Source: TradingView

Fed Chair Jerome Powell’s comments at Jackson Hole opened the door to rate cuts in September. This has strengthened the case for monetary easing as the US jobs market shows weakness.

Bitcoin rose 2.7% on Tuesday while other major cryptocurrencies posted gains. Ethereum remained flat as XRP, Solana, and Dogecoin all added more than 3%.

Gold has outperformed Bitcoin this year with gains exceeding 30%. Bitcoin’s year-to-date returns stand at 16%, trailing the precious metal.

Nick Ruck from LVRG Research sees both assets serving different hedging purposes. He notes that gold acts as a hedge against monetary debasement while Bitcoin evolves as an inflation hedge.

Institutional Demand Weakens

August marked a reversal in Bitcoin ETF flows after months of steady growth. Outflows from Bitcoin-backed exchange-traded funds reached $751.12 million during the 31-day period.

Source: SoSoValue

Source: SoSoValue

This development breaks a four-month streak of positive inflows that had supported Bitcoin’s price momentum. The asset’s push to new record highs has been directly tied to institutional ETF demand.

Ethereum faces its own challenges despite broader institutional adoption narratives. Daily trading volumes have slowed from July peaks.

On-chain metrics show a 28% drop in active addresses since late July. Augustine Fan from SignalPlus notes that rotation within digital assets has left major tokens on the sidelines.

Solana has emerged as a new focus for traders. The blockchain’s rebound in total value locked has helped it separate from broader market weakness.

September’s Historical Weakness

September has historically been Bitcoin’s weakest month. Data shows multiple negative returns during this period across different years.

The cryptocurrency dropped 8% in September 2020 and 7.3% in September 2021. It also fell 3.10% in September 2022 before showing marginal gains in recent years.

Bitcoin’s negative weighted sentiment currently stands at -0.707. This metric measures overall positive or negative bias by combining social media volume with discussion tone.

The negative reading reflects bearish market conditions and growing skepticism about short-term prospects. Lower confidence levels often translate to reduced trading volumes.

If selling pressure continues, Bitcoin could test support at $107,557. A break below this level might trigger deeper declines toward $103,931.

All eyes turn to Friday’s non-farm payrolls report. Economists expect around 45,000 new jobs with unemployment potentially rising to 4.3%.

A weak jobs print could confirm a September rate cut and revive appetite for riskier assets. Current options data shows downside protection at the highest levels in weeks.

The post Bitcoin (BTC) Price: Why September Could Spell More Trouble for Bulls appeared first on CoinCentral.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

‘Groundbreaking’: Barry Silbert Reacts to Approval of ETF with XRP Exposure