Dormakaba Holding AG (DOKA.SW) Stock: Drops 6.31% Despite Beating Profit Forecast

TLDRs:

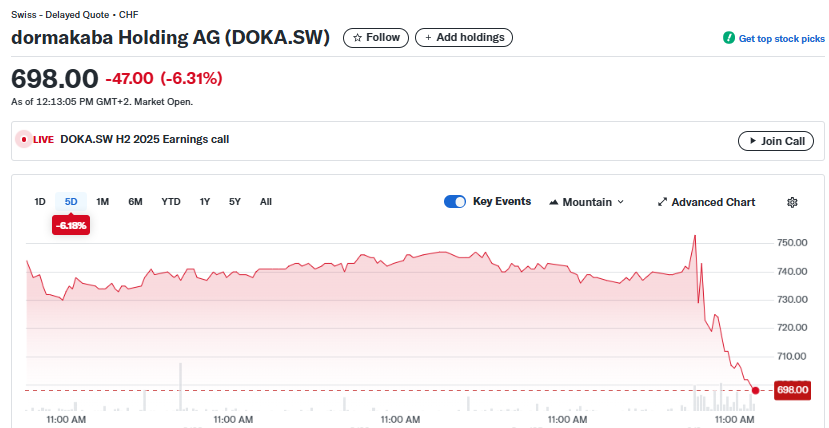

- Dormakaba shares fell 6.31% despite full-year net profit surpassing analyst expectations.

- Strong cost-cutting and diversified markets helped offset weaker residential and automotive demand.

- The company projects 3-5% organic growth and higher EBITDA margins next fiscal year.

- Dividend raised 15%, signaling confidence despite short-term market headwinds.

Swiss security firm Dormakaba Holding AG ($DOKA.SW) reported a full-year adjusted net profit of 188 million Swiss francs (US$234 million) for the fiscal year ending June 30, significantly surpassing analyst forecasts of 176 million francs (US$219.4 million).

Despite this strong performance, the company’s shares dropped 6.31% on Tuesday, reflecting broader market reactions and investor caution.

The decline comes amid concerns over softer demand in the residential and automotive sectors, as well as lingering uncertainty around U.S. import tariffs. Analysts suggest that even when companies report strong earnings, investor sentiment can be influenced by external economic factors, leading to short-term stock volatility.

dormakaba Holding AG (DOKA.SW)

dormakaba Holding AG (DOKA.SW)

Operational Efficiency Drives Earnings Growth

Dormakaba credited disciplined cost-cutting measures and ongoing operational improvements for its earnings outperformance.

The company’s transformation program, which targets CHF 170 million in annual savings by 2025/26, has enabled consecutive margin improvements over five half-year periods. Adjusted EBITDA margin reached 15.2% in the first half of 2024/25, illustrating the benefits of sustained operational restructuring.

By shifting its strategic focus from “reshaping” to “growth,” Dormakaba expects to capture additional cost savings of CHF 40 million by 2027/28. This approach highlights a common industrial trend: initial periods of restructuring, though challenging, can establish a foundation for long-term growth and profitability.

Diversified Markets Mitigate Risk

Dormakaba’s performance underscores the advantages of serving a diversified portfolio of end markets. The company’s Access Solutions segment saw 5% organic growth driven by demand in hospitality and workforce management, while Key & Wall Solutions grew 7%, bolstered by North American movable wall sales.

By distributing sales across Europe & Africa, Asia Pacific, and the Americas, Dormakaba mitigates risks associated with localized economic downturns.

This diversified approach provides more predictable cash flows compared with companies concentrated in a single sector, allowing the firm to maintain confidence in growth and dividend payouts even in uncertain market conditions.

Dividend Increase Signals Confidence

Reflecting its robust operational performance, Dormakaba’s board proposed an annual dividend of 9.20 Swiss francs (US$11.47), a 15% increase from the previous year.

The company aims to maintain this level of dividend in the future, signaling strong cash flow stability and management confidence despite short-term market volatility.

Looking ahead, Dormakaba forecasts organic sales growth of 3-5% for the 2025/26 financial year, with adjusted EBITDA margins expected to rise above 16%, supported by lower interest rates in Europe and increased investments in Germany and the U.S. Analysts note that these growth projections, combined with diversified markets and operational efficiency, position Dormakaba for steady long-term performance, even if near-term stock prices fluctuate.

Conclusion

Dormakaba’s recent stock decline highlights the sometimes disconnect between strong earnings reports and immediate market reactions. The company’s disciplined cost management, diversified revenue streams, and shareholder-friendly dividend policy underscore its resilience and potential for sustainable growth. While external factors may cause short-term volatility, Dormakaba’s fundamentals point to a stable outlook in the medium term.

The post Dormakaba Holding AG (DOKA.SW) Stock: Drops 6.31% Despite Beating Profit Forecast appeared first on CoinCentral.

You May Also Like

XRP Crowned South Korea’s Most-Traded Crypto of 2025

DeFi Development Corp. expands Solana treasury accelerator